- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Stimulus check and bank info showing on my return

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

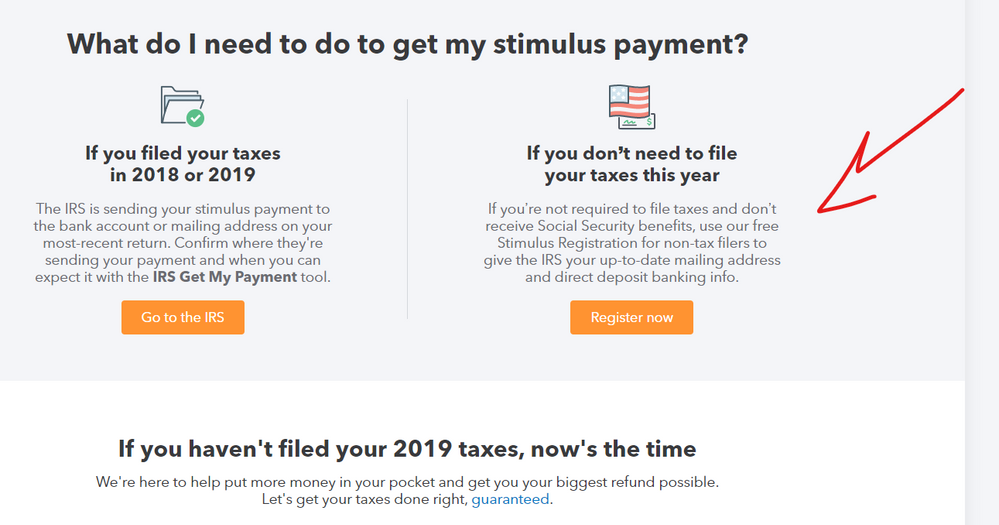

@Ginger6231962- I was wondering the same thing. The whole reason for going and filing out all our information through this website I was led to believe was to give our direct deposit information to the IRS for those of us who don't normally have to file taxes. But that wasn't what happened

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

Yes,

That is exactly what I am talking about and they are playing dumb trying to act like we are dixlexic and cant read or suffering from a lack of comprehension. Them [Profanity Removed] know what they are doing...FRAUD IN SOME TYPE OF WAY BUT THEY ARE GOING TO BE ON THE NEWS SO DONT WORRY

WHAT IS YOUR PHONE #

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

Hi. I've been hesitant to use this community thing because I know sometimes people will just say whatever they want to say, true or untrue, and you don't really know whether or not to believe their response. However, you sound like you know what you're talking about and, at this point, I have nothing to lose. I am 8 months pregnant, not currently working because of this whole virus nightmare and to say that I am dependent on this stimulus money would be a huge understatement. I did not file taxes for 2018. (My mom died at the end of November 2018 so I was extremely preoccupied and just never ended up doing it). Filed my 2019 taxes with TurboTax and my return was accepted on March 28 (3 weeks ago tomorrow). My direct deposit info is clearly on my tax return but my refund was offset due to back taxes (also a surprise to me because I was almost 100% certain that everything I read said the stimulus bill was putting all refund offsets, aside from child support, on hold this year. Not only were stimulus checks not being taken but I was almost certain refunds were not being taken either. Obviously I misread that about a thousand times). I still have not received my stimulus payment and I am definitely eligible. That is not even a question. I'm trying to understand why I have not received this money because I need it more than I can even put in words. The fact that my refund was offset should not affect my direct deposit correct? All my direct deposit info is right there on the return, but the refund didn't get deposited there. The irs should still have the direct deposit info tho right? Also, even tho where's my refund has said that my refund was offset since Monday the 13th, TurboTax still just says "accepted March 28th" with a half full status bar. Also, when I view my return, it is only 7 pages, but when I view past year returns they are 100+ pages. Could this mean my return isn't fully processed yet, even though where's my refund has said my refund was offset for 5 days now, and could the fact that it is not fully processed be the reason I haven't gotten the stimulus money? Sorry for all the questions, just starting to panic. I've been locked out of the IRS get my payment tool for 3 days. It initially told me it couldn't verify my eligibility then told me try again in 24 hours and has said that for the past three days. I attempted to fill out the non-filers form but it just keeps saying they already have a return for me. Can't call IRS..not sure what to do at this point. Any opinions, info, etc helps. Really need to start preparing for my newborn. Also kind of upset to not get the extra $500 when I would be using the money for my child who is almost here like everyone else with kids. Especially small babies. This whole stimulus thing is stressing me out more than helping me. I am incredibly grateful for any financial help, don't get me wrong, but only if I actually receive it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

