- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

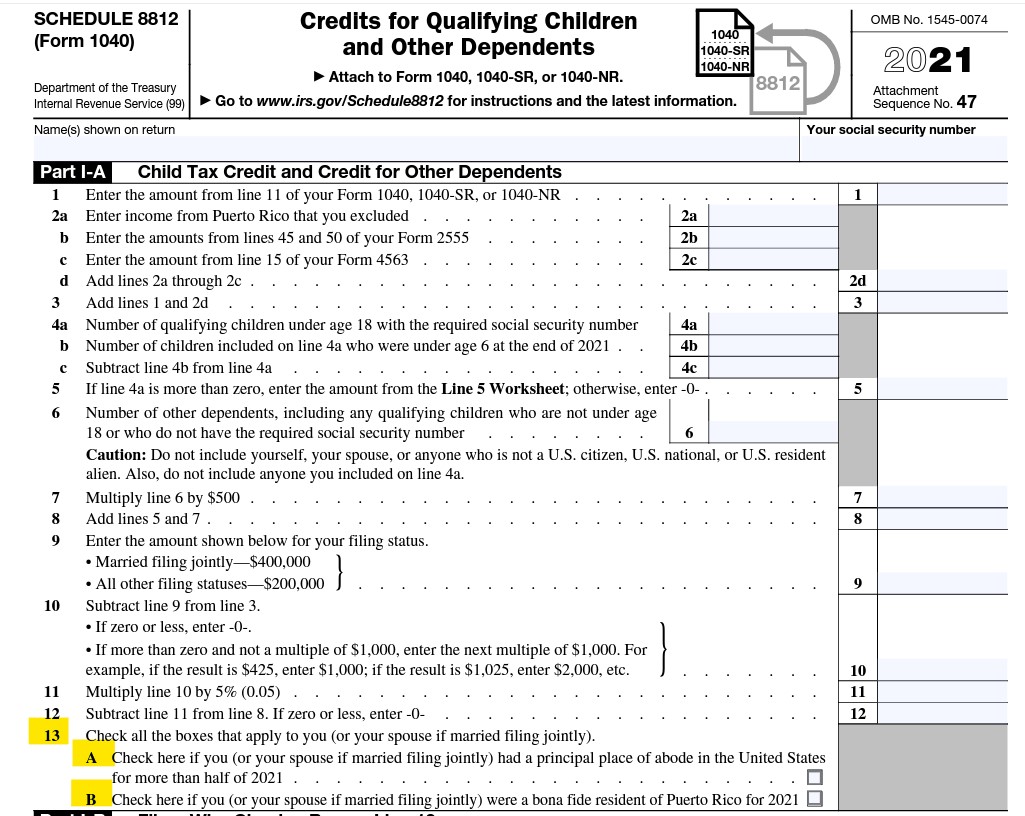

Those questions are relating the the advance Child Tax Credit payments that were sent out last year. If you have child dependents, you qualify for the credit. But you have to answer those 2 questions so TurboTax can complete Schedule 8812. TurboTax will ask about the advance payments because you may have received them even though you are not claiming dependents.

Do you have dependents listed on your return? If so, make sure you received the correct Child Tax Credit on Schedule 8812. If you don't have dependents and did not receive any advance payments, you don't need to take any additional steps.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 9, 2022

2:34 PM