- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where/How Do I file my 1099-G form????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where/How Do I file my 1099-G form????

I have looked at https://ttlc.intuit.com/questions/2892302-where-do-i-report-a-1099-g-for-unemployment-or-paid-family...

that doesn't answer my question.

I received unemployment in NYC for X amount. I am looking at my 1099-G Form I was given by the state. Where do I file this?

I am looking on tabs Federal > Wages and Income > unemployment > Did you receive unemployment or paid family leave benefits in 2018? > I clicked Yes. It now asks me "what type of payment did you receive?" 1.Taxable Grant. 2.Agriculture Farm payment 3. Market gain or CCC loans. 4. reemployment trade adjustment assistance (RTAA) payments 5. Business or farm tax refund. I am unsure what to select here, since my 1099-G form does not mention any of these. And i do not want to mess up my tax return

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where/How Do I file my 1099-G form????

Those are the questions for OTHER 1099-G forms.

Manually Navigate back to that section again. Don't use the Search or Jump-to functions.

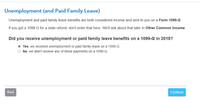

When I do Federal > Wages and Income > unemployment > Did you receive unemployment or paid family leave benefits in 2018?

I only get the proper unemployment / paid family leave questions (both when I use desktop software, and when I use Online software).

_______________________

IF still a problem...which software are you using Desktop of Online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where/How Do I file my 1099-G form????

I am not sure why you are getting the "what type of payment did you receive", since none of them apply to you. I just went through the steps & I did not get that .

- Federal Taxes (Personal for Home & Business)

-Wages & Income

- I'll choose what I work on (if it comes up)

- Unemployment - click Start or Update

- The next screen Unemployment (and Paid Family Leave), select Yes, we received unemployment or paid family leave on a 1099-G

Then you should get a screen that has Enter Your 1099-G info

The next screen should be What is the total amount you received on your 1099-G?

Continue to finish entering your 1099-G form

--------------------------------------

Try deleting what you have entered, and then go back through the steps above.

------------------------------------------

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where/How Do I file my 1099-G form????

I deleted what I entered. I go to Federal > Income and Wages, Unemployment > click Revisit > Did you receive unemployment or paid family leave benefits in 2018? > Clicked yes > says Great! We've got your income info and brings me back to Wages and income. I never get to a page where I can enter my 1099-G Information. Is this only available on a premium version? Also I am using Google Chrome on a laptop.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where/How Do I file my 1099-G form????

I am using Google Chrome. I do go to Federal > wages and income > Unemployment > Did you receive unemployment or paid family leave benefits in 2018? Click Yes > Then it says great! and brings me back to the wages and income page. It does not bring me to the 1099-G Page to fill out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where/How Do I file my 1099-G form????

Are you using the Free Edition? If so, it does not have the 1099-G form

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jakeschrum138

New Member

pamowen1027

New Member

AliciaW

Returning Member

ylma663338

New Member

danachavez53

New Member