- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where do I enter the federal tax withheld on an inherited IRA distribution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the federal tax withheld on an inherited IRA distribution?

I am a trustee for a special needs trust.

I found a workaround (not a Step by Step option) to enter the 1099 Inherited IRA Minimum Required Distribution amount on line 8 on form 1041.

Now where do I enter the amount of federal tax withheld on that distribution and/or any quarterly taxes already paid?

The TT Business package is supposed to handle trusts but does a very sloppy job. Many straightforward options are missing in the Step by Step tool including typical situations for Trusts with inherited IRAs or Investments.

The Business package should allow downloading 1099-INT, 1099-Div and 1099-R, especially the gain and loss details for investment accounts. We pay a lot more for this package but get less functionality than in the more basic packages.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the federal tax withheld on an inherited IRA distribution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the federal tax withheld on an inherited IRA distribution?

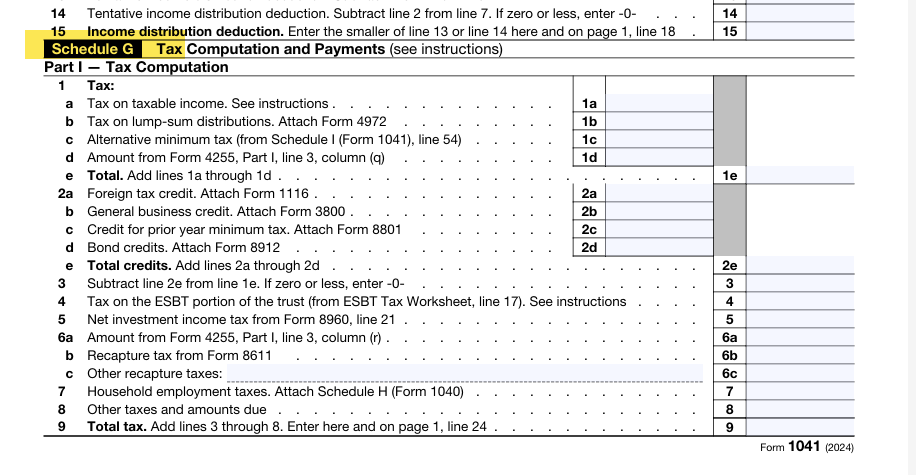

Schedule G on your 1041 (Line 14).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the federal tax withheld on an inherited IRA distribution?

Thank you.

I did find the Step by Step tab per your screen shot.

Schedule G never showed up on my list of forms, even after entering the withholding per your recommendation. The data was correctly referenced on my 1041.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the federal tax withheld on an inherited IRA distribution?

@Greenthumbs62 wrote:Schedule G never showed up on my list of forms, even after entering the withholding per your recommendation.

You are welcome, but note that Schedule G is actually part of your 1041. You can see it if you open your 1041 and scroll down in Forms Mode.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the federal tax withheld on an inherited IRA distribution?

I need to enter the federal tax withheld for a 1099-R for an inherited IRA MRD - to a special needs trust.

There is no schedule G showing up in the 2024 business version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter the federal tax withheld on an inherited IRA distribution?

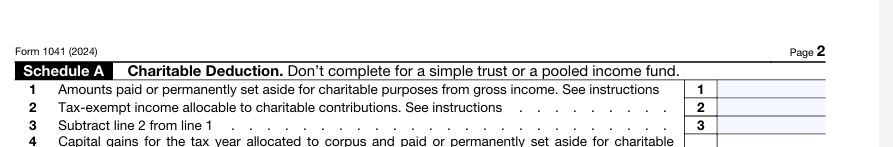

Schedule G in on page 2 of Form 1041:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lukas1994

Level 2

ecufour

Returning Member

elle25149

Level 1

WDM67

Level 3

JQ6

Level 3