- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TIN MATCHING Program for Sole Proprietor EIN- Biz Name or Legal Name?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TIN MATCHING Program for Sole Proprietor EIN- Biz Name or Legal Name?

I have to fill out a form for Amazon selling.

And it wants my EIN for sole proprietor. However I lost my SS4 like 5 years ago somewhere.

So.....I can't remember if it was for example "Don Smith Photography" or it was in the name of "Donald Smith" (legal name).

If I have both (which I'm sure I put like Don Smith Photography on it) but it's a sole proprietor EIN....so it's linked to my Legal name of course and soc. sec number.

Anxiety.........So I ended up using my full legal name on the W9 and it "Verified" however........now I worry at tax time it will get rejected for TIN Matching error or something and cause some huge issue since I don't have the original SS4 anymore.......and too much anxiety to call IRS and get a copy

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TIN MATCHING Program for Sole Proprietor EIN- Biz Name or Legal Name?

It will not be rejected for that reason. When Amazon sends the 1099 to the IRS has no affect on whether your return will be accepted or rejected. Your business name is already in the IRS system. If you add the income as suggested then you will not be required to complete a 1099-NEC in the software.

It takes one to two years for the IRS to actually attach that document to your tax return. Keep the 1099 in your files with your tax return should you need to show that it was included later.

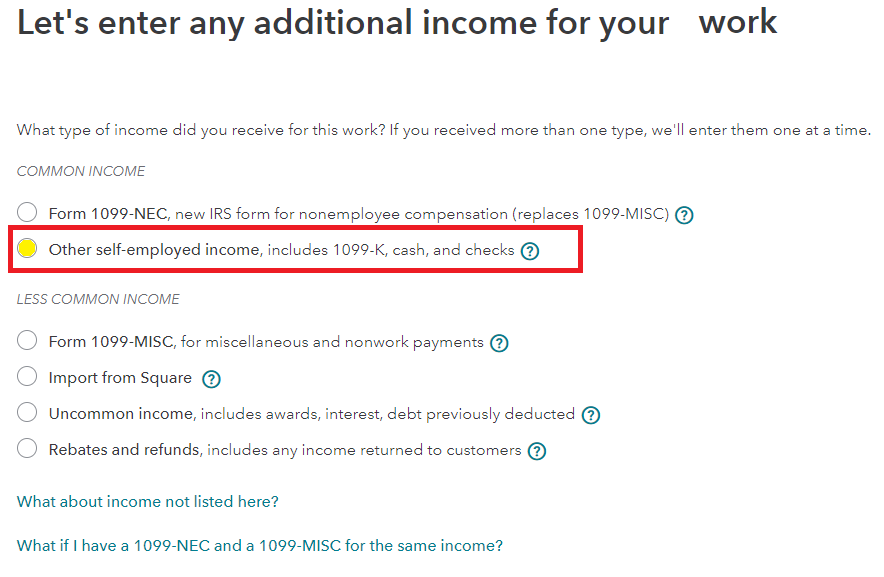

Enter your income as cash instead of entering your Form 1099-NEC. It's not required. The only thing that matters is that you include all of your income for self employment on the tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

palomino45

New Member

Harley4619

New Member

daniel-todd-beck

New Member

Taxguy100

Level 3

SerottaD

Level 2