- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

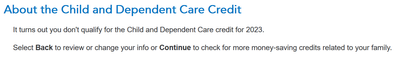

Thank you for your reply. What you said makes a lot of sense. However, when I tell TurboTax that she is neither a student nor disabled, the next screen reads:

So perhaps you are correct that it isn't saying that she makes too little. If that is the case, however, I don't have any idea why it claims that we do not qualify. I tried downloading the PDF form from the IRS, and it seems that we should qualify for 20% of $2024 = $404.

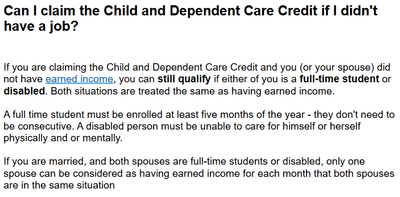

The reason I think that TurboTax is saying that we must earn more than $6000 is because when I click the Help link on the first page, it reads:

Actually, here's where things really get weird. I just tried lying to TurboTax and telling it that *I* am a student--and it works! If I claim to be a student, but indicate that Danielle is not a student, it goes through everything and provides me with a $405 credit.

This really seems to be a bug. I cannot fathom any reason why the credit should require me to be a student when my W-2 income is over $50k.

I wish I could just force it to allow the credit by going to Forms, but I can't find any way to make that work, because most of the fields are not fillable. Do you have any other suggestions?

Thanks again!