- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- The portion of tax exempt dividends that are taxable in MA is not carried from the federal return to the MA return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The portion of tax exempt dividends that are taxable in MA is not carried from the federal return to the MA return.

The portion of exempt and non-exempt dividends did not carry over from Fed to MA.

During the Fed process step-by-step, I indicated in the 1099 Div section that one portion $EEE was from MA (i.e., MA exempt) and another portion $NNN was from multiple states (code XX, and therefor taxable in MA). However, the MA return did not show the breakdown and entered the full amount as exempt.

Apparently, the error can be corrected in the forms view. You open the 1099Div form, then scroll down to box 12. The two entries show up on different lines: MA=$BBB and XX=$NNN. That's just as it was entered. So far so good. However, the last line of box 12 asks where the divs were earned. It shows MA, but that is incorrect. You need to change the entry to XX (multiple states). Doing so will then correct the amount that is excludable (exempt) from MA taxes.

This error was posted by another wrt to NY taxes. That's how I stumbled upon the aforementioned solution. This is an error that needs to be corrected by TT. If you enter more than one state as a source of exempt divs, then the final line of box 12 should be XX.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The portion of tax exempt dividends that are taxable in MA is not carried from the federal return to the MA return.

It depends. I tested this in TurboTax software and it seemed to work just fine. I reported $2000 as tax-exempt income in Box 12, and then reported $500 interest earned in Massachusetts and then made another entry reporting $1500 earned in multiple states.

After I recorded this, I went to Massachusetts state forms and looked at the Int/Div Excl and $1500 was properly excluded here meaning that $500 was still recorded as reportable income in Massachusetts. Here is the screenshot.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The portion of tax exempt dividends that are taxable in MA is not carried from the federal return to the MA return.

Ok. That's interesting. That didn't happen in my case. Did the last line of box 12 of the 1099 Div show XX as the state where tax exempt divs were earned? I assume it did.

Btw, I wasn't even aware of this issue until I saw someone reported the problem wrt to his NY return.

The other possible question is whether you downloaded the 1099 from your brokerage or entered it manually. I downloaded. Also, I am using desktop version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The portion of tax exempt dividends that are taxable in MA is not carried from the federal return to the MA return.

I downloaded my 1099 (and on a desktop) as well and ran into the same issue you had. I had to correct it in the Forms view. Thanks for your post. But this should be corrected by TT!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The portion of tax exempt dividends that are taxable in MA is not carried from the federal return to the MA return.

I have the same problem for Ohio. I am using TurboTaxOnline which doesn’t appear to have “Forms” view. Is there another way to get the correct information to show up on my state tax forms? I have tried many different ways.

My 1099-DIV has an amount in box 12. That tax-exempt interest amount shows up as it should on my federal tax return (1040-SR) on line 2a.

At "Tell us more about your exempt-interest dividends”, I checked “I earned exempt-interest dividends in more than one state."

I entered the calculated exempt-interest dividend amount for “Ohio" and the rest for "Multiple States”.

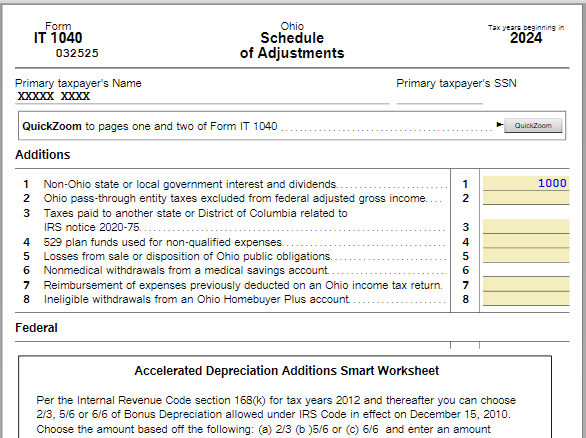

On my Ohio tax return the Multiple States amount should be entered on the Schedule of Adjustments, Additions, line 1 “Non-Ohio state or local government interest and dividends”. No amount is entered there which means the non-Ohio dividends are not being taxed by Ohio as they should be.

How can I correct this? Do I need to purchase the desktop version (both federal and state) of TurboTax so I can access forms? If so, I should be reimbursed for the money I spend on the online versions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The portion of tax exempt dividends that are taxable in MA is not carried from the federal return to the MA return.

When I prepared a return with a similar situation, $3000 of tax exempt dividends, $2000 from Ohio and $1000 from multiple states, my Ohio Schedule of Adjustments does show $1000 on line 1 for Non-Ohio state or local government interest and dividends.

If you imported this 1099-DIV, I suggest that you delete it and re-enter the information by hand.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The portion of tax exempt dividends that are taxable in MA is not carried from the federal return to the MA return.

My concern is when you download 1099's and you answer all the questions in the step-by-step, the taxpayer assumes TT will handle the information correctly. That's the point of downloading - to avoid errors creeping in. In my case, I told TT what portion was MA and what portion was multiple states (i.e., not MA) in the step-by-step. How on earth would I even imagine that TT would insert MA instead of XX on the last line of box 12 and thereby exclude all the exempt income from my MA tax return? It was a complete accident that I happened to catch this. I'm purchasing TT to handle my tax return correctly and accurately. If I have to correct TT errors, then exactly what am I paying for? This is really disappointing. It also makes me wonder if there are other errors that I haven't caught.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The portion of tax exempt dividends that are taxable in MA is not carried from the federal return to the MA return.

I agree whole-heartedly, williasp! To say nothing of the huge amount of time spent trying to figure out how to make it work.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Omar80

Level 3

tianwaifeixian

Level 4

kms369

Level 2

mjtax20

Returning Member

M_S2010

Level 1