- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbo Tax gave me one amount that I owe... then put 4 pre-pay coupons in the PDF with totally different amounts!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax gave me one amount that I owe... then put 4 pre-pay coupons in the PDF with totally different amounts!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax gave me one amount that I owe... then put 4 pre-pay coupons in the PDF with totally different amounts!

The Form 1040-ES that is included in the PDF are for your use only and you can use them or not. They are for 2023 estimated tax payments based on your 2022 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax gave me one amount that I owe... then put 4 pre-pay coupons in the PDF with totally different amounts!

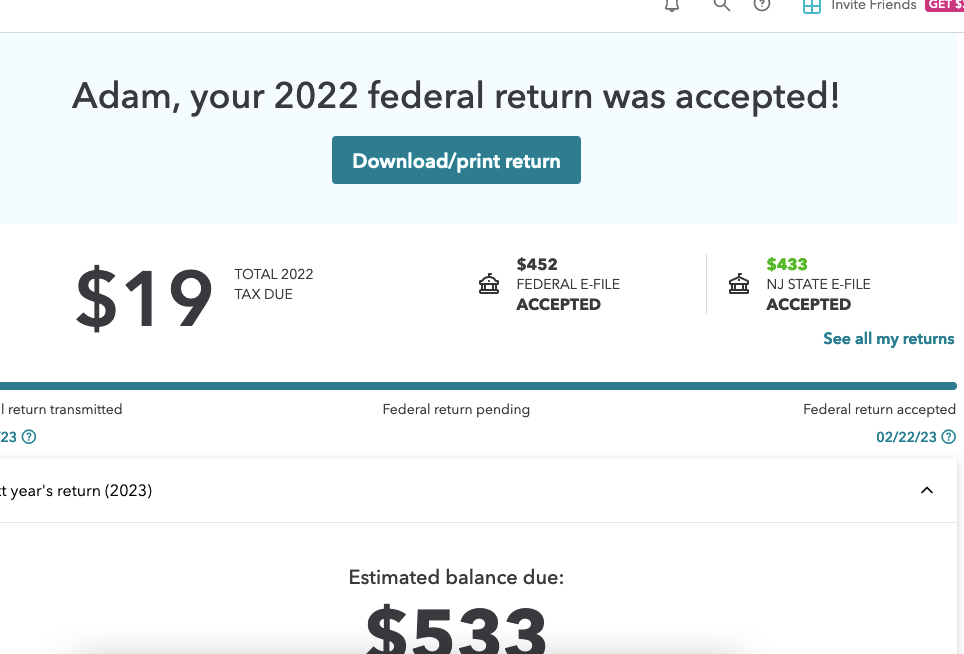

I appreciate your response - but - I forgot to mention that TurboTax also estimated my 2023 taxes will be $533. (Pic attached below.) That doesn't seem to fit with $690 x 4 pre-payments coupons.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax gave me one amount that I owe... then put 4 pre-pay coupons in the PDF with totally different amounts!

The 2023 tax due screen is a new thing this year. We don't know anything about it. I would ignore it. Maybe it's after the 4 estimated payments?

The 1040ES are estimates for next year. The 1040ES quarterly estimated tax payments DO NOT get sent to the IRS or state with your return. So they won't be expecting them. They are optional to pay. Turbo Tax is very conservative and doesn't want you to owe too much next year. They might have printed out if you got a one time large income this year. Like if you took a IRA or 401K distribution. You can ignore them. You might want to adjust your withholding at work so you won't owe too much next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax gave me one amount that I owe... then put 4 pre-pay coupons in the PDF with totally different amounts!

Since you are owing Federal Income on your 2022, TurboTax is estimating you pay $533 additional tax for 2023. You can print the Form 1040-ES worksheet to see how they compute the $690 shown on the payment vouchers.

See how to compute estimated tax liability below.

Based on your 2022 tax info, we’ll use the lower of the following IRS-approved methods to calculate your estimated tax payments.

- 90% of your estimated 2023 taxes

- 100% of your actual 2022 taxes (110% if your adjusted gross income was higher than $150,000, or $75,000 if Married Filing Separately)

There are two additional IRS-approved methods available:

- 100% of your estimated 2023 taxes

- 66 2/3% of your estimated 2023 taxes (farmers and fishermen only)

If you’d like to use one of the additional methods, answer Yes to the question "Do you want to adjust your income or deduction?" on the Review Your Estimates for 2023 screen. Once you review your income and deductions, you’ll have the option to select from any of the four methods.

How to Print 2023 Estimated Tax:

You can print next year's estimated tax vouchers (Form 1040-ES) in your 2022 program:

- Sign in to your TurboTax account, then open your return by selecting Continue or Pick up where you left off in the progress tracker

- When your return is open, search for 1040-es (be sure to include the hyphen) and select the Jump to link in the search results

- Answer No to the question Do you want to change your W-4 withholdings for 2023?

- Answer the questions about things like your 2023 filing status, income, and deductions

- Eventually, you'll come to the Print Vouchers? screen. Answer Yes and we'll include your 2023 1040-ES payment vouchers when you print a copy of your return later

- If you get the No Payments screen instead, you don't need to make 2023 estimated payments based on what you entered

- To check that the forms were added to your return, you can go to Tax Tools in the left menu, then Tools. In the pop-up, select Delete a Form. From here, you should see Form 1040-ES in the list of forms included with your return. You won't actually delete it, but this allows you to confirm it's there

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

stumbleine517

New Member

VB27

New Member

kurtpeliks1221

New Member

vcntlee-umich-ed

New Member

christianalb07

New Member