- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule E Error - Income from Rental and Royalties must be reported as separate properties

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E Error - Income from Rental and Royalties must be reported as separate properties

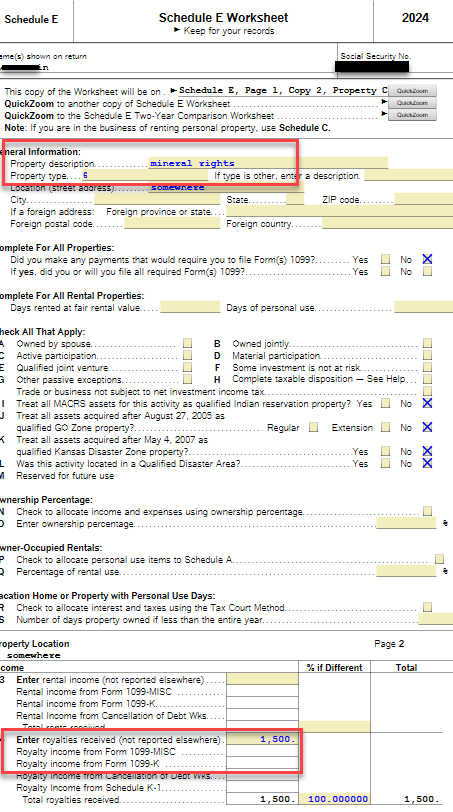

I received a 1099-MISC for mineral rights on land in West Virginia that I do not own. I only own the mineral rights. The 1099-MISC contains an amount in Box - 1 Rents, as well as Box 2 - Royalties. I've read every community post I can find, and I have tried to correct the entries on Turbo Tax, but I cannot get past schedule E. I only received one 1099, but created multiple properties in the Rental Properties / Royalties section; however, I cannot seem to correct the error. When I look in the "forms" section, I can see that two Schedule E's have been created. One of the Schedule E's only includes the Royalties, but he second Schedule E contains both the Rents and Royalties on the same form. Any helpful advice is appreciated - and if you could be as specific as possible, I would appreciate it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E Error - Income from Rental and Royalties must be reported as separate properties

You are either really close or have it. They should be on the same sch E. You should only have one Sch E but will also have worksheets.

Box 1 rent does create a Sch E page 1 for renting out the right to explore.

Box 2 royalty does create Sch E page 1 for royalty income. The royalty is listed as code 6 for property type on line 1b.

Reference: Instructions for Schedule E (Form 1040)

Here are some screenshots. I have two royalties listed with the rent.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wendytatro45

New Member

ashleighlefranc

New Member

atn888

Level 2

rkoenigbauer

New Member

jenniferbews

New Member