- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter a computer purchase for college expense in TurboTax deluxe

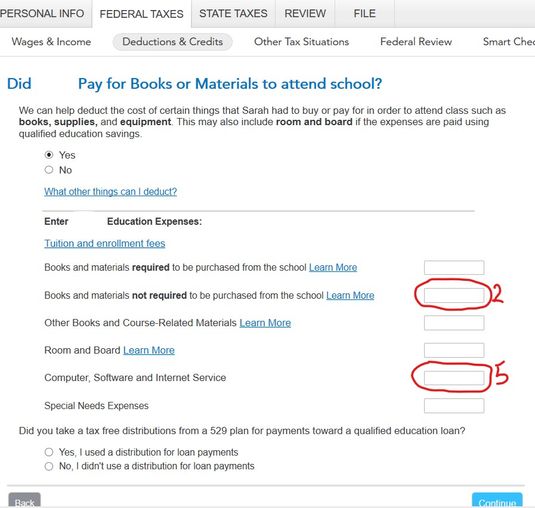

When completing child’s undergrad college education expense section in TurboTax deluxe, I would like to know where I should enter a computer purchase expense – where I have two choices with different end results (referring to the attached screenshot):

[Field-2]: If I enter it in the "Books and materials not required to be purchased from the school", I end up with a lower tax liability (more favorable).

[Field-5]: If I enter it in the "Computer, Software and Internet Service" field, I end up with higher tax liability (less favorable).

If I click on the "Learn More" link by [Field-2] , the explanation says for the purpose of AOC: "Computers may be deducted if they are needed as a condition of enrollment or attendance at the school"

It is rare for a school to make such a "conditional" statement, that a computer is needed as a "condition of enrollment". But we know it is needed and not having one is a significant disadvantage to say the least.

So, which field should I enter the computer purchase expense?

TIA.