- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- state sales tax wrong

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

I've used Turbo Tax for many years, but I am really unhappy right now. I spent the day putting in all the info. and then looked at the figures comparing this year and last year. Couldn't figure out why it showed the state sales tax deduction as being $500 less than last year. After figuring it with the IRS tool and looking up the worksheet Turbo Tax did, I discovered Turbo Tax had used the correct 6.25% state tax number, but had put 0.00 for my local tax rate! I had to manually override it and change it to 2.0% to get the correct 8.25% rate we pay and have it match the IRS computation. It meant another $110 for my tax refund! I should never have to worry about Turbo Tax's mathematical errors! Now I'm wondering if it did all our investment calculations properly. At the very least, I'd like back the price I paid for this year's TT CD. I took screenshots of all of it. Has anyone else run across this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

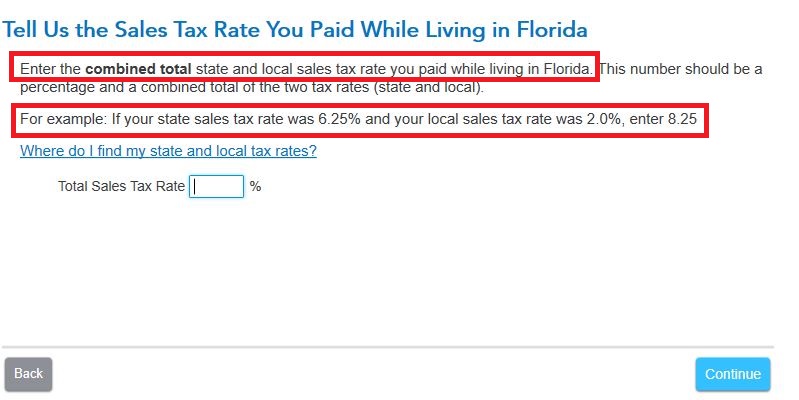

In the Sales Tax section, TurboTax asks that you enter the combined total state and local sales tax rate. You shouldn't have had to override anything. See example.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

It didn't ask me to put in my state percentages. I have a screenshot, but can't upload it for some reason. It said:

Let's Compare Your Sales Tax and Income Tax

Based on your entries so far, we recommend the sales tax deduction for you.

Here's how they compare:

Your state and local income tax deduction - 0

Your estimated state sales tax deduction - $1374

(Instead of $1374, it should have said $1814!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

Yes, so on that page you select continue and then select the EasyGuide link on the next page. Enter you dates that you lived in your state, continue and you will see the page I listed above.

Note: From the page you listed above, the amount is listed as 'Estimated'. You have to complete the section to get the final figures. If you have overrided amounts in Forms mode, go back and remove, then complete the sales tax section. Overrides void any program warranties.

It didn't ask me to put in my state percentages. I have a screenshot, but can't upload it for some reason. It said:

Let's Compare Your Sales Tax and Income Tax

Based on your entries so far, we recommend the sales tax deduction for you.

Here's how they compare:

Your state and local income tax deduction - 0

Your estimated state sales tax deduction - $1374

(Instead of $1374, it should have said $1814!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

I went to the form, canceled the override, went back to the step by step. It lets me put in .0825, but it STILL comes up with the wrong $1374! The IRS calculator for AGI between $140,000 and $160,000 in Texas shows the State sales tax as being $1374, the Local sales tax as $439.68 and the total sales tax deduction as $1813.68. I do appreciate your help, but this is making me crazy!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

When I go back to the forms now, it's back to showing my local sales tax percentage as 0. If I'm answering correctly in the step by step that the total is .0825 and it's not changing the figure, how am I supposed to get it corrected without changing it manually on the form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

Are you entering in the field box .0825 or 8.25? Enter 8.25 please.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

Bless you!!!! That fixed it! Thank you so much. I greatly appreciate your help!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

You are so very welcome! 🙂

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

I am having the same problem. I entered the sales tax of 8.25 for Illinois and the EasyGuide did not include the local sales tax portion in the final computation. The IRS calculator indicates it should be $972 state tax and $368 local tax. On the Tax and Interest Deduction Worksheet in TurboTax 2019, it shows $972 for State Taxes and $0 for local taxes. How can this be corrected? By the way, in the prior year 2018 TurboTax software, it was calculated correctly and matched the IRS calculations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

I have noticed the same issue. Easy guide calculates a number that is different from what the IRS calculator calculates. In my case there is no local tax there is just state sales tax. I have no idea how it could be possible that the turbotax number doesn't match IRS number, given that to get the IRS number you had to enter just a few numbers (i.e. your dependents, the state, the income band, and the date). How could Turbotax get such simple calculation wrong!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

I also have the same problem with Turbo Tax's calculation of sales tax. I live in California, and my combined local and sales tax is 7.875. I put that in the easysolve, and it gives me $1.073. But the IRS calculator and the IRS worksheet both come up with $886.

Has there been a correction to Turbo Tax, and how can I get this fixed on my State return so I can file?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

Just spoke to a CPA that TurboTax connected me to since I have that benefit included with my version of TurboTax. When going through the steps of EasyGuide to calculate the Sales Tax deduction on Schedule A (Itemized Deductions), it will ask you, Do you have any other nontaxable income? I did, so I put yes and entered it. When the CPA logged onto my taxes and looked up the Tax and Interest Deduction Worksheet, we found that my nontaxable income was entered twice. Therefore when it looked up my income in the tax table, it was in a higher tax bracket and had the wrong tax amount. To make a long story short, I had to go back and change the answer to NO, I do not have any other nontaxable income and don't enter it, since TurboTax had already captured it. Hope this may answer the question from anyone else who this might have happened to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

How do you go back and say no? I put "yes" to see if it applied to me and realized it didn't, but it keeps wanting me to enter my state and city and the taxable income. I want to go back and click no but i can't find the way to since i had originally said yes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state sales tax wrong

Use the following steps to go back to the Sales Tax section of your return. You can delete any entries that have been made so that sales tax will not be a consideration for your situation by selecting Delete or clicking the trash can icon next to the state name that has been entered.

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “sales tax” (be sure to enter exactly as shown here) and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to sales tax”

- Click on the blue “Jump to sales tax” link

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

karent668

Level 1

leggettanthony04

New Member

Mikes20222022

New Member

user17709205839

New Member

Grimmrlg

New Member