- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: State Tax married living together and part separate - Need Help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax married living together and part separate - Need Help

Hi Everyone,

Can please someone guide me on how to file my taxes this year with the following situation:

1) Myself and my wife lived together in Texas till June 2022. At that time only I was working.

2) My wife moved to New Jersey in June 2022 for a job. While I stayed in Texas for my job.

3) In November I left my job in Texas and joined a new job moved to New Jersey.

How do I file my taxes so that I don't have to pay new jersey state tax on my income from June to November? (my wife will definitely pay her portion) Also, for a majority of year we lived together and in past I have always filed my taxes Married filing jointly.

TIA

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax married living together and part separate - Need Help

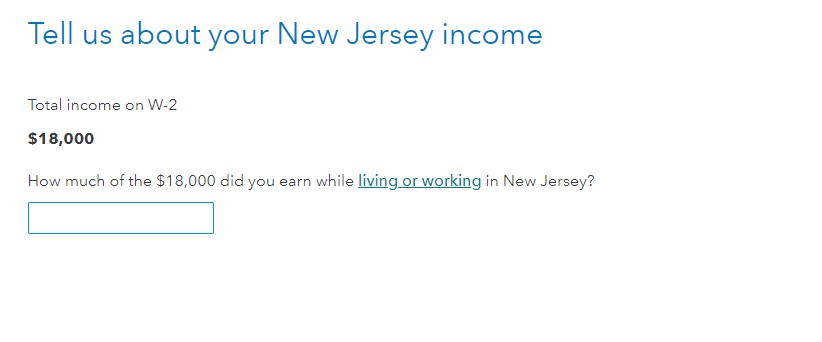

You will both file jointly as part year residents. As you walk through the New Jersey return, you will be given the option to remove income that should not be taxed by NJ. This is where you will remove your income earned in Texas so you are only taxed on your NJ income while living in NJ.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax married living together and part separate - Need Help

You will both file jointly as part year residents. As you walk through the New Jersey return, you will be given the option to remove income that should not be taxed by NJ. This is where you will remove your income earned in Texas so you are only taxed on your NJ income while living in NJ.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax married living together and part separate - Need Help

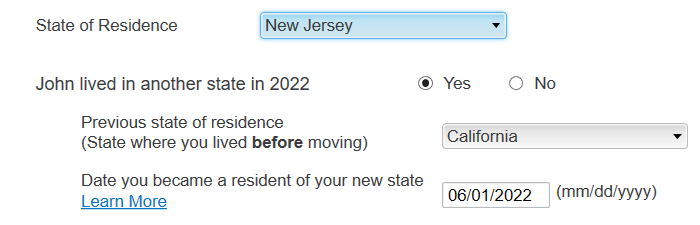

Thanks for the quick response @Vanessa A! Can you please clarify on what dates should I put in for New Jersey residency? Form NJ 1040 has boxes for filling the dates for which I was a resident of NJ. As I mentioned, my wife moved in June, where as I moved in November.

TIA!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax married living together and part separate - Need Help

As I go through a NJ Part Year return, I am not coming to a section that asks about date. Instead I am only coming to a screen that asks about NJ Income. Are you seeing the date in the Personal Info section or the NJ section? If it is the personal info section you should be able to enter the date for each of you. If it is in the NJ section, you can choose either date as the allocation screen is what is affecting the return I am going through.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax married living together and part separate - Need Help

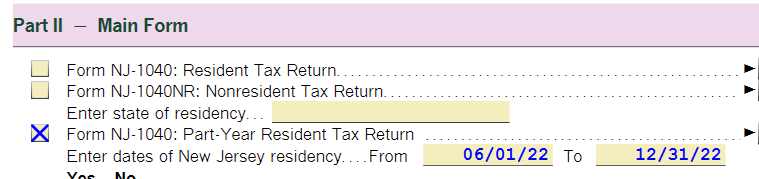

@Vanessa A Yeah, its not present in Turbo Tax, but in NJ tax website (NJ Division of Taxation - Income Tax - Part-Year Residents (state.nj.us)) and in the NJ State form (2022 New Jersey Resident Return, Form NJ-1040 (state.nj.us))

Its clearly mentioned to fill in those dates.

Screenshot attached:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax married living together and part separate - Need Help

Yes, in the personal information section, you fill in your residency dates and the program does capture the information. The information shows in the worksheet. You will each enter your dates in the personal information section.

In the NJ section, just allocate which wages are taxable by NJ.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Tax married living together and part separate - Need Help

Thanks for explaining this!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

peanutbuttertaxes

New Member

user17549282037

New Member

user17538710126

New Member

user17525140957

Level 2

user17523150919

New Member