- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

"If I select "None" I never get a change to show I had coverage all year."

As I noted above, you get a chance to show coverage all year only if you have an HSA. And if you had an HSA in 2020 and showed coverage, then - unless your coverage was not for the full year - you would not even be asked this question.

"Why does December of 2019 matter for 2020?"

I will repeat what I wrote above:

This question is trying to determine if you utilized the "last-month" rule in 2019 (yes, 2019). The last-month rule lets you use the full annual HSA contribution limit if you had HDHP coverage on December 1, even if you were not covered by an HDHP for all of the year.

However, the catch is that if you used the last-month rule, the IRS requires that you stay under HDHP coverage for all of the following year (2020).

So this question is supposed to ask about 2019. And as I noted above,

- If you had HDHP coverage for all of 2019 , then enter NONE

- If you had no HDHP coverage for all of 2019, then enter NONE.

- If you did not have an HSA in 2019, then enter NONE.

- If you had an HSA in 2019 but did not contribute to it in 2019, then enter NONE.

So, if you don't have an HSA or HDHP coverage, all this may make no sense to you, but's that's OK, because the question doesn't apply to you. Just answer NONE and move on.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

The question "What type of High Deductible Health Plan did you have on December 1st, 2019?" has nothing to do with California requirements.

TurboTax is asking this question to test for a specific situation: where you had and contributed to an HSA in 2019 under the last month rule, but where you did not stay under HDHP coverage for all of the "testing period" which is essentially all of 2020.

Any California requirements would be addressed in the California interview, not in the HSA interview on the federal return.

This is a legitimate question within its narrow scope but which is lacking the context that would show that it does not apply to most taxpayers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

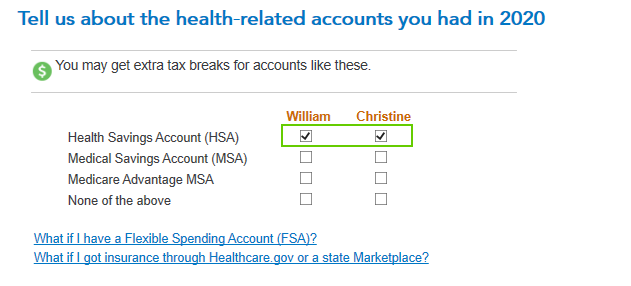

So where it says "Tell us about the health0related accounts you had in 2020", you have to select both yourself and your spouse for Health Savings Account (HSA). That should fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

Yeah, this worked for me... I had no HSA this year, but I had to check yes...

Then afterwards you just say you made no contributions...

Makes no sense... most would leave one of the boxes unchecked, but that shouldn't make

TT think you werent't covered by an HDHP that year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

Just spoke to an agent and in my case it wasn’t related to either the last month rule or the question about December 1 of the previous year. In my case (married filing jointly) I had to mark (check box) that we both have “health related accounts” though its just one of us who pays for it. In a family plan though one person is paying into HSA, both family members are on the account, so when you’re asked to check all the boxes that apply under both names, for the question “Tell us about the health-related accounts you had in [year]” make sure you check HSA for both members if not it assumes that you didn’t have an account or HDHP and asks why you had a break.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

"In my case (married filing jointly) I had to mark (check box) that we both have “health related accounts” though its just one of us who pays for it."

This is not an accurate way to describes how HSAs work.

HSAs belong only to an individual; it does not matter if the couple has Family HDHP coverage, like an IRA, the HSA belongs to only one person.

"In a family plan though one person is paying into HSA, both family members are on the account"

This is true for the HDHP insurance policy, but it is not true for the HSA.

"so when you’re asked to check all the boxes that apply under both names, for the question “Tell us about the health-related accounts you had in [year]” make sure you check HSA for both members ."

This is not correct. Answering this way will cause TurboTax to issue two forms 8889 - one for each taxpayer - when, in fact, only one taxpayer actually has an HSA. This may cause considerable confusion with the IRS down the road. Plus in the HSA interview, you will be answering questions about the spouse's HSA that don't apply because the spouse doesn't have an HSA.

"if not it assumes that you didn’t have an account or HDHP and asks why you had a break"

No, this is not the reason. The problem - as I described above several times - is that most taxpayers should not see this question. It should be presented only to taxpayers who had an HSA in 2019 and who contributed to it. Unfortunately, the question does not clarify this, so many taxpayers answer Family or Self, when they should just answer NONE.

