- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

@dennis-donovan wrote:

I am still waiting for the online version of Turbotax to be updated to reflect the American Rescue Plan. It has not been as of 4-10-2021.

The unemployment compensation exclusion was updated across all TurboTax platforms, online and desktop, on 03/26/2021.

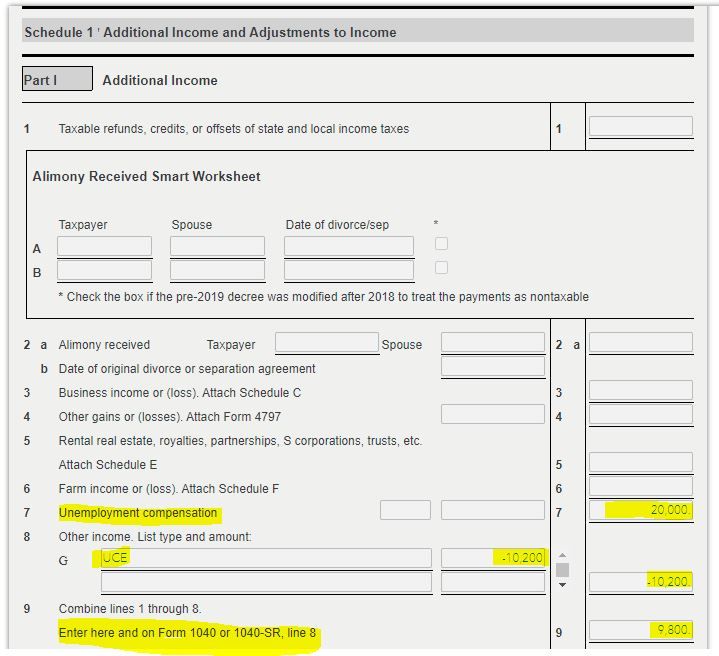

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

For unemployment? Online was updated before the Desktop program. But I think they are still updating the state returns.

How to claim the new unemployment exclusion.

Try deleting the 1099G and starting it over.

If you have unemployment you can exclude up to 10,200 if your income is under $150,000. The exclusion will be on Schedule 1 Line 8 as a negative number. Your unemployment compensation will be on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

The boxes in Schedule 1, line 8 are still blank on my 1040 preview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

@dennis-donovan wrote:

The boxes in Schedule 1, line 8 are still blank on my 1040 preview.

If your 2020 AGI is greater then $150,000 you are not eligible for the exclusion.

If your 2020 AGI is less than $150,000 then delete the Form 1099-G for the unemployment and re-enter.

If that does not fix the problem, close the TurboTax online program and window. Clear cache and cookies from your web browser - https://ttlc.intuit.com/community/troubleshooting/help/how-to-clear-your-cache/01/26135

Close the web browser. Restart the browser and sign back onto the online account - https://myturbotax.intuit.com/

If the problem persists, change your web browser.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

I started my taxes online prior to the announcement of the tax break.

I received $8,000 in unemployment, and had $859 fed tax withheld and $165 state tax withheld.

I was waiting for the update to see how my estimated refund would change, but it didn't change.

Is that right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

Do you have a high income? Or maybe it was already figured in.

If you have unemployment you can exclude up to 10,200 if your income is under $150,000. The exclusion will be on Schedule 1 Line 8 as a negative number. Your unemployment compensation will be on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

@jro6Did the amount you owe on federal decrease or are you getting a refund from Federal? What state do you live in and are they complying with the exclusion? Did you check your schedule 1 Line 8 to see if your $8000 unemployment exclusion was applied?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

Has anyone update desktop premier and get the 10,200 credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

Yes! It is first recorded on Schedule 1 as Unemployment Compensation on line 7.

Then on line 8 there is a UCE (Unemployment Compensation Exclusion) of -$10,200.

This is then carried over and posted to your tax return (1040) on line 8.

So, it’s already included.

Unemployment Stimulus: Am I Eligible for the New Unemployment Income Relief?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

I do not have the tax tool option on the Left hand side like in previous years. If I download my tax return it still shows the same information as when I filed. Does not show the 10,200 UCE. I still feel I have not updated as my TurboTax home page still shows Federal Return received and projected refund date. I do not believe my version has updated. Online Self employed..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

@Happygirl1 Do you have a high AGI?

On 3/19 they updated the Online version for the unemployment 10,200 exclusion. Desktop was updated on March 26. Try updating your program. How to update

https://ttlc.intuit.com/community/installing/help/how-do-i-update-turbotax-cd-download/00/26038

If updating doesn't help then delete the 1099G and re enter it.

If your modified AGI is $150,000 or more, you can’t exclude any unemployment compensation. The exclusion will be on Schedule 1 Line 8 as a negative number. Your unemployment compensation will be on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

Unfortunately 2020 was a rough year income wise. We did not earn near the 150K AGI. How do I remove a 1099 when I have already filed my taxes? If I click state (like I'm going to add) it shows the difference in refund amount, but I do not proceed being I live in Florida.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

Don't know why your return is not updated for it. It should be. When did you file? If it was before the update the IRS will be adjusting returns for it. There is no need for taxpayers to file an amended return unless the calculations make the taxpayer newly eligible for additional federal credits and deductions not already included on the original tax return.

https://www.irs.gov/newsroom/irs-to-recalculate-taxes-on-unemployment-benefits-refunds-to-start-in-m...

The exclusion will be on Schedule 1 Line 8 as a negative number. Your unemployment compensation will be on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

I file Feb 12th and received my refund March 5th, which was before the changes went into effect. I will wait for the IRS to do the adjustments. I just keep seeing everyone has updated through Turbo but I have not. I do not have the tax tool in the left corner like previous years. If I download my tax form it still shows my old figures.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

And you entered the unemployment 1099G in the right place? Is it on Schedule 1 line 7? It may have been entered as a different kind of 1099G (there are several).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Bailey7557

Level 2

Fred_R

Level 3

tobenna9

New Member

Mikelhouston94

New Member

olwi00

Level 2