- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section d...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section doesn't have that box but the regular 1099-div does but the tax rates differ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section doesn't have that box but the regular 1099-div does but the tax rates differ?

It depends. What is the amount of the 1099-DIV and the amount of foreign tax?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section doesn't have that box but the regular 1099-div does but the tax rates differ?

I have the same question. My child's 1099-DIV shows a foreign tax paid of $50.38 but the Child Income Section on TurboTax didn't ask for that. Where do I record it?

Also, where do I record the advisor management fees for my child's account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section doesn't have that box but the regular 1099-div does but the tax rates differ?

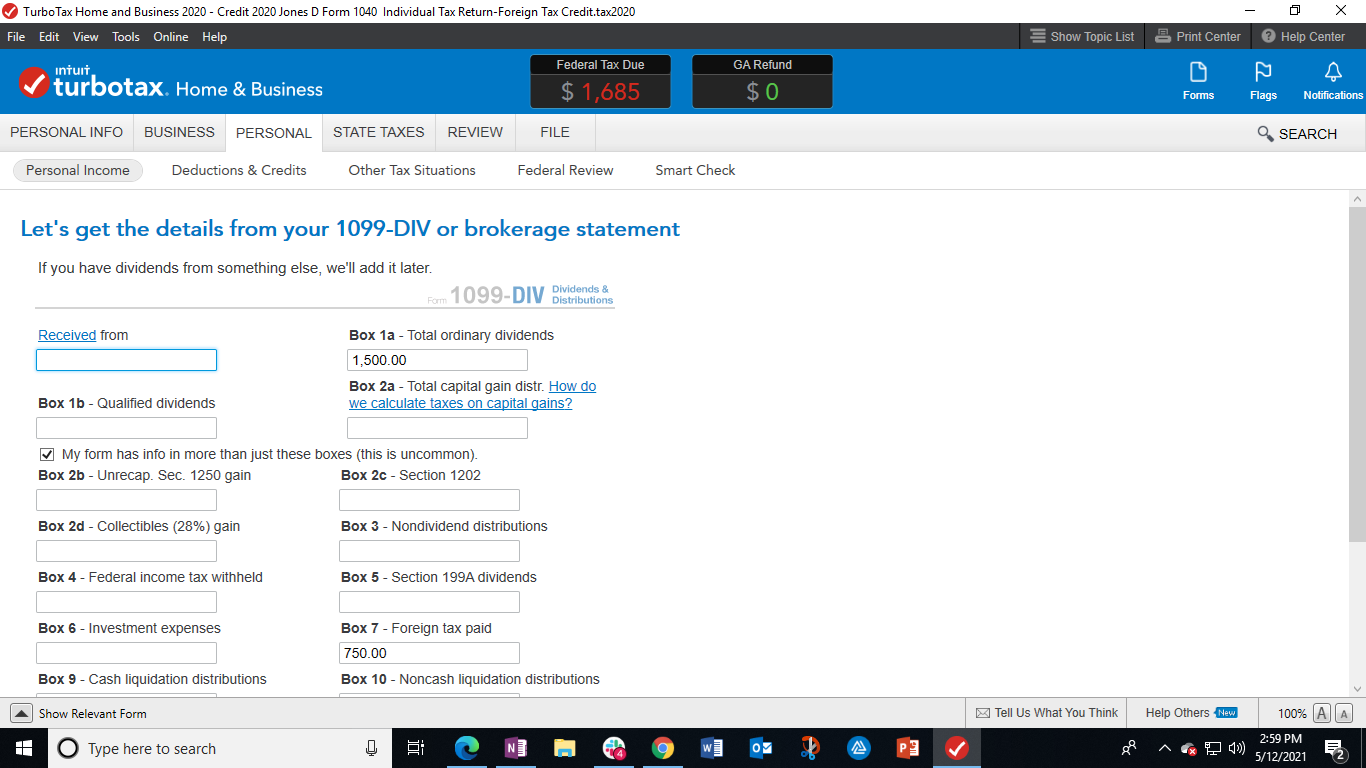

When you report the 1099-DIV, there is a line with a checkbox in the program that says My form has info in more than one of these boxes. Check the box and record the foreign taxes paid in Box 7 after the drop down appears.

You can deduct management fees in federal>deductions and credits>other deduction and credits>legal fees. This will not make much of an impact in the return since your child will not be itemizing expenses. You can enter this in your return however and may be able to claim if you itemize.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section doesn't have that box but the regular 1099-div does but the tax rates differ?

Thank you. I'm using EasyStep and it doesn't give me the checkbox option you are referring to in the Child Income section. In the Dividend section, it only asks about Ordinary dividends, qualified dividends, capital gains (including section 1202 gain and those subject to 28% tax rate). That's it. Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section doesn't have that box but the regular 1099-div does but the tax rates differ?

It depends. When looking at the 1099-DIV section, do you have a format in accordance with the screenshot below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section doesn't have that box but the regular 1099-div does but the tax rates differ?

Mine looks a bit different.

Mine looks a bit different.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section doesn't have that box but the regular 1099-div does but the tax rates differ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section doesn't have that box but the regular 1099-div does but the tax rates differ?

I answered "yes" to the EasyStep question that asked if my child's unearned income was only from interest, dividends (including capital gains and Alaska Permanent Fund dividends). Since there was also foreign tax paid (from a global equity fund investment), should I have answered differently?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Foreign Tax Paid from Child Income 1099-div since the Child Income section doesn't have that box but the regular 1099-div does but the tax rates differ?

Try this and see if this works.

- Federal>deductions and credits>deductions and credits>estimate and other taxes paid>Foreign Tax Credit>start or revisit

- Follow the questions as it asks about dividend income. As you follow the prompts, you should be taken to a section where it asks dividend information and then the foreign taxes that were paid.

- Start the section, if you get stuck, repost to me @DaveF1006 and I will attempt to be your assistant through this event. I am here until 9PM PST, with an hour off for lunch.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abarmot

Level 1

sam992116

Level 4

v8899

Returning Member

MaxRLC

Level 3

MaxRLC

Level 3