- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Should I put in my 1099-MISC other income I won from a contest into my non-resident PA state return without it showing up as gambling winnings? If so, how do I do that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I put in my 1099-MISC other income I won from a contest into my non-resident PA state return without it showing up as gambling winnings? If so, how do I do that?

-Trying to file the non residential PA return and I'm afraid it might be showing the wrong tax info. The 1099 MISC is only showing up as gambling winnings. Is something wrong?

-Also I am filing this return before my residential ones so that is not the issue and I did click earned other income from another state in the info section.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I put in my 1099-MISC other income I won from a contest into my non-resident PA state return without it showing up as gambling winnings? If so, how do I do that?

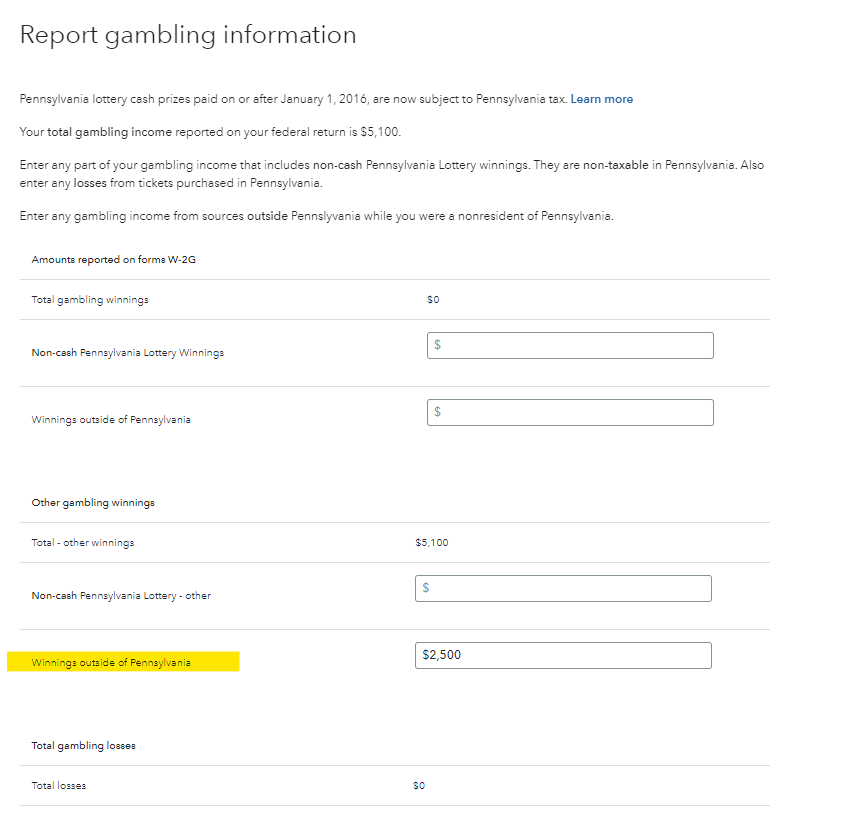

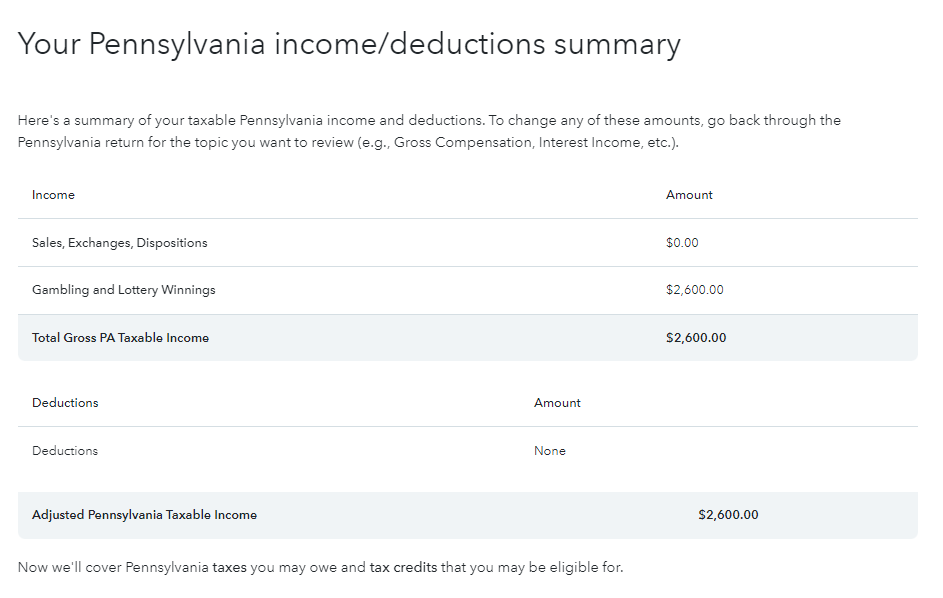

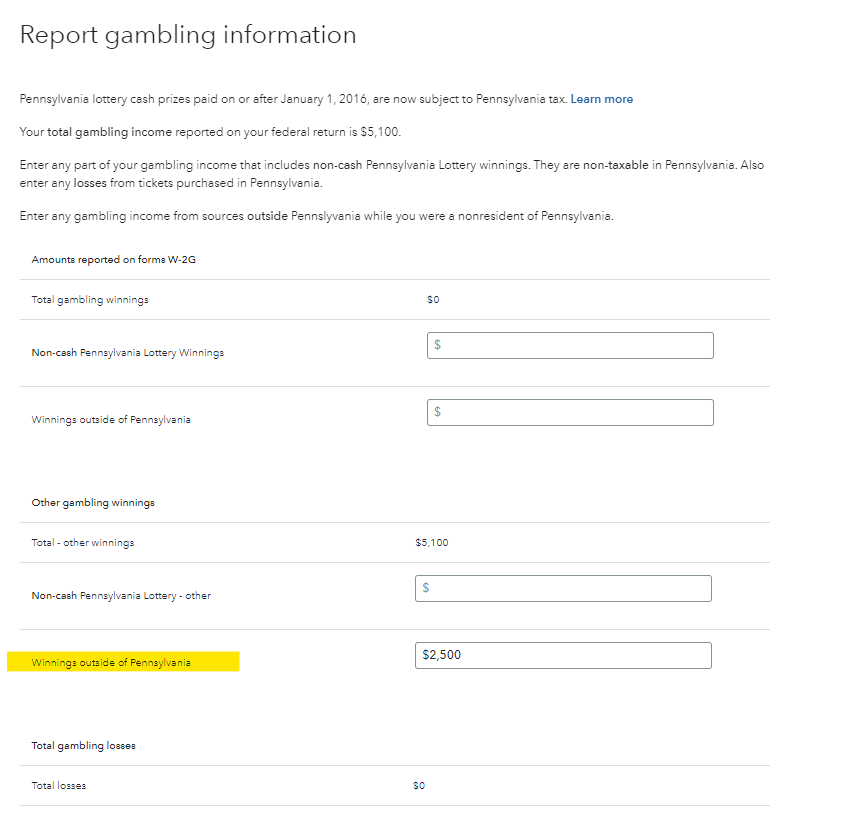

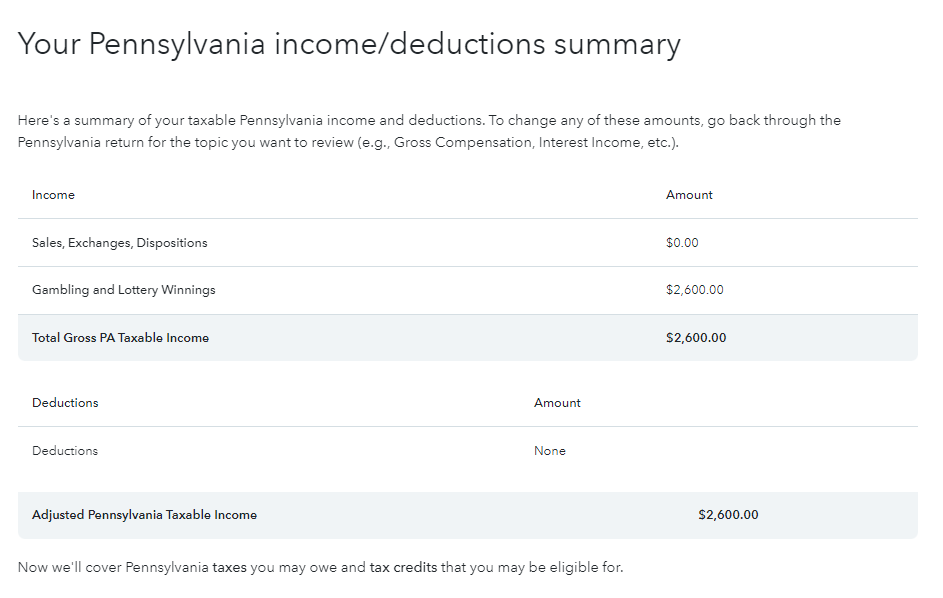

How much is the 1099-misc for? When you entered the income on the Federal Return, it is automatically transferred to your state returns, but you will come to a screen, see below, where you have to tell TurboTax how much of that income does not belong to PA.

If you reported your prize winnings from a From 1099-misc, TurboTax will put that with gambling winnings (tax the same as ordinary income), so that is the screen you need to allocate - and you will only need to subtract out any of that income that does not belong to PA. I reported $5100 in federal winnings and reported $2500 was not PA-sourced. No tax was due.

