- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: The box numbers on the 1099-R verification page do not match the page before where I entered my 1099-R. Not 1 of the four boxes is correct. For example, my 1099-R and your entry page say the sta...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The box numbers on the 1099-R verification page do not match the page before where I entered my 1099-R. Not 1 of the four boxes is correct. For example, my 1099-R and your entry page say the state ID box is box 15. Verification page says it is box 13.

It's March 26 and I have just downloaded the most recent update available. Now I am entering a 1099-R for a military pension. The 10099-R box numbers on the Turbotax data entry screen differ from some of the box numbers on the actual paper 1099-R, and in one case, Turbotax uses the same box number twice:

Category 1099-R Box # Turbotax Box #

State tax withheld 12 14

State ID no such box 15- State ID

State payer's ID# 13 15- Payer's State No.

State Distribution Amt 14 16

I'm tranferring the data into the box descriptions and ignoring the discrepant box numbers. Hope it works.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The box numbers on the 1099-R verification page do not match the page before where I entered my 1099-R. Not 1 of the four boxes is correct. For example, my 1099-R and your entry page say the state ID box is box 15. Verification page says it is box 13.

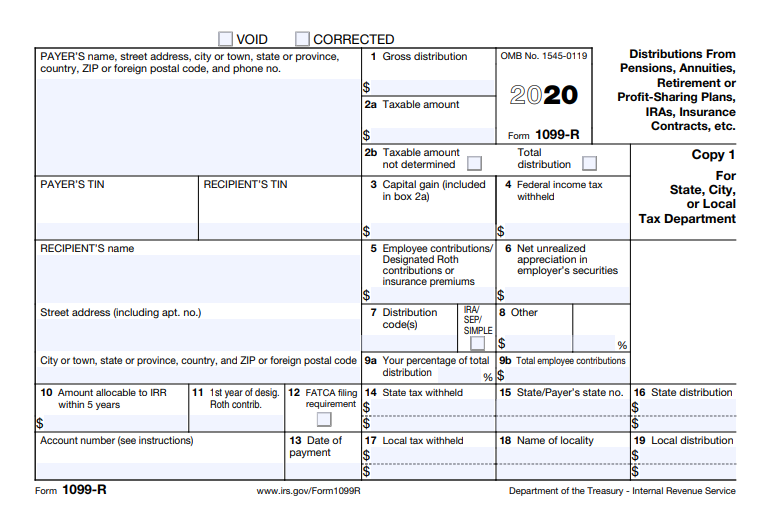

It sounds as if the issuer of the 1099-R is still using the old 1099-R form. For 2020, the IRS added some boxes and renumbered the ones that followed. [See Screenshot below.] The box numbers in TurboTax are correct.

Just go by the box descriptions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The box numbers on the 1099-R verification page do not match the page before where I entered my 1099-R. Not 1 of the four boxes is correct. For example, my 1099-R and your entry page say the state ID box is box 15. Verification page says it is box 13.

I'm trying to enter in a 1099-R for retirement from NYS as a former law enforcement officer. As I've read before, the boxes on the doc sent by NYS don't align with those in TurboTax. Our box 14 says EXEMPT, 15 has the state payer's number and box 16 has NY. TurboTax doesn't allow for Exempt to be typed anywhere and no matter what we try, our NYS return is still taxing the pension amount (which it shouldn't).

Box 16 in TT has the taxable amount which if I take out, automatically fills. If I enter in the same amount in box 14 labeled State Tax Withheld, my NY refund jumps to almost that number, which is definitely not correct.

Any suggestions as to how to input the information to generate the correct tax owed/due? TIA!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The box numbers on the 1099-R verification page do not match the page before where I entered my 1099-R. Not 1 of the four boxes is correct. For example, my 1099-R and your entry page say the state ID box is box 15. Verification page says it is box 13.

You just enter the 1099R as it is or is it a W-2. Law enforcement retiring in NY does not pay NYS income taxes you are exempt.

You make the adjustment on the NYS tax return.

TurboTax will not automatically exempt the pension after you select a qualifying New York state pension in the Form 1099-R input. Another step is necessary in the New York section.

- Go to the screen Changes to Federal Income

- Select Received retirement income

- Click Done on the screen Retirement Distributions Summary

- Enter the excludible amount of you NY pension(s) on the screen Governmental Pension Exclusion

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The box numbers on the 1099-R verification page do not match the page before where I entered my 1099-R. Not 1 of the four boxes is correct. For example, my 1099-R and your entry page say the state ID box is box 15. Verification page says it is box 13.

I need to change 1099 R to 42-075020 in lieu of 42-072020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The box numbers on the 1099-R verification page do not match the page before where I entered my 1099-R. Not 1 of the four boxes is correct. For example, my 1099-R and your entry page say the state ID box is box 15. Verification page says it is box 13.

You need to log into your return. Go to the federal income section. Scroll down to the 1099-R that needs correction and edit. Locate the wrong number and change it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pritch5984

New Member

jimgol

New Member

heidiyin6

New Member

rrhcccc

New Member

glovermichelle97

New Member