- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Texas Community property allocation for non resident alien spouse who did not live in the US in 2023

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas Community property allocation for non resident alien spouse who did not live in the US in 2023

I'm in a tricky situation. My wife is a resident of Canada, and lived in Canada the whole of 2023. I lived in Texas in 2023. Both of us lived apart the whole year. I'm filing with the "Married Filing Separately" status. Is there any part of my income that I need to allocate to her with the community property law?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas Community property allocation for non resident alien spouse who did not live in the US in 2023

Yes. In viewing Publication 555, the only income you would need to allocate is income such as dividends, interest, rents, royalties, or gains, as provided under your state's community property law. This income is allocated 50/50.

All other income earned by you is allocated to you only.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas Community property allocation for non resident alien spouse who did not live in the US in 2023

Ah okay. Unfortunately, I already filed my taxes and assigned all of dividends/interest etc. to me. :( Would you recommend I file an amendment? And in this case, would my spouse have to file a tax return as well (for her share of the above income)? She currently has no other income in the US, but lived and worked in Canada in 2023, with Canadian income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas Community property allocation for non resident alien spouse who did not live in the US in 2023

I do want to clarify though - all of the interest and dividends are from separate property (and not from community property). So I should be fine in that case, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas Community property allocation for non resident alien spouse who did not live in the US in 2023

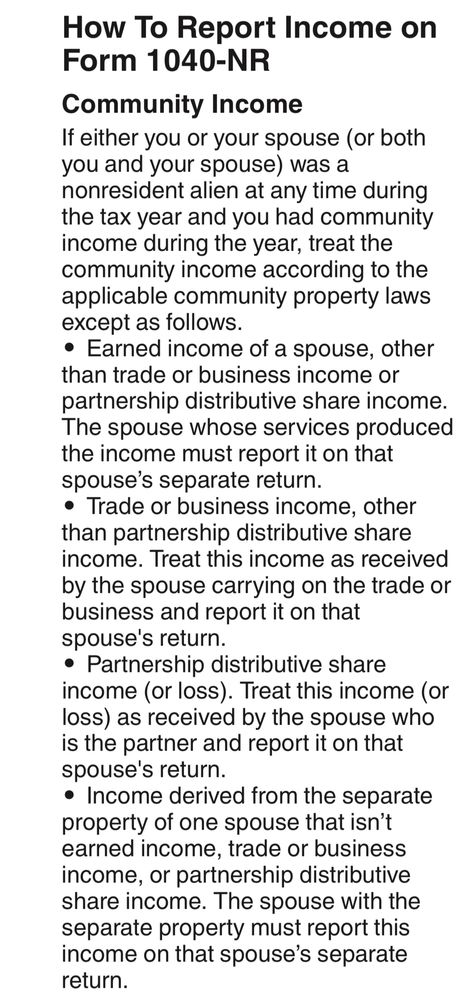

I see this in the 1040-NR instructions though - would you know if this bullet point means I can disregard interest and dividends too, and allocate all of it to just me?

- Income derived from the separate property of one spouse that isn't earned income, trade or business income, or partnership distributive share income. The spouse with the separate property must report this income on that spouse's separate return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Texas Community property allocation for non resident alien spouse who did not live in the US in 2023

In this instance, because she is a foreign national, I would leave it as is and not amend the returns. You've been taxed on the dividends and that will be enough. If the IRS wants more information they would send a letter.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RyanK

Level 2

dpa500

Level 2

dpa500

Level 2

Blue Storm

Returning Member

rlb1920

Returning Member