- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Sent Money From a 401K That Was Closed But Did Not Get a 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sent Money From a 401K That Was Closed But Did Not Get a 1099-R

I received a payment in 2020 (less than $100) from a 401K that I had rolled over years before. Apparently it was due to some bookkeeping error on their part. I did not roll this payment into any other retirement plan. The 401K administrator sent a letter with it saying I would receive a 1099-R but what I got was just a statement saying this was a "Termination claim", the amount, account number.

I'm not sure how to claim this as income. I was older than 59.5 in all of 2020.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sent Money From a 401K That Was Closed But Did Not Get a 1099-R

File a Form 4852.

This form serves as a substitute for Forms W-2, W-2c, and 1099-R and is completed by taxpayers or their representatives when:

- Their employer or payer does not give them a Form W-2 or Form 1099-R, or

- An employer or payer has issued an incorrect Form W-2 or Form 1099-R.

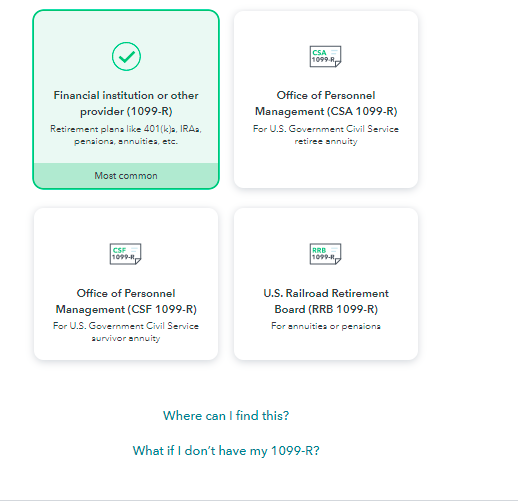

Click on "What if I don't have my 1099-R" at the bottom of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sent Money From a 401K That Was Closed But Did Not Get a 1099-R

File a Form 4852.

This form serves as a substitute for Forms W-2, W-2c, and 1099-R and is completed by taxpayers or their representatives when:

- Their employer or payer does not give them a Form W-2 or Form 1099-R, or

- An employer or payer has issued an incorrect Form W-2 or Form 1099-R.

Click on "What if I don't have my 1099-R" at the bottom of the screen.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vo21vo88

New Member

vo21vo88

New Member

vo21vo88

New Member

cnhowardcell

Returning Member

cherylsatt

New Member