- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Stuck with K-3 mismatch in Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stuck with K-3 mismatch in Turbotax

Hi guys. Im stucked with my tax filing because turbotax is no matching correctly my K-3 total. So basically what is going on is that the K-3 that I received has only values in column A (US source), and column F (sourced by partner), and column G (total). Columns B, C, D and E are empty on every row. So when I fill all the data, Turbotax doesn't let me advance because there is a mismatch between the "total" and the sum of the "foreign" and "US source" data, as turbotax does not ask for column A data. Should I uncheck box 16 if only columns A, F and G have data, and all columns B, C, D and E are empty? I cant really advance, and the suggestions for Turbotax is putting a number in the foreign section to make it "sum" up with the total (I dont think is the correct solution). I would really appreciate your help with this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stuck with K-3 mismatch in Turbotax

If your K-3 has only US income you do want to uncheck box 16.

So the purpose of this entry is to include foreign income, if you have no other foreign income or foreign tax credits to report on your return you do not have to include the K-3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stuck with K-3 mismatch in Turbotax

Thanks for the response. It is not clear to me though if column F qualifies as foreign or not? my K-3 has all columns B, C, D and E empty on every row. The only columns that have little info are column A and column F (sourced by partner). IS column F considered like foreign? Only little info in the K-3 that has data is line 49 column A and F, and line 54 and 55 (just because line 49 has data as line 54 and 55 are totals). Nothing at all in columns B, C, D and E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stuck with K-3 mismatch in Turbotax

I fully understand your follow up question regarding it not being apparent. To help I am attaching the columns a-g from the first six lines of the K-3:

So what then is Column f, which is your concern. Sourced by Partner only shows up twice in the IRS instructions for the K-3 1065 Instructions This is the one that has an actual instruction though:

Column (f). Sourced by partner. You must determine the source and separate category of the income reported in this column. The income in this column will generally be with respect to sale of personal property other than inventory, depreciable property, and certain intangible property sourced under section 865. This column might also include foreign currency gain on a section 988 transaction. If you're a U.S. citizen or resident, sales and gains reported in this column will generally be U.S. source income and not reported on Form 1116 or 1118 unless you elect to re-source such income under an applicable income tax treaty. There are certain exceptions, for example, a U.S. citizen or resident with a tax home (as defined in section 911(d)(3)) in another country is treated as a nonresident if an income tax of at least 10% is imposed by and paid to a foreign country regarding such sale. See the instructions for box 1 of Part I, earlier. Also, the source of foreign currency gain or loss on section 988 transactions may be determined by reference to the residence of the QBU on whose books the asset, liability, or item of income or expense is properly reflected. See the Instructions for Form 1118 and Pub. 514 for additional details.

So the answer to your question is that unless there are any numbers in columns b-e, you would be safe unchecking the box as recommended by @Alicia65 since there is unlikely any foreign source income or expenses. It is also unlikely that any of the items in Column f are foreign either based upon the single instance that the K-3 instructions have any detail on Column f.

Thank you for your question @Javitch

All the best,

Marc T.

TurboTax Live Tax Expert

27 Years of Experience Helping Clients

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stuck with K-3 mismatch in Turbotax

I have a similar question.

I have foreign income and foreign deductions.

I also have US local source deduction.

If I check box 16, local deductions don't appear.

Please help resolve this.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stuck with K-3 mismatch in Turbotax

TurboTax does not allow you to enter US local source deductions when box 16 is checked. This is because box 16 is specifically for reporting foreign transactions. If you have US local source deductions, you may need to enter them separately in a different section of TurboTax.

If you have both foreign and US local source deductions, you may need to create separate entries for each type. Enter your foreign income and deductions under box 16, and then enter your US local source deductions in the appropriate section of TurboTax depending on the type of the deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stuck with K-3 mismatch in Turbotax

I have foreign income and need to include a k-3 for each partner. Do these need to be manually added in? I tired check the box in line 16 of the K-1 with no success.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stuck with K-3 mismatch in Turbotax