The Pennsylvania personal income tax does not provide for a standard deduction or personal exemption. However, individuals may reduce tax liabilities through certain deductions, credits and exclusions.

Deductions:

- Taxpayers may reduce taxable compensation for allowable unreimbursed expenses that are ordinary, actual, reasonable, necessary and directly related to the taxpayer’s occupation or employment.

- PA law allows three deductions against income: deductions for medical savings account contributions, health savings account contributions and IRC Section 529 tuition account program contributions.

Credits:

- Credit against Pennsylvania income tax is allowed for gross or net income taxes paid by Pennsylvania residents to other states.

- Credit is available to lower income families and individuals receiving Tax Forgiveness.

- Tax credit programs also reduce income tax liability for qualified applicants.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I put in my 1099-MISC other income I won from a contest into my non-resident PA state return without it showing up as gambling winnings? If so, how do I do that?

How much is the 1099-misc for? When you entered the income on the Federal Return, it is automatically transferred to your state returns, but you will come to a screen, see below, where you have to tell TurboTax how much of that income does not belong to PA.

If you reported your prize winnings from a From 1099-misc, TurboTax will put that with gambling winnings (tax the same as ordinary income), so that is the screen you need to allocate - and you will only need to subtract out any of that income that does not belong to PA. I reported $5100 in federal winnings and reported $2500 was not PA-sourced. No tax was due.

The Pennsylvania personal income tax does not provide for a standard deduction or personal exemption. However, individuals may reduce tax liabilities through certain deductions, credits and exclusions.

Deductions:

- Taxpayers may reduce taxable compensation for allowable unreimbursed expenses that are ordinary, actual, reasonable, necessary and directly related to the taxpayer’s occupation or employment.

- PA law allows three deductions against income: deductions for medical savings account contributions, health savings account contributions and IRC Section 529 tuition account program contributions.

Credits:

- Credit against Pennsylvania income tax is allowed for gross or net income taxes paid by Pennsylvania residents to other states.

- Credit is available to lower income families and individuals receiving Tax Forgiveness.

- Tax credit programs also reduce income tax liability for qualified applicants.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I put in my 1099-MISC other income I won from a contest into my non-resident PA state return without it showing up as gambling winnings? If so, how do I do that?

It turns out I just had to put a 0 in for the winnings outside of PA as I just left it blank when I originally did it. This response solved my issue and was extremely helpful and reassuring

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17552101674

New Member

keriswan58

New Member

keriswan58

New Member

trelawneyscroggins

New Member

721alucio

New Member