@Ginger6231962- yes I agree, seems very shady at the least. Here's my email- [email address removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

I think this bunch bs I have setup my other bank cause irs won't send it to the account they got there money

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

I used portal to enter my direct deposit info and then 3 days later said I was still getting a check

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

I would download the app

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

What app?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

I hope you will be able to see that whoever's is responsible for this fraudulent activity being arrested on your App, because if that's the last thing I do, somebody going to jail

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

That **bleep** wish she did have an app, I hope she have that App when they be taking they ass to jail for fraudulent activity, because somebody definitely is going to jail. I can not miss a stimulus check that I never had , somebody going to jail, that's it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

The only thing that you could have possibly seen in 3 days is that your return was accepted, the IRS has not ever in history fully processed a return in 3 days so get your story straight

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

The idiots at the IRS had my banking info as I received a redund last year....yet the new GET MY PAYMENT portal said they didn't have it.....so I put the info in again for them. I checked a couple of days ago and portal said my check would be direct deposited into my bank account number XXX and that they would let me know what date, soon. I checked portal this morning and it says that they will be MAILING me a check a week from now ??!!!!

So now I won't have that money for another 7 to 10 days !! Complete b.s. .....

Meanwhile my partner's info said direct deposit in April 15th....and still no money in that account from these idiots.

Who is driving this **bleep** bus?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

Also, even tho where's my refund has said that my refund was offset since Monday the 13th, TurboTax still just says "accepted March 28th" with a half full status bar. Only the IRS has control of your refund processing time and the offset ... they were not supposed to offset a refund or the stimulus check with the exception of child support ... watch the IRS site for your return processing situation : https://www.irs.gov/refunds

I have heard of instances where the offset amount has been sent back if it was not for child support so watch your bank account.

Also, when I view my return, it is only 7 pages, but when I view past year returns they are 100+ pages. Could this mean my return isn't fully processed yet, even though where's my refund has said my refund was offset for 5 days now, and could the fact that it is not fully processed be the reason I haven't gotten the stimulus money? As for the PDF ... the one you can download from the landing page is limited to just what was filed ... if you want the entire return with all the useless worksheets :

When you sign this onto your online account and land on the Tax Home web page, scroll down and click on Add a state. This will take you back to the 2018 online tax return.

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year's return. It is wise to save the return PDFs two ways for your records ... once as filed and again with all the worksheets included.

Sorry for all the questions, just starting to panic. I've been locked out of the IRS get my payment tool for 3 days. It initially told me it couldn't verify my eligibility then told me try again in 24 hours and has said that for the past three days. The IRS payment tool is not fully operational ... try every couple of days.

I attempted to fill out the non-filers form but it just keeps saying they already have a return for me. You cannot file a real return AND one to register for the stimulus ... the program told you that at least 3 times before you filed it ... the rejection is expected if you did not follow the screen instructions.

Can't call IRS..not sure what to do at this point. Any opinions, info, etc helps. Really need to start preparing for my newborn. Also kind of upset to not get the extra $500 when I would be using the money for my child who is almost here like everyone else with kids. Especially small babies. You will get the extra $500 on your 2020 tax return when you file it.

All you really can do now is wait patiently for the IRS to do what it needs to do ... nothing you can do to make them work any faster as they are over tasked and under staffed due to the circumstances.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

I am so pissed off right now, I keep seeing replies that all we can do is wait for the IRS. Why should we have to contact the IRS for something that was started and created by Turbo Tax.

We the customers submitted bank info on your fake stimulus registration tool and was asked for our banking info by turbo tax , but when we print the fake simple return our bank info is fixed out., so why were we asked for out bank info in the 1st place ?. Please read before you answer this question. Do not answer a question that I am not asking you ..THANK YOU

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus check and bank info showing on my return

I am trying to understand why you think that stimulus registration portal thru ANY DIY program or even the IRS site means you jump to the head of the line for the money .

All you get from any DIY program is that the return was successfully filed. Nowhere did it say it meant your stimulus check would be released immediately. Once TT has delivered your return to the IRS successfully they have absolutely no control over what the IRS does. Those returns you filed still have to be processed by the IRS and they have not given any information on this unusual tax filing ... they are still trying to figure this all out for Pete's sake.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dssniezko

New Member

alex_garzab

New Member

faiderfan679

New Member

ravenmhug

New Member

djpmarconi

Level 1