- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax 2018 Home and Business thinks I have cancelation of debt but I don't

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2018 Home and Business thinks I have cancelation of debt but I don't

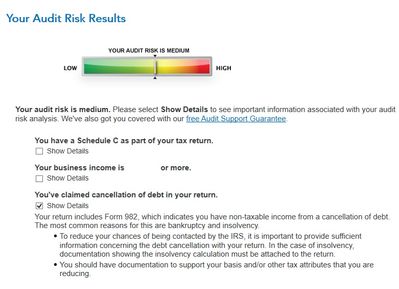

When I run the final review it tells me I have medium audit risk due to claiming cancellation of debt. See attached screen shot.

The text mentions I have included Form 982, which I have not. When I look at the list of forms on my return there is no 982.

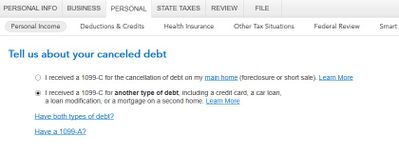

When I look in Personal Income, Misc Income, Cancelation of Debt, I find 2 radio buttons both of which state I received 1099-C.

There is no way to turn this off that I can see on the screen. I can see an empty Canceled Debt Summary worksheet in the forms list.

I can delete it but it comes back. There is no 1099-C.

I called support on 2/10/19 to report this and after a very painful discussion they said they would report the issue.

I got an email stating 'your Investigation # is 1358.'

When I called support today to follow-up they said that's not a numbering system they use.

I went thru the issue with the support person who was very nice and helpful but not able to remedy the problem.

She had her supervisor on messenger and he was not able to help either.

Please let me know if you have any idea what is going on here.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2018 Home and Business thinks I have cancelation of debt but I don't

If your actual tax return is correct and doesn't show Form 982, and the only thing that seems to be affected by this issue is your Audit Risk meter, I would advise you to file the return you prepared. The Cancellation of Debt Summary Worksheet does not get sent to the IRS, and since you don't have a 1099-C, the IRS will not receive any information concerning any non-existent cancellation of debt. I can't explain why this is happening to you. All I can do is recommend the most practical course of action that will result in the correct tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2018 Home and Business thinks I have cancelation of debt but I don't

Thanks for your response. I will take a close look and make sure the return doesn't show anything to do with cancellation of debt before I file. Even so, I can't help being bothered that the software is doing this. It's a bug on the page where you can't select 'neither' with respect to cancellation of debt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2018 Home and Business thinks I have cancelation of debt but I don't

Frances,

I just had the EXACT same thing happen to me this morning: audit check informed me I was at 'medium' risk of an audit because I'd claimed debt reduction on my return, which I had NOT done. Similarly, there was no Form 982 in my return. I think you've identified the issue, i.e. that there's no 'neither' option with which to answer the question re: cancellation of debt(s). I'm sorry you had such headaches trying to sort through the problem, but I'm 'glad' someone else had the same issues I did, as I was really tearing my hair out! Let's hope TurboTax can correct the bug so others don't have the same frustrations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2018 Home and Business thinks I have cancelation of debt but I don't

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2018 Home and Business thinks I have cancelation of debt but I don't

This is happening on TurboTax 2019 Home and Business, too. Why didn't Turbo-Tax fix this? How do we get rid of it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2018 Home and Business thinks I have cancelation of debt but I don't

To delete a form in TurboTax Home & Business, the standard procedure is to go into Forms mode, by clicking the toggle in the right hand corner.

Click on Open Forms

In the search type 1099-C, Canceled Debt Worksheet or Canceled Debt Summary

At the lower left corner, click Delete a Form

You may want to just type in "debt" to search. Check that there is nothing on your state return for the form that may be preventing the deletion.

Then, I would follow these steps carefully to force your program to do a manual update.

This should release the 1099-C details that are not applicable.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mary625

Level 2

risman

Level 2

evltal

Returning Member

Viking99

Level 2

gavronm

New Member