- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Why after I put $300 cash donation, my tax due still the same without any reduce?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why after I put $300 cash donation, my tax due still the same without any reduce?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why after I put $300 cash donation, my tax due still the same without any reduce?

You have to exit out of the review to complete the process as you can't enter amounts directly on the forms in the review. Please take the following steps:

1. Login to TurboTax Online

2. Select FEDERAL from the left menu

3. Click on Deductions & Credits and the top of the screen

4. Scroll all the way down and click on Wrap-Up Tax breaks

5. You will be asked about the cash contributions you made, confirm the amount

6. Check Line 10b again and the amount should be there

It is a deduction, not a tax credit, so it will have a smaller effect on your refund amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why after I put $300 cash donation, my tax due still the same without any reduce?

Entering this deduction is a two-step process...please see below:

For 2020, Congress has changed tax law to permit the deduction of certain charitable contributions “above the line”, even if the taxpayer is taking the Standard Deduction otherwise. The new deduction will appear on line 10b on the 1040.

There are restrictions: the contribution must be in cash or cash-equivalent and it cannot exceed $300 for most filing statuses (exception: $150 for Married Filing Separate).

To enter this deduction, you must enter the charitable contributions as if you were going to itemize these contributions (do a Search (upper right) for charitable contributions and click on the jump-to result). Be sure to indicate that the contribution was “Money” or else TurboTax will not ask about it later.

Note that you do not need to enter any other charitable contributions if you are not planning to itemize.

Then, in the Federal Review at the end of your data entry, TurboTax will realize that you are taking the Standard Deduction and ask you to enter the amount of the charitable contribution that was in cash. Note the limits described above ($300 or $150); in the desktop product, at least, if you enter an amount larger than this, you will be asked to reduce it to the limit when you enter the amount.

When you enter the cash-based charitable contribution this way, the result will appear on line 10b on the 1040 as an above-the-line deduction.

-follow this link for charitable deduction information-

Video: Deducting Charitable Contributions - TurboTax Tax ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why after I put $300 cash donation, my tax due still the same without any reduce?

Thank you for your reply. I tried until the federal review and it didn't ask me to enter the amount of the charitable contribution that was in cash. Please help. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why after I put $300 cash donation, my tax due still the same without any reduce?

Look on your 1040, line 10b to see if you have a deduction for $300 or $150. If you do it is done.

You can view it through the forms mode, see below for instructions on how to access-

To switch to Forms Mode, open your return and click the Forms icon in the upper-right corner of your screen (or choose Forms from the View menu at top).

The 1040 Worksheet will display and all the forms in your return will be listed on the left side. Simply select a form to open it.

To switch back to the interview, click the Step-by-Step icon in the upper right corner, or choose it from the View menu.

Tips

- In Step-by-Step mode, you can view the underlying tax form by clicking Show Relevant Form near the bottom of your screen. Not all screens will have this, only those where the input relates directly to a tax form.

- It's OK to switch to Forms Mode if you want to look at a form or two, but constantly toggling back and forth between Forms Mode and Step-by-Step has been known to cause problems and data corruption.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why after I put $300 cash donation, my tax due still the same without any reduce?

Thank you for your reply. No, the 10b is not filled and I can't edit the field too. My tax due amount still the same, no change. Please will you advise? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why after I put $300 cash donation, my tax due still the same without any reduce?

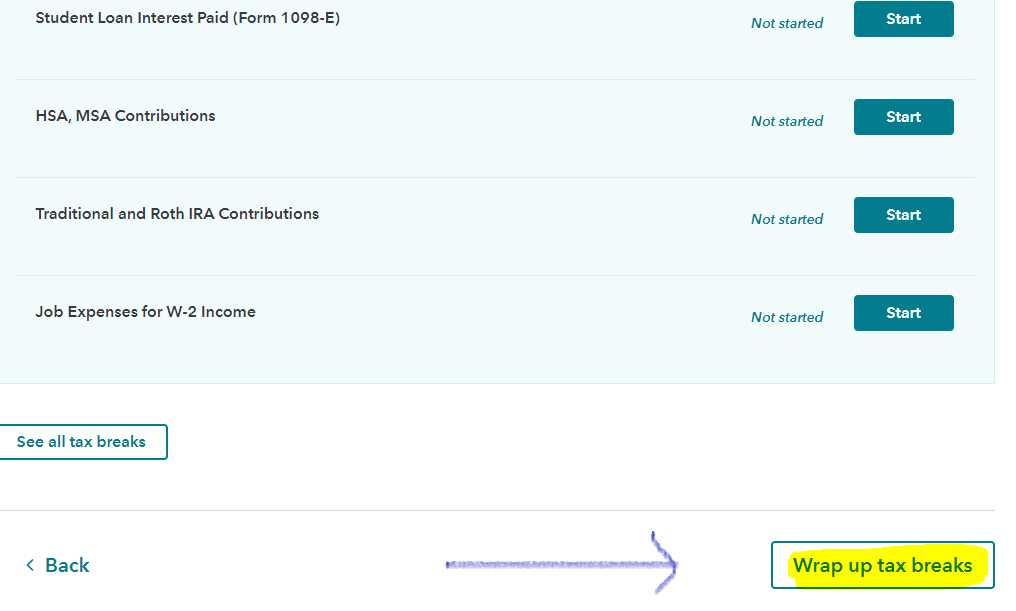

You have to exit out of the review to complete the process as you can't enter amounts directly on the forms in the review. Please take the following steps:

1. Login to TurboTax Online

2. Select FEDERAL from the left menu

3. Click on Deductions & Credits and the top of the screen

4. Scroll all the way down and click on Wrap-Up Tax breaks

5. You will be asked about the cash contributions you made, confirm the amount

6. Check Line 10b again and the amount should be there

It is a deduction, not a tax credit, so it will have a smaller effect on your refund amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why after I put $300 cash donation, my tax due still the same without any reduce?

I followed guidance and found there was no change in the amount of my refund. I confirmed that $300 is on line 10b of my 2020 Federal 1040 preview. This is my total allowable cash charitable contributions since I took standard deduction. But Turbo Tax did not calculate any change (expected increase) to my refund amount. Is there a glitch?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why after I put $300 cash donation, my tax due still the same without any reduce?

Maybe you are already getting back all that you can and more deductions won't increase it. Did the tax on line 16 change? You have to check all the lines to the end to see why not.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kemp5774

New Member

kac42

Level 2

user17550205713

Returning Member

Awalk0428

New Member

intuit

New Member