If you do not have an HSA (remember, an HSA belongs only to an individual), then do not check that you have an HSA. And if you did not have an HSA in 2019 (this is for tax year 2020) or did not make any contributions to it, then answer the "What type of High Deductible Health Plan did [your name] have on December 1, 2019?" with NONE.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

This is such a confusing situation, I wish that TurboTax would fix their software. I'm hitting the same thing this year, haven't hit in the past. Talked to two different TT reps today, neither of which had a good explanation about what was going on or why. Have deleted my return and restarted twice trying to figure out what's going on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

The community does not know your question. Is it that turbo tax doesn't think you had health insurance all year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

Correct. TurboTax still thinks that I haven't had health insurance for the entire year. The application seems to believe that I had a break in coverage, regardless of which menu item I select.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

Clarification Are you filing a 2019 return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

Not anymore. It's doing the same thing for my 2021 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

If you are filing Married Joint, this question (about what type of High Deductible Health Plan you had on December 1, 2020") can be asked of each taxpayer. The question should be asked only of a taxpayer who (1) had an HSA in 2020, and (2) contributed to that HSA. So, simply, put, if you did not have an HSA in 2020 (remember the HSA belongs to an individual) nor did you (or anyone, like your employer) contribute to your HSA in 2020 (or in 2021 for 2020), then answer NONE. The error message about a lapse in coverage should now not appear.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

I file single, as I've always done. I have an HDHP, not an HSA. No matter which option I choose. TT assumes that my insurance lapsed at some point. It did this in 2019, it did this in 2020, and now it's doing this in 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

OK, you say that you have HDHP coverage but no HSA. It's unusual for a taxpayer to be under HDHP coverage to not go ahead and open an HSA and contribute to it. It's not required that you do so, but you are missing on a tax break if you don't open an HSA and use it.

Now, since you say that you don't have an HSA, this means that you did not go through the HSA interview. In the HSA interview, you indicate that you have HDHP coverage. Since you did not do that, TurboTax has to consider the possibility that you had HDHP coverage last year and used the "last-month rule" to maximize your HSA contributions but did not remain under HDHP coverage for 2021, which is required in such a case.

Unfortunately in the TurboTax interview, people see this question which often doesn't apply to them.

Now I want to reconfirm - did you or did you not go through the HSA interview (it begins asking what medical accounts you have)? If you did not go through the HSA interview, then answering NONE to the "What type of High Deductible Health Plan did you have on December 1, 2020?" question will avoid the error message about the lapse.

If you are still seeing this error message, then I have to guess that you have somehow indicated to TurboTax that you have an HSA. Please do the following:

It is possible to accidentally indicate to TurboTax that you had an HSA when perhaps you didn't. If you did not have an HSA, please do the following to remove all traces of HSA information from your return.

NOTE: if you see a question "What type of High Deductible Health Plan did you have any December 1, 2020?" (yes, 2020), be sure to answer "NONE".

1. make a copy of your W-2(s) (if you don't have the paper copies)

2. delete your W-2(s) (use the garbage can icon next to the W-2(s) on the Income screen

*** Desktop***

3. go to View (at the top), choose Forms, and select the desired form. Note the Delete Form button at the bottom of the screen.

*** Online ***

3. go to Tax Tools (on the left), and navigate to Tools->Delete a form

4. delete form(s) 1099-SA (if one), 8889-T, and 8889-S (if one)

5. go back and re-add your W-2(s), preferably adding them manually

6. continue with your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax thinks I had a break in HDHP health plan coverage during 2019, but I didn't. Where do I go to make sure Turbo Tax knows I had health insurance all year?

I would love to have the HSA option. Unfortunately, my high deductible plan doesn't allow it. I also have no W-2s since I'm self-employed.

At the question Tell Us About Your Health-Related Accounts, I choose None

The next question asks: What Type of High deductible health plan did you have on Dec 1, 2020. I choose Self only since according to the information popup, I'm an eligible individual (whatever that means.)

The next question asks if my HDHP lapsed due to disability. Neither of the answer options fits since my coverage did not lapse.

And there is my problem. My coverage never lapsed. I was covered continuously through 2020.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kendall96666

New Member

Vickiez1121

New Member

Vickiez1121

New Member

Vickiez1121

New Member

georgiesboy

New Member