- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to r...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

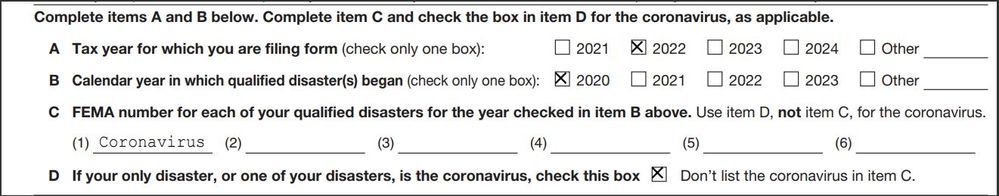

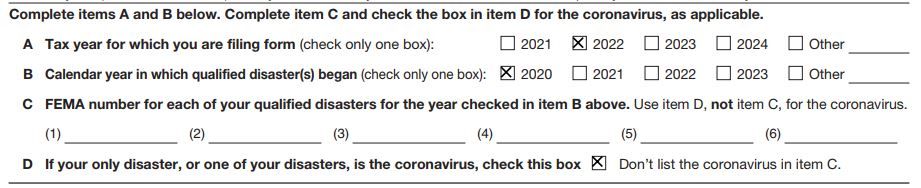

You are correct. Line "C" should list "coronavirus" only line "D" should be checked. This causes your e-file to be rejected. Must be fixed by TT. You cannot manually change it. Any advice on how to escalate this @CarissaM @AnnetteB6 @SForrestLO @DavidD66 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

Having the same issue but it says "COVID" in line C rather than Coronavirus.

Whats interesting is comparing my 2021 turbo tax return, its exactly the same and didnt get rejected. Line C has "COVID" and line D is checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

" my 2021 turbo tax return, its exactly the same and didnt get rejected."

IRS adds to or tightens the e-File rules when they see the tax software is doing it wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

Please try these steps to fix the rejection issue:

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Uncheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and click continue

- On the "Which disaster affected you in 2020?" screen I selected the blank entry and click "back"

- Then recheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and continue.

Another option is to delete "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and then go back to the retirement section and reenter the information:

- Open or continue your return in TurboTax.

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information.

Please let me know if this worked for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

This worked for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

@DanaB27 this worked for me it looks like. I checked the pdf files of the return and the "coronavirus" on line "C" was gone.

before:

after:

Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

I followed the steps and when I review the return "Covid" is still in Line 1. Am I missing something? Turbotax won't refund me even though return is rejected due to this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

It worked for me too. I did have to look back at last years return to put the amounts back in as those were deleted too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

This did not work for me, I still see covid 19 in box C and D is checked. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

I resolved this issue by going directly into the 8915E-T Wks (worksheet) and deleting NA from line A (FEMA disaster number), this flowed into and removed from form 8915F-T and federal return was accepted. Repeated for 8915E-S.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

How did you delete the NA, when I'm in my worksheet I can highlight Covid 19 but cannot delete. Please let me know. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

Got it, found where to delete, thank you very much for the feedback

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

If you are using the desktop program, you can click on Forms and delete ''covid'' from Line C. @sstl71 Posted before you found where to delete. For anyone else still having reject issues, here are the steps from Dana's post above:

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Uncheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and click continue

- On the "Which disaster affected you in 2020?" screen I selected the blank entry and click "back"

- Then recheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and continue.

Another option is to delete "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and then go back to the retirement section and reenter the information:

- Open or continue your return in TurboTax.

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo tax fix the flipping 8915-f for Coronavrius so it's not causing the form to reject because they put coronavirus on line C incorrectly?

I have tried numerous times to delete the Form using the tools menu method with the online version and the Form is not deleting. Not sure what to do.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.