- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Two forms of self-employment income, one was over the $600 threshold and other was under. Questions about how to file properly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Two forms of self-employment income, one was over the $600 threshold and other was under. Questions about how to file properly.

How do I report tax on two forms of self employment income, both incomes were from different jobs. One of the incomes was under the $600 irs threshold, and the second one was over the $600 threshold that requires payment of self employment tax and I received a 1099-misc for this income. Do I report the income under $600 as other income on line 21 of the 1040 or do I have to fill out a schedule-c?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Two forms of self-employment income, one was over the $600 threshold and other was under. Questions about how to file properly.

Sorry it goes on Schedule C with your other 1099Misc. The $600 threshold refers to the min amount the payer has to file the 1099Misc. Not to you. You have to report all your income even if you don't get a 1099Misc or even if it is less than $600.

Self Employment tax (Scheduled SE) is automatically generated if a person has $400 or more of net profit from self-employment. You pay 15.3% SE tax on 92.35% of your Net Profit greater than $400. The 15.3% self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. So you get social security credit for it when you retire.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Two forms of self-employment income, one was over the $600 threshold and other was under. Questions about how to file properly.

Would the amount that I didn’t receive a 1099 for be considered other income, line 21 of the 1040, since the company didnt and wasnt required to send me a 1099 because it’s under the $600 mark? I also don’t have their tax identification number so how would I fill out a schedule c without a 1099-misc that states their identification number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Two forms of self-employment income, one was over the $600 threshold and other was under. Questions about how to file properly.

@elifeli1 wrote:

Would the amount that I didn’t receive a 1099 for be considered other income, line 21 of the 1040, since the company didn’t required send a 1099 because it’s under the $600 mark? I also don’t have their tax identification number so how would I fill out a schedule c without a 1099-misc that states their identification number?

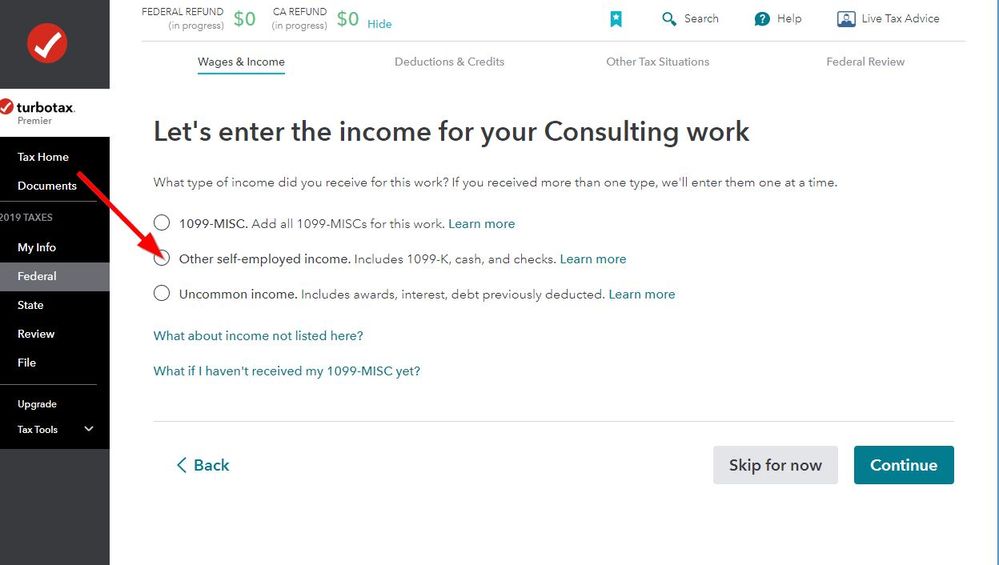

You do not need a 1099-MISC to report your self-employment income. Just select Other self-employed income. Includes 1099-K, cash, and checks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Two forms of self-employment income, one was over the $600 threshold and other was under. Questions about how to file properly.

Where? I don't see this tab that you listed in bold?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Two forms of self-employment income, one was over the $600 threshold and other was under. Questions about how to file properly.

Did you see this FAQ on how to enter self employment income? It has 2 sections, if you got a 1099Misc and if you just got cash

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Two forms of self-employment income, one was over the $600 threshold and other was under. Questions about how to file properly.

When you start the self employment section you may have to go though a lot of screens asking about your business. Eventually you will get to this income screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Two forms of self-employment income, one was over the $600 threshold and other was under. Questions about how to file properly.

Thanks so much I finally understand

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

prakashnaga88

New Member

akalb18

Level 1

XEN0

Level 2

cjames24

Level 1

Samoyed

New Member