- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Upon going to file, it keep giving a flag on my state taxes that my witholding ID number must be 14 characters and end with WTH. It meets both of those. What is wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upon going to file, it keep giving a flag on my state taxes that my witholding ID number must be 14 characters and end with WTH. It meets both of those. What is wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upon going to file, it keep giving a flag on my state taxes that my witholding ID number must be 14 characters and end with WTH. It meets both of those. What is wrong?

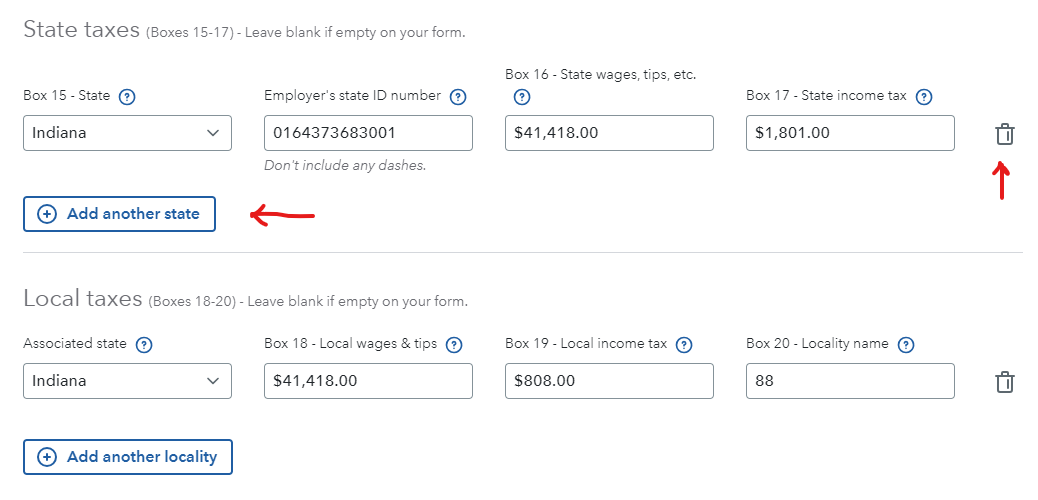

Perhaps there is a 'phantom' character embedded in the box for the Employers state ID number.

Consider deleting the line by selecting the trashcan to the right. Select Add another state to re-enter the information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upon going to file, it keep giving a flag on my state taxes that my witholding ID number must be 14 characters and end with WTH. It meets both of those. What is wrong?

Thanks for the reply! It looks like that did not work either. Still giving the same error. Any other suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upon going to file, it keep giving a flag on my state taxes that my witholding ID number must be 14 characters and end with WTH. It meets both of those. What is wrong?

Indiana state ID numbers should be 13 digits long and start with a zero. You may have too many numbers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upon going to file, it keep giving a flag on my state taxes that my witholding ID number must be 14 characters and end with WTH. It meets both of those. What is wrong?

@RobertB4444 @JamesG1 I am in Utah so it needs to be 14 characters and end with WTH. It has exactly that and was confirmed by my previous employer and its on my W-2s. Unsure if I will just need to file by mail at this point?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upon going to file, it keep giving a flag on my state taxes that my witholding ID number must be 14 characters and end with WTH. It meets both of those. What is wrong?

I’m also having this exact same issue and am from Utah

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upon going to file, it keep giving a flag on my state taxes that my witholding ID number must be 14 characters and end with WTH. It meets both of those. What is wrong?

@kennethbrady @camdenfolkman89

_______________________

It's been an issue for the past couple of years, and the solution is the same:

1) Delete the whole number

2) re-enter it, but make the last three letters..... lower case "wth".

I have no idea why it make s a difference, but it does.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upon going to file, it keep giving a flag on my state taxes that my witholding ID number must be 14 characters and end with WTH. It meets both of those. What is wrong?

Unfortunately, while I overrode the entry and typed it in myself, the characters failed to become lowercase. Why? This problem has been discussed in your forums, specifically for the state of Utah.

I am unable to use TurboTax to file my state return which is unfortunate as TurboTax was very easy to use in filing my federal tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upon going to file, it keep giving a flag on my state taxes that my witholding ID number must be 14 characters and end with WTH. It meets both of those. What is wrong?

If you simply overtype the letters with lower case...no, that may not work as the system seems to think it wasn't changed.

You should delete the box 15 number/letter entry entirely...then click in another box on the form so that the computer sees that the state number is empty...then come back to the number-letter box and retype the entire number and letters again.....lower case.

This time, it should keep the lower case letters.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

heidiyin6

New Member

Oj1955

New Member

phildangel

New Member

Aleyana-lawson

New Member

Laniegirl

New Member