- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop won't allow me to claim Child and Dependent Care Credit despite earned income?

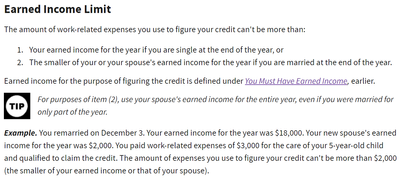

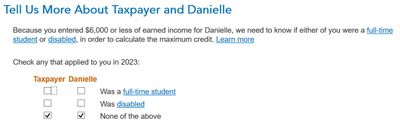

My earned income is over $50k and my spouse's earned income is $2024 according to line 5 of the Earned Income Worksheet. Despite this, TurboTax Desktop says:

This page seems to say that my spouse must earn a minimum of $6000 for us to qualify for the Child and Dependent Care Credit. However, I cannot find that rule anywhere. I have searched diligently, and as far as I can find on the IRS web site, there should be no minimum earned income. In fact, one of the examples that the IRS uses as a qualifying case for the Child and Dependent Care Credit actually cites $2000 as a spouse's earned income (https://www.irs.gov/publications/p503#en_US_2023_publink1000203350 :(

Please help me to understand.

- Why does TurboTax desktop cxonsider my wife's earned income of $2024 too low for the Child and Dependent Care Credit?

- Assuming this is an error, how can I force TurboTax to include this credit?

Thanks!

March 16, 2024

1:27 PM