- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule SE issue with turbotax online

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule SE issue with turbotax online

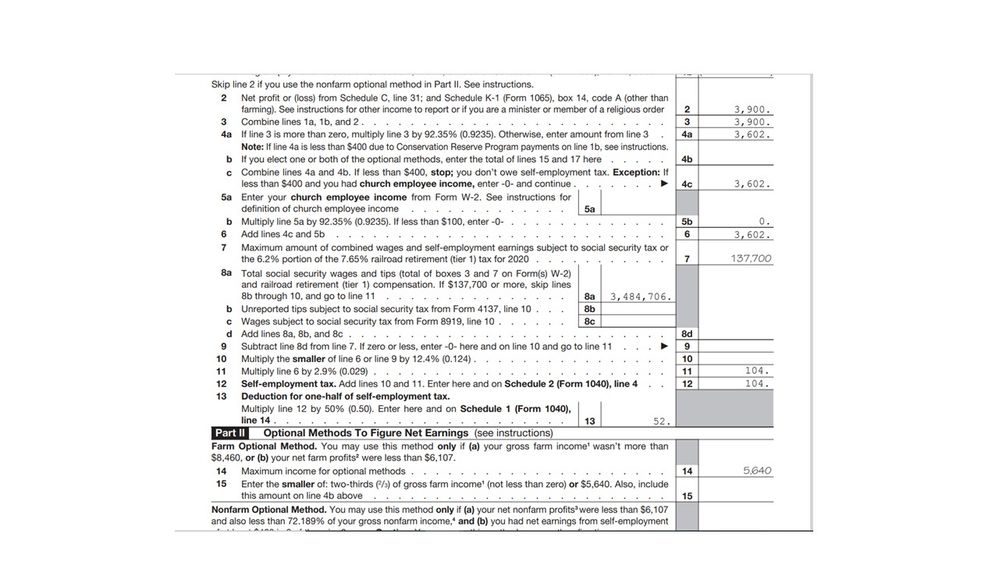

I was ready to submit my taxes and noticed some really strange numbers on my schedule SE part of form 1040. Line 7 has 137,700 which is well more than I made and is coincidentally the same as the threshold for the next line 8a. Line 8a has a number over 3 million. Then again, line 14 has 5,640 in it which is coincidentally the same as the threshold for line 15. Has anyone else had issues with this form on turbotax online? Since it is an updated form this year, is there just a glitch?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule SE issue with turbotax online

I created a tax return in TurboTax Online Self-employed version. The numbers reflected on Schedule SE appear to be correctly computed and the amounts in box 7 and box 14 are pre-printed on the IRS form.

Line 8a of Schedule SE reflects the amount of box 3 of a form W-2 which has also been entered.

Do you know where the entry on your line 8a originates?

Lines 7 through 9 compute the amount of combined wages and tips subject to Social Security tax up to the maximum amount of $137,700 for 2020 tax year.

My example did not use optional method which is computed in lines 14 and below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule SE issue with turbotax online

Hi James. Thanks for the reply. I'm using turbo tax deluxe rather than SE. I just got a little bit of extra income from a 1099-NEC from a side job. I attached a screenshot of that page. Even the font is different, but the numbers don't make any sense. 8a should at least be below 60,000, but I'm a little unsure because I have two W-2s as I changed jobs during the year. I'm not sure why box 14 has any number as I answered "no" to having income from a farm.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule SE issue with turbotax online

No need to be concerned with Line 14. This is the amount of allowed optional earnings if this method is chosen by a farmer and is preprinted on the form ($6,107 x .9235 = $5,640).

And there is no cause for alarm on Line 7. This is the maximum amount of earnings that is subject to social security tax and is preprinted on the form.

The number on Line 8a is possibly remembering data that it shouldn't. The social security tax is not being calculated on the $3.602 like it should be based on the information you provided earlier. Please be sure to clear all cache and cookies, maybe include browsing history as well. This really should be done regularly so that your computer doesn't remember data you wanted gone.

Then open your TurboTax again to see the results. Last action may be to completely delete the income and re-enter it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

delta_hotel

Level 3

ihikaru1

Returning Member

TeaTax23

New Member

user17708430112

New Member

bklawns2

New Member