- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund

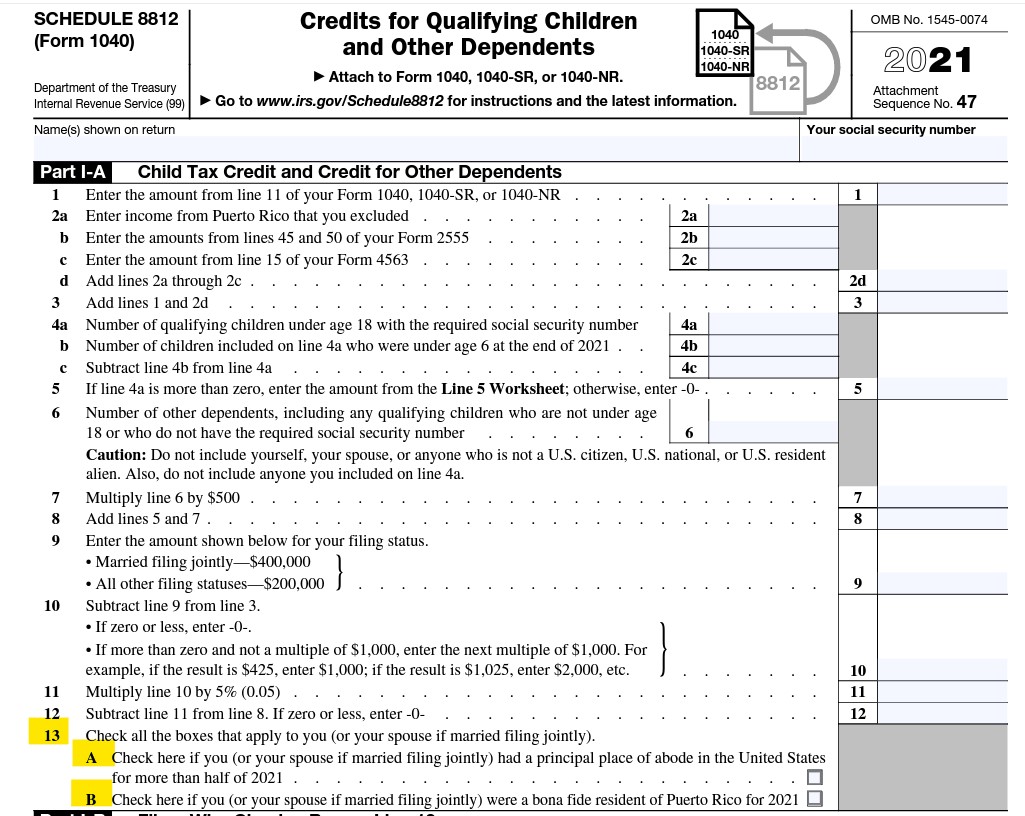

I went to e-file my return. I was told I needed to submit more info before e-filing. I was asked to provide info on Schedule 8812, which is child care credit. It then asked me for info about my Puerto Rico citizenship. I don't qualify for child care and I am not a citizen of Puerto Rico! The progr am then proceeded t o reduce my federal refund by $200. I was then able to e-file. What the hell is going on?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund

Those questions are relating the the advance Child Tax Credit payments that were sent out last year. If you have child dependents, you qualify for the credit. But you have to answer those 2 questions so TurboTax can complete Schedule 8812. TurboTax will ask about the advance payments because you may have received them even though you are not claiming dependents.

Do you have dependents listed on your return? If so, make sure you received the correct Child Tax Credit on Schedule 8812. If you don't have dependents and did not receive any advance payments, you don't need to take any additional steps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kaylinmarcum14

New Member

branmill799

New Member

mycst85

New Member

mycst85

New Member

lmunoz101923

New Member