- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax Business 2019 stuck in "We need to make one more check"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

I'm stuck in e-filing federal and CA s corp return. After I click on "Transmit Returns Now", it will say "We need to make one more check ...". After I click "continue', it asks me to "Reviewing your return. This review searches the return for incomplete information, amounts that may be too high or too low and amounts marked as estimated. We recommend that you check for any product updates before you finalize this return."

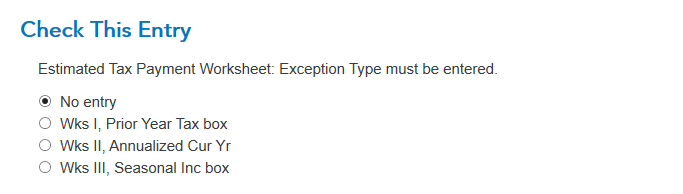

Then I click "Continue". It says "Check This Entry. Estimated Tax payment Worksheet: Exception Type must be entered. " I have "No entry" selected.

Then after I click "Continue", it shows below screen:

Then after I click "Continue", it goes back to Transmit Your Returns screen again:

Then after I click "Transmit Returns Now", the whole process comes again and again.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

Clear the cookies on your browser, log out of Turbotax and log back in.

Here is a link that reviews how to clear the cookies on most browsers.

How to Clear Cookies on Major Browsers

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

Hi Karen,

Please take a second look. My question is about TurboTax Business, which is a Windows app. It is not in browser, so there is no cookies to clear.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

Okay. Make sure you have updated the software to the latest update.

There is a TurboTax help article that goes on to suggest that the software be uninstalled and reinstalled:

- Uninstall TurboTax.

- Browse to C:/Program Files (x86)/TurboTax/ and delete the 20XX folder (substitute XX for your product's year and your version.

- Reinstall TurboTax and return to the File section to run the Review again and efile.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

Karen, I confirm that I have updated to latest version, which is 2020/1/23 version. I also tried uninstall and reinstall and re-update. Neither of them work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

Please check after 02/03/2020 for additional program updates. IRS has finalized the approval of most Corporate and Individual forms for electronic filing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

I just updated again and it is still the same. Dead loop for "transmit now"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

It turns out to be my California return. I just efiled my federal business. California 100S cannot be e-filed. Is there any issue with CA business e-file?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

Please see this link for State Forms Availability. State Business Forms Availability

CA Form 100-S is now showing available.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

I am having the same problem with NY S-corp. Has a resolution been found?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

My case was due to penalty of underpaying estimate tax. TT doesn't handle that case. I manually added the penalty form and it passed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

Thanks jacksunwei. I do not have an underpayment penalty, so my problem is not related.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

Hi,

Did you solve the problem? Because I got the same problem here too... It always need me to make one more check. I don't have penalty, use windows download and update to latest version. I don't know how to solve it. If you already solved, would you please share the problem is? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

I have this same issue with both of my S-Corp returns.

I have TurboTax Business 2019 for Windows (the download).

I am stuck in a loop at the Transmit E-File section. It will NOT let me file because there is an error where the underpayment penalty forms have fields that are zero.

Neither of my companies owe underpayment penalty. We are paid fully and owe $0 in taxes and $0 in underpayment.

This is frustrating. The software is buggy and we all deserve refunds for this. Did no one QA this product? It has only gotten worse every single year I've used it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Business 2019 stuck in "We need to make one more check"

Exit from Turbo Tax.

Reboot your PC.

Sign in to Turbo Tax and load your saved return.

All should now work correctly with the error checking.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thisblows

New Member

amyonghwee

Level 4

kim-gundler

New Member

MaxRLC

Level 3

sunflower110603

New Member