- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

You can visit the Medical section in Deductions and Credits and choose Affordable Care Act (Form 1095A) :

On the screen that says Here's what we have for your 1095-A you will see an option to delete your form 1095-A:

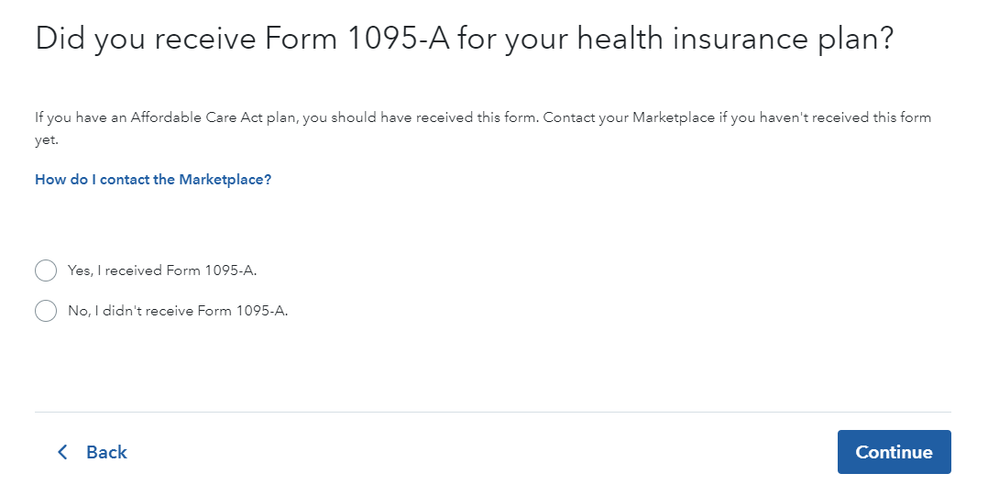

One you do that, you can revisit the same section and indicate that you don't have a Form 1095-A:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

In the Search box type "1095-a" (without the quotes), then click the link that says "Jump to 1095-a." That will take you back to the screen that asks whether you received a 1095-A, and you can answer No.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

Review your entries by following the instructions below:

- Launch TurboTax and type 1095-A in the search box at the top

- Select Jump to 1095-a

- If you see a Form 1095-A, select the trash can to delete

- If you don’t see a Form 1095-A, make sure that you select No when you get to the screen that asks Did you received Form 1095-A.

Also, try deleting the forms your tax return. Follow the steps below.

- Launch TurboTax

- Select TaxTools in the menu on the left

- Select Tools

- Select Delete a Form in the pop-up window

- Scroll down until you see Form 1095-A and delete

- If you see Form 8962, delete that form also

- Return to your tax return and review.

Refer to the TurboTax article How do I view and delete forms in TurboTax Online? for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

You are correct, your return won't be rejected just because you indicated that you had marketplace insurance in error. If a form 1095-A was not issued to you, then the IRS will not believe you have marketplace insurance so they will not reject your return for not reporting the Form 1095-A information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

@scottchopchop wrote:

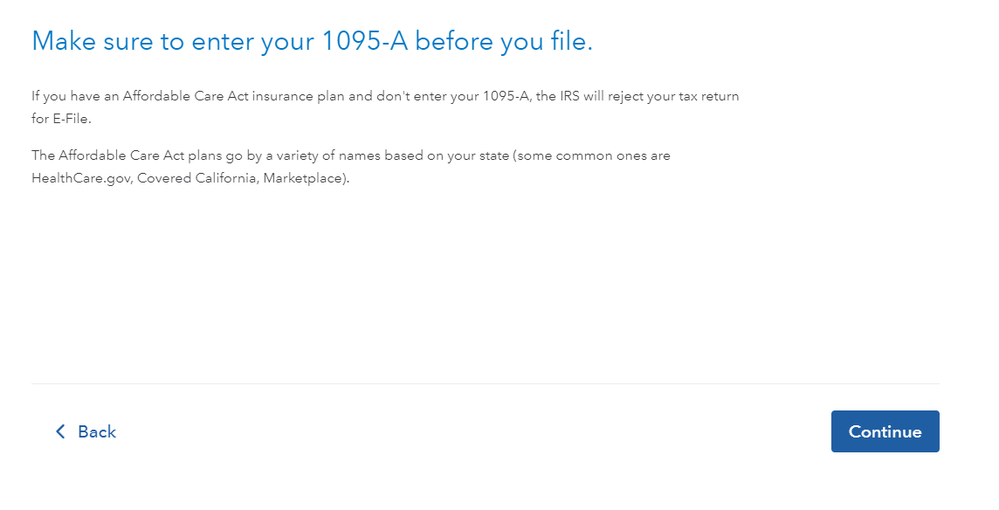

I assume had I not mistakenly answered the (now disappeared) question "did you have a Marketplace Insurance Plan for 2023?" as "yes", had I correctly answered that as "no", then Turbo Tax would not be serving me questions and warnings about being sure to include my 1095-A before I file.

@scottchopchop Your assumption is not correct. TurboTax displays that warning to everyone, even if you never said that you had Marketplace insurance or received a 1099-A.

Note that the warning says the IRS will reject your tax return "if you have an Affordable Care Act insurance plan and don't enter your 1095-A." The IRS knows whether you actually had ACA insurance, regardless of anything you might have entered in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

The IRS is rejecting my 2023 return because I have no 1095 A . I did not have heath insurance in 2023

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

There is a workaround for this situation, @4322121224 Make sure you have verified with Healthcare.gov that you have no 1095-A on file. If your return is still rejected after verification, use the workaround found in this help article. After you get the reject message, you will be able to certify you do not have the form and will be able to e-file.

- Select Federal from the left menu, then Deductions & Credits.

- Navigate to Medical and select Show More.

- Select Start or Revisit next to Affordable Care Act (Form 1095-A).

- You'll be asked if you received a 1095-A. Select No.

- Select the statement indicating you did not receive a 1095-A. By selecting this certification, you will be able to e-file your return and meet the requirements under rejected code F8962-070.

- Select File from the left menu and continue through the process to resubmit your return.

If you're not sure if someone in your household purchased insurance through HealthCare.gov or your state's Marketplace, check those websites for an account.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

I have the exact same issue but I did have regular non-healthcare.gov insurance, a turbo tax representative tried to tell me all these same responses and I still got rejected again. All I need to know is how to get to the question that says

“Did anyone listed on your tax return have marketplace health insurance in 2023?”

please no one tell me to go to a separate question I’ve tried that multiple times. All I need to do is answer no to the question I quoted above. It seems TurboTax doesn’t have the capabilities to allow people to undo their answer to that question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax asked if I had Marketplace Insurance for 2023, and I accidentally checked "yes"

@Nathanneedshelp Did you already use this procedure?

- Select Federal from the left menu, then Deductions & Credits.

- Navigate to Medical and select Show More.

- Select Start or Revisit next to Affordable Care Act (Form 1095-A).

- You'll be asked if you received a 1095-A. Select No.

- Select the statement indicating you did not receive a 1095-A. By selecting this certification, you will be able to e-file your return and meet the requirements under rejected code F8962-070.

- Select File from the left menu and continue through the process to resubmit your return.

If so, and you are still being asked about a Form 1095-A, then see if there is a 1095-A listed as part of your tax return and if it is, delete the Form 1095-A

Click on Tax Tools on the left side of the online program screen

Click on Tools

Click on Delete a form

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stephanie-dotson

New Member

kendall96666

New Member

earnieebarniee16

New Member

kac42

Level 2

donnapb75

New Member