- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where do I enter sale expenses for sale of land using TurboTax Premier 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale expenses for sale of land using TurboTax Premier 2019

I sold land in 2019. I received a 1099-S for the sale of the land. I need to make adjustments to the amount specified on the "Gross proceeds" amount specified on the 1099-S. From reading other discussions, a box "I paid sale expenses not included in proceeds" should appear in TurboTax when entering the information pertaining to my land sale. I'm using TurboTax Premier 2019 and no such box appears. Because of this, I have no way of entering any adjustment to my land sale. Any suggestions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale expenses for sale of land using TurboTax Premier 2019

Just enter the net proceeds. The sale of land is considered the sale of an investment. You can report the sale in TurboTax using these steps:

- Click on Federal > Wages & Income

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other.

- If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 2019? Click the Yes box.

- On the screen, Choose the type of investment you sold, mark the button for Other and click Continue.

- On the next screen, Enter Land Sale Information, enter the sale information. Be sure to enter the NET proceeds.

- On the next screen, enter the sale date.

- On the screen, Tell Us How You Acquired This Property, mark the radio button for Purchase and click Continue.

- Continue through the screens, entering the requested information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale expenses for sale of land using TurboTax Premier 2019

What you state is what I ended up doing prior to asking my question; however, per the instructions for Form 8949, the expenses are to be entered as an adjustment in column (g) of the form along with a code entered in column (f) of the form. What I'm worrying about is that the IRS will not like the proceeds amount that ends up in column (d) of the form will not be in agreement with the "gross proceeds" amount in box 2 of the 1099-S without any explanation for the difference. I may be setting myself up for receiving a letter from the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale expenses for sale of land using TurboTax Premier 2019

The amount you report for the proceeds should agree with the amount on the 1099-S any selling expenses, improvements and your basis in the property are added together to arrive at your cost for the land.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale expenses for sale of land using TurboTax Premier 2019

The point is that there is no obvious place to enter the expenses. Exactly where do we enter them?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale expenses for sale of land using TurboTax Premier 2019

@catbill76 wrote:

The point is that there is no obvious place to enter the expenses. Exactly where do we enter them?

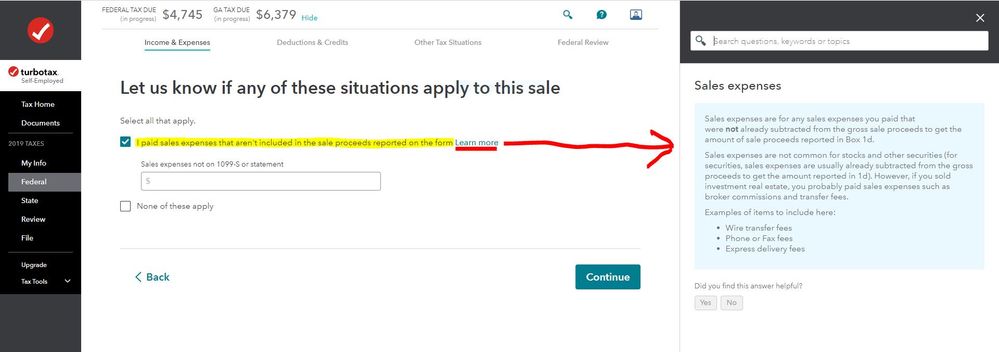

After you enter the proceeds from the Land Sale the following screen specifically asks about Sales Expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale expenses for sale of land using TurboTax Premier 2019

We are referring to TurboTax Premier, not self-employed.

In this version, the box says "I have more info to enter that I don't see here."

When checked, fields appear for such things as accrued market discount and taxes withheld but there is no box for sales expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale expenses for sale of land using TurboTax Premier 2019

@catbill76 wrote:

We are referring to TurboTax Premier, not self-employed.

In this version, the box says "I have more info to enter that I don't see here."

When checked, fields appear for such things as accrued market discount and taxes withheld but there is no box for sales expenses.

The Premier and Self-Employed online editions should have the exact same format when using the Investment section of the program.

What is on the next screen after you enter the proceeds and amount paid and click on Continue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale expenses for sale of land using TurboTax Premier 2019

Oh, now I see. It is certainly not intuitive. The lesson for others is that we even though we have additional information that is not on the form, we should not check the box for adding additional information 🙂

Anyway, now that I see where we are supposed to input the expenses after clicking Continue, I expected Turbotax to provide more guidance on what expenses should be included. The closing statement shows expenses for commissions, title charges, escrow charges, and excise taxes. Should all of those be included here or should excise tax, for example, go under taxes somewhere else?

I appreciate your patience in answering my questions.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jeff-W

New Member

VJR-M

Level 1

Mike6174

Level 2

ping5

New Member

ortega_j777

New Member