- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax Desktop won't allow me to claim Child and Dependent Care Credit despite earned income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop won't allow me to claim Child and Dependent Care Credit despite earned income?

My earned income is over $50k and my spouse's earned income is $2024 according to line 5 of the Earned Income Worksheet. Despite this, TurboTax Desktop says:

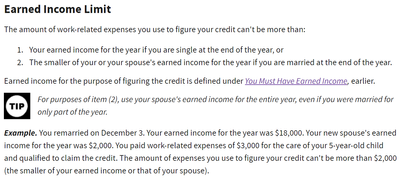

This page seems to say that my spouse must earn a minimum of $6000 for us to qualify for the Child and Dependent Care Credit. However, I cannot find that rule anywhere. I have searched diligently, and as far as I can find on the IRS web site, there should be no minimum earned income. In fact, one of the examples that the IRS uses as a qualifying case for the Child and Dependent Care Credit actually cites $2000 as a spouse's earned income (https://www.irs.gov/publications/p503#en_US_2023_publink1000203350 :(

Please help me to understand.

- Why does TurboTax desktop cxonsider my wife's earned income of $2024 too low for the Child and Dependent Care Credit?

- Assuming this is an error, how can I force TurboTax to include this credit?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop won't allow me to claim Child and Dependent Care Credit despite earned income?

Thanks for the suggestion. My income is W-2 and my wife's is 1099-NEC from self-employed work as an independent contractor. I checked, and the income is indeed divided under the appropriate names. Plus, everything I read seems to indicate that 1099-NEC still counts as earned income. For example: "Earned income includes wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment." (https://www.irs.gov/publications/p503#en_US_2023_publink1000203280)

I do have some good news, though. I figured out how to force TurboTax Desktop to allow me to claim the credit. I filled it out with myself as a student (as I indicated above). Then, I was able to switch to Forms mode and delete any reference to me being a student. I double-checked everything and it looks like all of the numbers are correct after the change.

Thank you again for your help. This workaround at least fixes the issue for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop won't allow me to claim Child and Dependent Care Credit despite earned income?

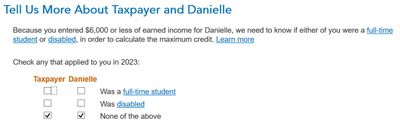

No, TurboTax isn't saying your wife's income must be $6,000 to get the credit. TurboTax is asking if the reason she earned so little is because she is a student, or disabled.

The Child and Dependent Care Credit is limited to a percentage of the lower earning spouse's income.

In your case your credit will be limited to a percentage of $2,024, which is her income. If she were also a student, or disabled, the credit would be based on $6,000 instead of her earned income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop won't allow me to claim Child and Dependent Care Credit despite earned income?

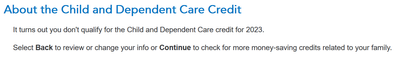

Thank you for your reply. What you said makes a lot of sense. However, when I tell TurboTax that she is neither a student nor disabled, the next screen reads:

So perhaps you are correct that it isn't saying that she makes too little. If that is the case, however, I don't have any idea why it claims that we do not qualify. I tried downloading the PDF form from the IRS, and it seems that we should qualify for 20% of $2024 = $404.

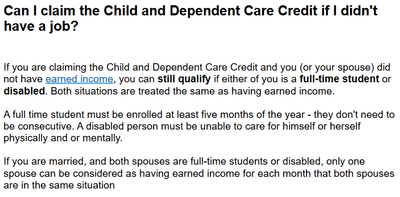

The reason I think that TurboTax is saying that we must earn more than $6000 is because when I click the Help link on the first page, it reads:

Actually, here's where things really get weird. I just tried lying to TurboTax and telling it that *I* am a student--and it works! If I claim to be a student, but indicate that Danielle is not a student, it goes through everything and provides me with a $405 credit.

This really seems to be a bug. I cannot fathom any reason why the credit should require me to be a student when my W-2 income is over $50k.

I wish I could just force it to allow the credit by going to Forms, but I can't find any way to make that work, because most of the fields are not fillable. Do you have any other suggestions?

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop won't allow me to claim Child and Dependent Care Credit despite earned income?

You need to double check your w2 entry screen. It sounds like both w2s are under one name. The child care credit is to allow you to work or go to school. If not disabled or in school, you must both have earned income and the lowest income limits the credit.

From Child and Dependent Care Credit FAQs

A1. You are eligible to claim this credit if you (or your spouse in the case of a joint return) pay someone to care for one or more qualifying persons in order for you to work or look for work, and your income level is within the income limits set for the credit. If you are married, you must file a joint return to claim the credit. However, if you are legally separated or living apart from your spouse, you may be able to file a separate return and still claim the credit. If you or your spouse was a full-time student, see Q17 and IRS Publication 503, Child and Dependent Care Expenses, for more information on eligibility.

Earned Income Requirement: You (and your spouse in the case of a joint return) must have earned income during the year to claim the credit. See Q16 and Q17 for more information, including special rules that may apply if you are a student or are unable to care for yourself.

Reference:

About Form 2441, Child and Dependent Care Expenses

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop won't allow me to claim Child and Dependent Care Credit despite earned income?

Thanks for the suggestion. My income is W-2 and my wife's is 1099-NEC from self-employed work as an independent contractor. I checked, and the income is indeed divided under the appropriate names. Plus, everything I read seems to indicate that 1099-NEC still counts as earned income. For example: "Earned income includes wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment." (https://www.irs.gov/publications/p503#en_US_2023_publink1000203280)

I do have some good news, though. I figured out how to force TurboTax Desktop to allow me to claim the credit. I filled it out with myself as a student (as I indicated above). Then, I was able to switch to Forms mode and delete any reference to me being a student. I double-checked everything and it looks like all of the numbers are correct after the change.

Thank you again for your help. This workaround at least fixes the issue for me.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

freddytax

Level 1

achilles113

New Member

Cat_Sushi

Level 2

juicyboog

New Member

ValerieC1

New Member