- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

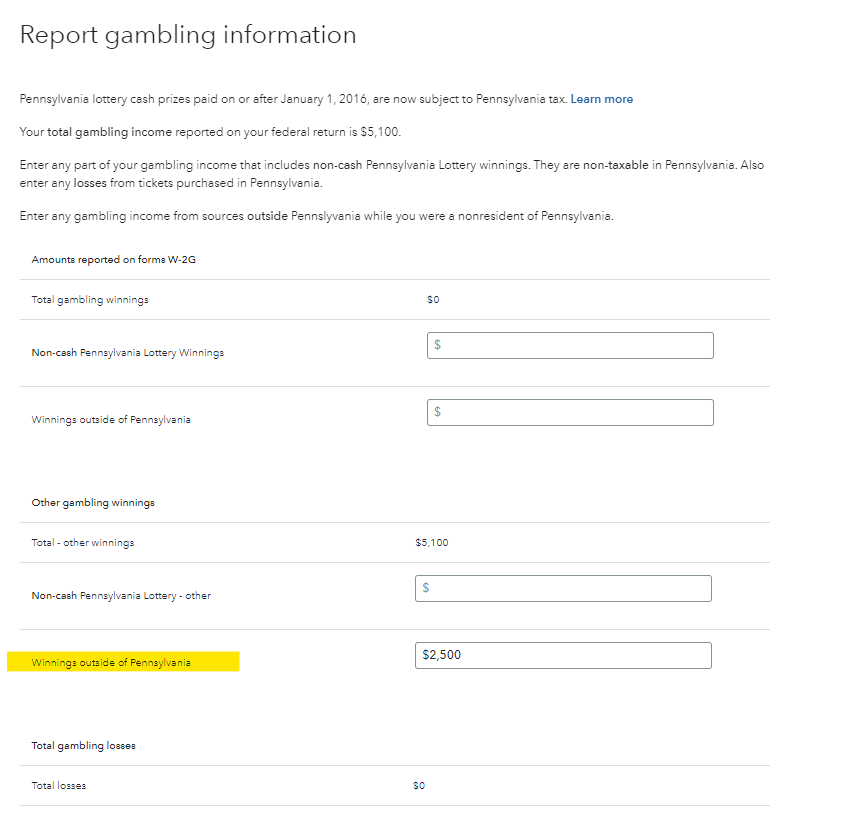

How much is the 1099-misc for? When you entered the income on the Federal Return, it is automatically transferred to your state returns, but you will come to a screen, see below, where you have to tell TurboTax how much of that income does not belong to PA.

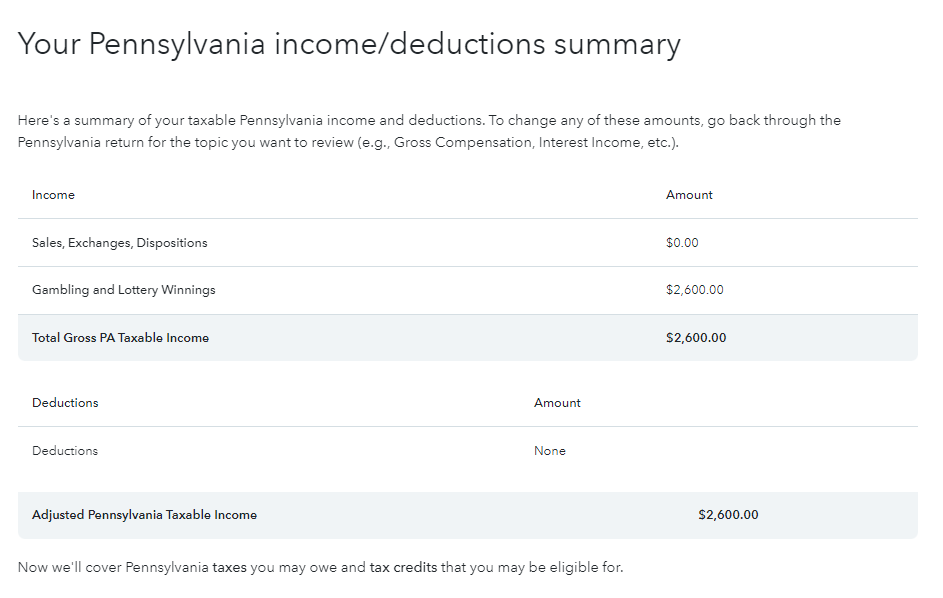

If you reported your prize winnings from a From 1099-misc, TurboTax will put that with gambling winnings (tax the same as ordinary income), so that is the screen you need to allocate - and you will only need to subtract out any of that income that does not belong to PA. I reported $5100 in federal winnings and reported $2500 was not PA-sourced. No tax was due.

The Pennsylvania personal income tax does not provide for a standard deduction or personal exemption. However, individuals may reduce tax liabilities through certain deductions, credits and exclusions.

Deductions:

- Taxpayers may reduce taxable compensation for allowable unreimbursed expenses that are ordinary, actual, reasonable, necessary and directly related to the taxpayer’s occupation or employment.

- PA law allows three deductions against income: deductions for medical savings account contributions, health savings account contributions and IRC Section 529 tuition account program contributions.

Credits:

- Credit against Pennsylvania income tax is allowed for gross or net income taxes paid by Pennsylvania residents to other states.

- Credit is available to lower income families and individuals receiving Tax Forgiveness.

- Tax credit programs also reduce income tax liability for qualified applicants.

**Mark the post that answers your question by clicking on "Mark as Best Answer"