- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where is the form 8915-f for 2023 filing of 2022 taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Mine was rejected for this as well and I can't get to the form on the online version to clear this... FML... I hate TurboTax, this is the last time I use it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Yea I have no idea what the fema text is it says n/a on mine

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

For clarity, I am using the desktop software.

I went to worksheet 8915E-T and cleared the text on line A. that cleared the information on line C on the actual form 8915.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

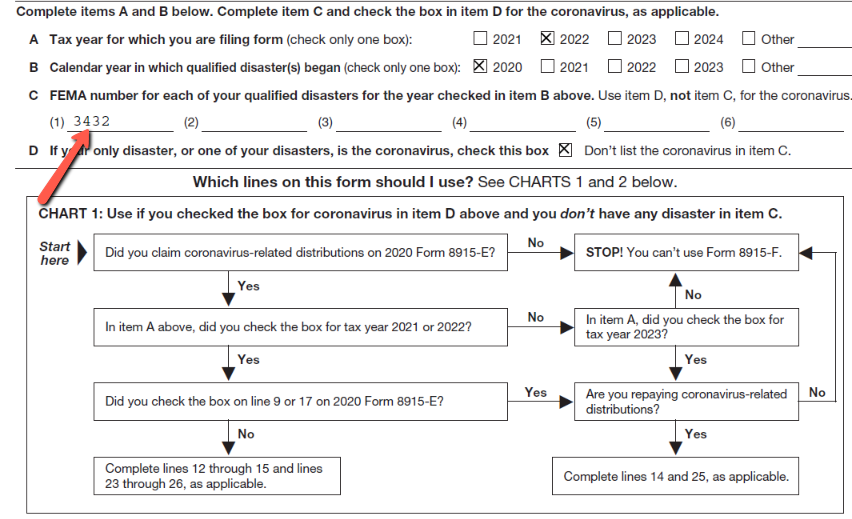

It keeps putting this darn number in here and there is no way to get rid of it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

are you on the online or desktop version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Online, there doesn't seem to be a way to get rid of it. The funny thing is I went back and looked at last years and it did the same thing but the IRS didn't reject it last year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

You will have to go in the work sheet and delete the number there

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

And how do you go into the form and delete it on the online version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

I have having the same issue EXACTLY as you are describing. Currently looking... maybe delete that form and regenerate it? I am assuming it pulled the entry on C1 from last year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Confirming I am experiencing the same issue. Using TurboTax online.

When e-filing with TurboTax online last year (2021) Form 8915-F Line C was pre-populated as "n/a" and was accepted by the IRS.

When e-filing this year, the same line is pre-populated with "n/a" and now it is being REJECTED by the IRS with no option to manually edit in TurboTax online (that I am aware of).

If anyone has a suggestion, please let me know. I'm not printing and sending in the return after paying TT to e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

This is what I am seeing in "what needs to be done". second have says how to go through TT verbage to clear that unwanted description.

"This return cannot be electronically filed due to invalid information on Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments. Print your return and review information that appears on Form 8915-F: - If there is a FEMA number listed on line C, it must be a valid. federally declared disaster n number, and it must be formatted as XX-NNNN-ST, where XX is either DR or EM, NNNN is a four digit number, and ST is a valid state abbreviation. - If box D is checked, no FEMA number should be listed on line C. If corrections are needed, go to Federal Taxes / Income, then scroll down to the section on Retirement, and select the 1099-R topic. If you have 1099-R entries, go to the end of the 1099-R summary, and select Continue. If you do not have any 1099-R entries for the current year, answer no when you see the question, Did you receive any 1099-R Forms? Then click continue. Follow the steps below to correct invalid information: 1) Answer on-screen questions until you get to the screen. "Did You take a 2020 Qualified Disaster Distribution?" 2) Mark the yes box at the top of the screen. 3) If you need to correct the FEMA Number that appears on Form 8915-F, line C, you must clear the checkbox labeled "If this was a Coronavirus-related distribution reported in 2020 check here". Then proceed to the next screen, where you can select a valid FEMA number. Click continue. If you need to clear the FEMA Number, go back and select the blank entry at the top of the FEMA dropdown list. 4) If necessary, go back to the screen in step 1, and check the box to indicate that this was a Coronavirus-related distribution. After making corrections, print for 8915-F and review information on lines C and D. Review for errors and re-submit the return for electronic filing. If the reject continues, you will need to print and file the return by mail."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

As a follow up. After my correction, my return was just accepted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

It doesn’t seem to get rid of it. I just went through the steps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Completed the steps listed above that TurboTax Online recommended and it did not change the form to blank - still says "n/a".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Hi all...after one more failed attempt in using on line TT this morning, I swiched over to online H&R Block. IT WORKED GREAT!! It took a little getting used to after using TT for so many years, but the screens and questions were very easy to navigate. I did have to reenter all the info I had input into TT ....but it was no big deal. I had not paid TT any fee yet so there was no double fee. Unbelievable!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PWELTY

New Member

meech1011

New Member

franderpolido

New Member

tomjenzen

New Member

rtoler

Returning Member