- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Section 1256 Option Contracts Loss Not showing up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Option Contracts Loss Not showing up

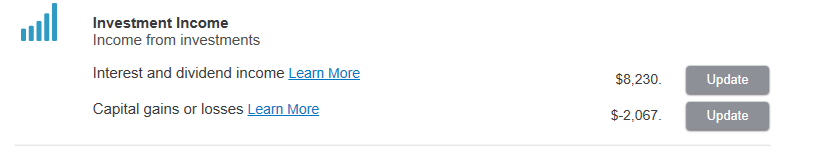

Hi. I have loss about $6000 from SPX option contracts which brokage reports under Section 1256 Option Contracts. I also have short term loss about $2000. I entered each one but, in summary, it only shows 2000 short term loss. What happened to Section 1256 loss? Is it supposed to be recorded 60% as long term loss and 40% as short term loss?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Option Contracts Loss Not showing up

You have to review your actual tax return, namely Schedule D, to see what is happening.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Option Contracts Loss Not showing up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Option Contracts Loss Not showing up

Actually it does show up when I print final return. it just did not show on the software. So I am good.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Option Contracts Loss Not showing up

So, does that mean your left-over losses from the SPX trades carry over to subsequent years?

Thanks in advance!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17644336202

New Member

wrshirleytaxes101

Level 1

harvey_berman

New Member

alexander-fitness26

New Member

yonghai

Level 2