- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where to enter a computer purchase for college expense in TurboTax deluxe

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter a computer purchase for college expense in TurboTax deluxe

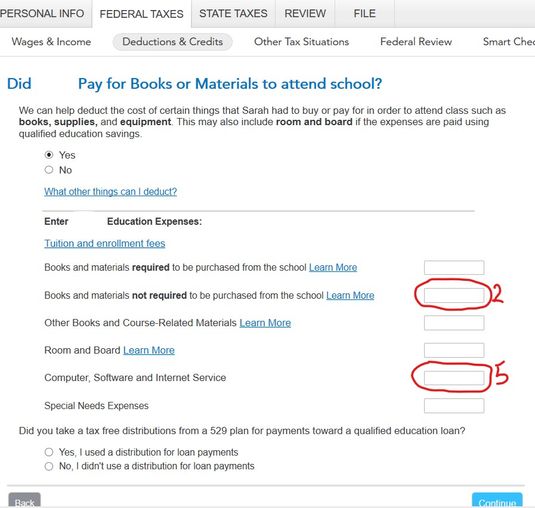

When completing child’s undergrad college education expense section in TurboTax deluxe, I would like to know where I should enter a computer purchase expense – where I have two choices with different end results (referring to the attached screenshot):

[Field-2]: If I enter it in the "Books and materials not required to be purchased from the school", I end up with a lower tax liability (more favorable).

[Field-5]: If I enter it in the "Computer, Software and Internet Service" field, I end up with higher tax liability (less favorable).

If I click on the "Learn More" link by [Field-2] , the explanation says for the purpose of AOC: "Computers may be deducted if they are needed as a condition of enrollment or attendance at the school"

It is rare for a school to make such a "conditional" statement, that a computer is needed as a "condition of enrollment". But we know it is needed and not having one is a significant disadvantage to say the least.

So, which field should I enter the computer purchase expense?

TIA.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter a computer purchase for college expense in TurboTax deluxe

Enter in "Field 2", since it gives you the result you want.

TurboTax needs to improve this screen. The "required" computer (the one you basically need to be college student) is considered "books and materials" and qualifies for the American Opportunity Credit (AOC or AOTC). Any other electronics, software, internet qualify for a 529 plan distribution, but not the AOC.

You only get this screen if you have a 529 plan distribution. If you're only claiming an education credit, you get a screen with fewer choices.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter a computer purchase for college expense in TurboTax deluxe

Perhaps @Hal_Al can help with this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter a computer purchase for college expense in TurboTax deluxe

Enter in "Field 2", since it gives you the result you want.

TurboTax needs to improve this screen. The "required" computer (the one you basically need to be college student) is considered "books and materials" and qualifies for the American Opportunity Credit (AOC or AOTC). Any other electronics, software, internet qualify for a 529 plan distribution, but not the AOC.

You only get this screen if you have a 529 plan distribution. If you're only claiming an education credit, you get a screen with fewer choices.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter a computer purchase for college expense in TurboTax deluxe

Thank you @Hal_Al !

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

william-b-clay

New Member

travisbens

New Member

dhinsman

New Member

ashley-brooks4

New Member

Liza-Zinola

New Member