- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Substitute Payments in Lieu of Dividends

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substitute Payments in Lieu of Dividends

Hi,

If I have Substitute Payments in Lieu of Dividends, how do I enter them in TurboTax to use my Investment Interest Expense to offset them? Do I enter them as Other Investment Income in Investment Interest Expenses section?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substitute Payments in Lieu of Dividends

Payments received in lieu of dividends are normally shown on Form 1099-MISC in Box 8. These payments are treated as ordinary income and will flow to Line 8z on Schedule 1 to be included as additional income. This, unfortunately, does not allow you to offset your investment interest expense.

Payments in lieu do not qualify for favorable tax rates on qualified dividends. Currently, qualified dividends have maximum rates of 0% to 20% depending on your regular tax bracket, but they always save you at least 10 percentage points on the tax rate you pay on the dividends.

Payments in lieu don't qualify for that favorable treatment and get taxed at ordinary income rates. With those rates rising as high as 39.6%, payments in lieu can represent a costly tax problem.

To enter the data, follow these steps:

- Click on Wages & income

- Scroll down to "Other common income", click on "Show more"

- Click on "Start" or "Revisit" at Form 1099-MISC

- Answer yes if you received the 1099-MISC

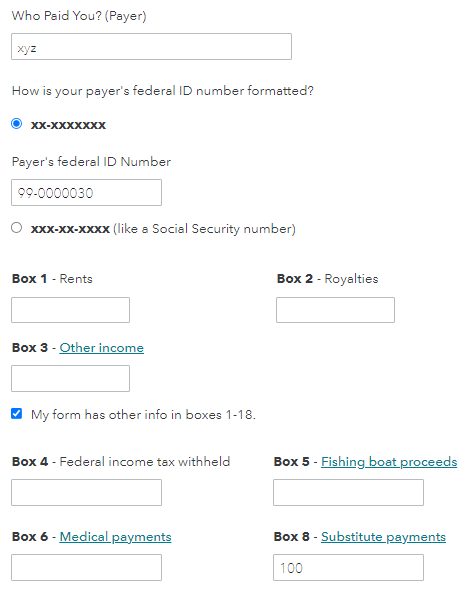

- Enter the identifying data and then click in the box for My form has other information in boxes 1-18

- Enter the amount in Line 8 as shown below. Please be advised the example is for presentation purposes only.

- After entering the data, scroll down and click continue

The screen will ask if you have another 1099-MISC. After answering you will return to the 1099-MISC Summary and click done if all appears correct. You will then see the income summary screen where you can continue with your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

user17524395330

Level 1

tianwaifeixian

Level 4

Sweet300

Level 1

kms369

Level 2