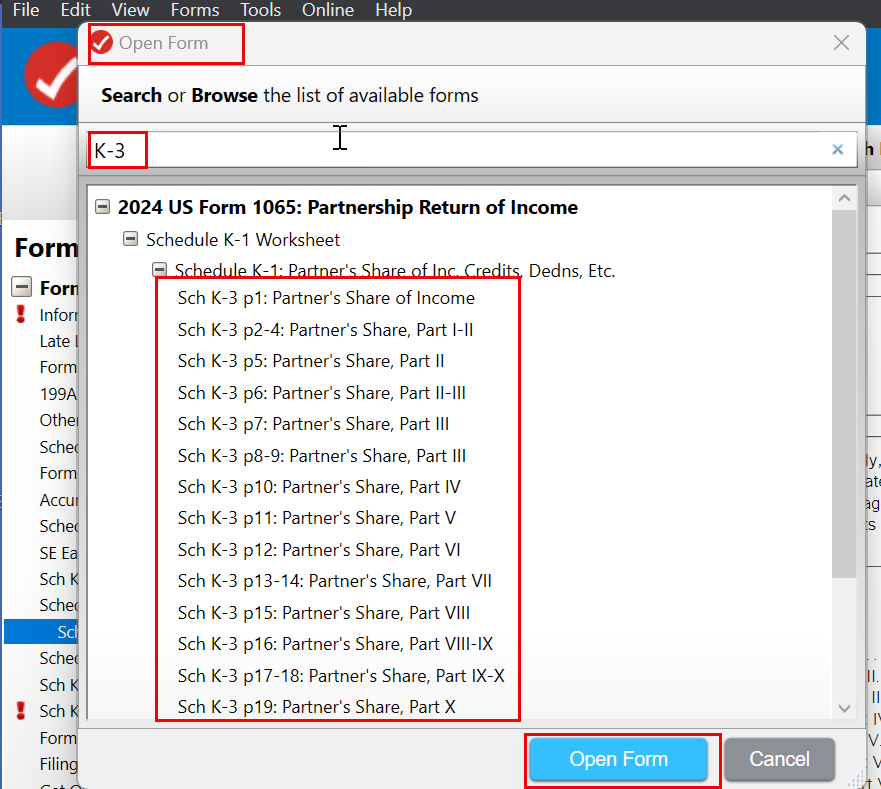

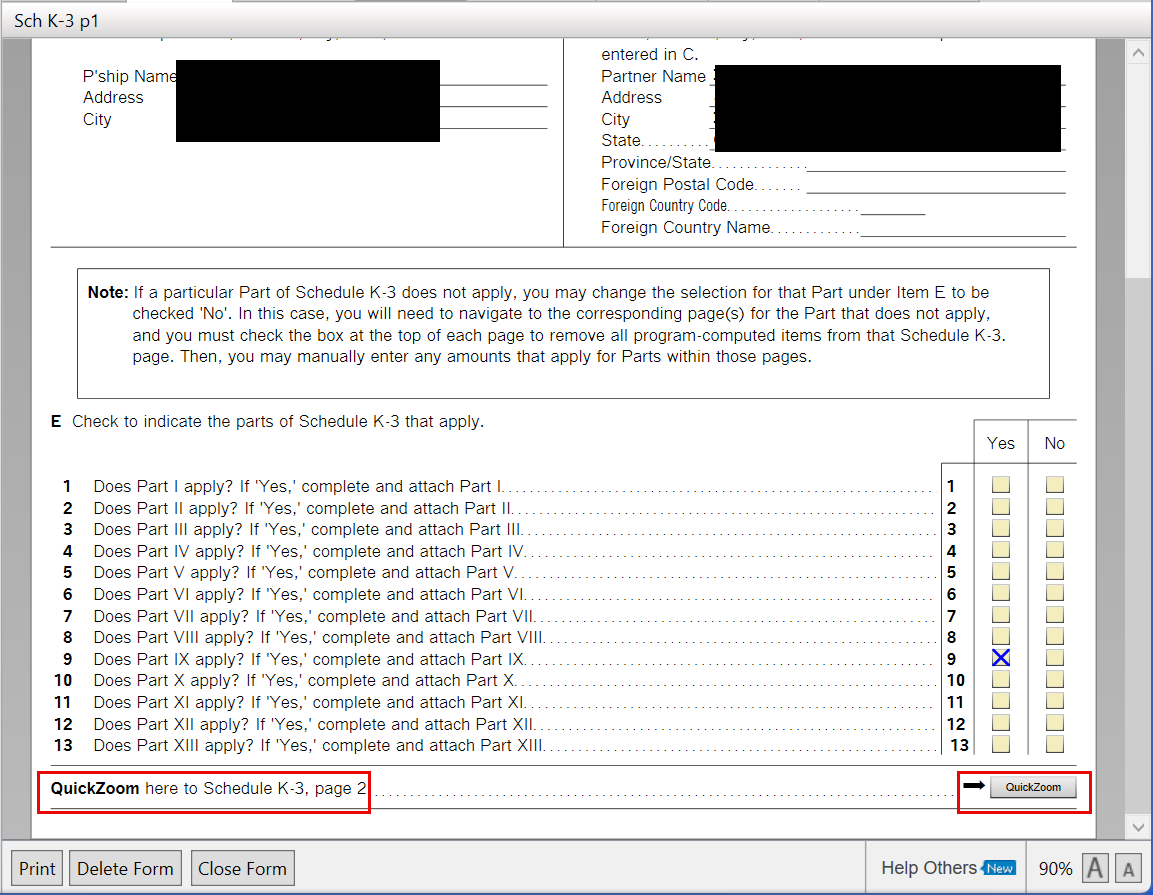

If you are preparing a partnership return, you will need to go to Forms, select Open Form, and search for K-3. You will see a list of options appear in the pop up screen. Select the appropriate section as it applies to the foreign items that need to be reported.

At the bottom of each screen, you will be able to continue to the next page of the Schedule K-3 if needed by selecting the QuickZoom option.

If you are trying to enter this information for your individual return, please see how do I enter Schedule K-3 in TurboTax for guidance on entering this information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

zsbprice456

New Member

williamhein

New Member

rhudethompson

New Member

TheHolyHolden

New Member

Irasaco

Level 2