- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- State 1040 form has different boxes for Mailing and Legal Residence Address which Turbotax will not edit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State 1040 form has different boxes for Mailing and Legal Residence Address which Turbotax will not edit

Hi all.. hoping you can provide some assistance.

I am filing taxes on behalf of my grandmother who passed away and I am the executor of her estate. I've read many comments stating you only need to enter your own mailing address as long as it's in the same state which the resident lived.

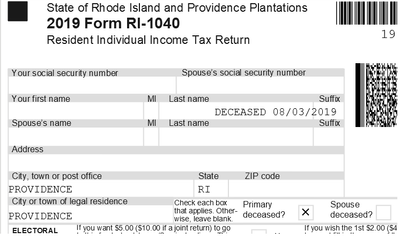

However on my 1040 state return, there are two clear boxes for different entries. One says "City, town, or post office" which has my own City as the mailing address. The second box says "City or town of LEGAL residence". Turbotax copies the information for BOTH of these boxes from the mailing address you enter in "My Info" and doesn't give an option to enter separate addresses.

Since the State form clearly has two boxes for different entries, how can I best get around this? So far I clicked the "New Address" box on the state return but think a better option would be if I could edit the "Legal Residence" box. Any suggestions? Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State 1040 form has different boxes for Mailing and Legal Residence Address which Turbotax will not edit

Please share which state you are filing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State 1040 form has different boxes for Mailing and Legal Residence Address which Turbotax will not edit

Apologies.. the state is Rhode Island.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State 1040 form has different boxes for Mailing and Legal Residence Address which Turbotax will not edit

BUMP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State 1040 form has different boxes for Mailing and Legal Residence Address which Turbotax will not edit

Which state are you referring to? Remember that we in the Community cannot see your tax return nor the screen you are on.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State 1040 form has different boxes for Mailing and Legal Residence Address which Turbotax will not edit

Hi Bill,

I keep replying that the state is Rhode Island. It's showing on my screen?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State 1040 form has different boxes for Mailing and Legal Residence Address which Turbotax will not edit

Sorry, the previous comments were not showing when I read your question; I don't know why. Well, on to your question.

When I ran my test, the My Info had an out-of state address (for RI). I checked that I wanted to do a resident return anyway, and then I got this screen.

As you can see, I selected "Providence" and that is the name that appears on the state return as the "City or town of legal residence".

Are you not seeing this data entry screen?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State 1040 form has different boxes for Mailing and Legal Residence Address which Turbotax will not edit

Hi Bill,

Unfortunately the Free Online Edition of TurboTax does not have a screen selection that looks like that. In the Free Online Edition, you enter you Address in My Info and it uses that throughout that though the RI 1040 has seperate selections for mail City, Town, or Post Office, and City or Town of legal residence.

Most of the "Accepted Answers" here just say that box does not matter and to repeat your own city as the legal residence. I found that the best solution for this case is to open the completed tax return in a PDF editor and simply edit the legal residence box to the correct city. This works for me as the Executor I cannot e-file anyway and must paper mail with a copy of the executor appointment.

I marked your answer as best. Thank you for your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

matto1

Level 2

deniseh

Returning Member

clarkson38

New Member

benzaquenbills

New Member

anil

New Member