- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Sale of Vacant lot

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

Your description of the process does not happen in the desktop version. The only option one has is to add the sale of a stock.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

The look up thru the thread ... someone posted the downloaded version's screenshots ... you are making a form 8949 entry exactly like entering a stock sale so indicating it was land is immaterial.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

where do I enter the sale of a vacant lot in TurboTax deluxe

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

The sale of land is reported on sch D.

Go to income section

1. click on Add More Income

2. scroll down to Investment Income

3. Show more

4. Select Stocks, Mutual Funds, Bonds, Other

5. Start: Continue answering the questions.

- Select Yes,

- 1099-B? - Select no

- Select I'll enter one sale at a time

- the boxes appear for your entries for the lot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

I have Turbotax Premier and I am trying to record a vacant land sale with a 1099S. I go to Investments to edit and say NO to 1099B and no list comes up to show land. I have tried everything and can't find how to input a land sale. HELP

Richard

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

You must report the sale of vacant land as a capital gain or loss. Form 8949, "Sales and Other Dispositions of Capital Assets," is used to figure the amount of gain or loss from the sale.

You cannot report it in the (Online) Deluxe version; you have to upgrade to Premier.

To report the sale :

- Select Federal Taxes tab,

- Go to Wages & Income

- scroll down to Investment Income

- Select Stocks, Mutual Funds, Bonds, Other.

- Respond "yes" to Did you sell any investments?

- You'll then be asked Did you get a 1099-B or brokerage statement?

- you'll answer "no." Then you'll be shown a list of various investment sales and you'll select "land."

- You'll be taken to the screen that says Enter Land Sale Information and you'll be able to enter your information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

That is NOT what happens in 2020 version of Deluxe or Premier

however it does populate the correct form to the IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

A land sale is considered a sale of an investment. To report this in TurboTax, please follow these steps:

TurboTax Online

- Click on Federal > Wages & Income

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, OK, what type of investments did you sell? mark the Other box and click Continue.

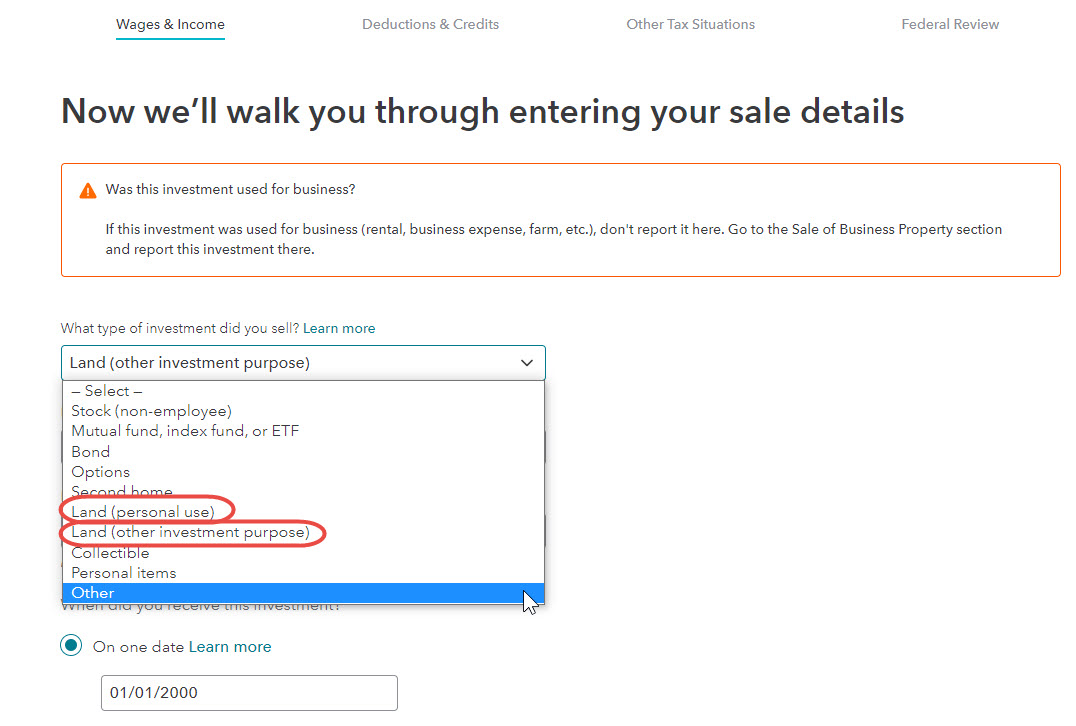

- When you get to the screen, Now we’ll walk you through entering your sale details enter the details of the sale. You will be able to select the type of investment in the first box [second home, land, etc.] [See Screenshot below.]

- Click Continue when done.

TurboTax CD/Download

- On the Wages & Income screen, in the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen,

- Did you get a 1099-B or brokerage statement... click the No box.

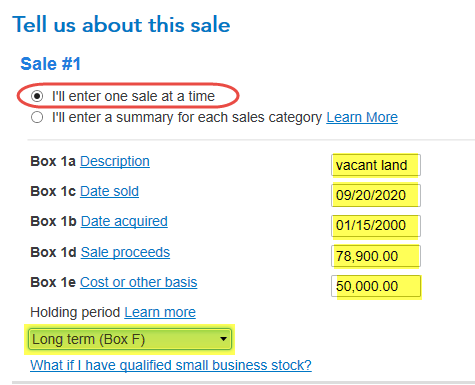

- On the screen, Tell us about this sale, mark the radio button, I'll enter one sale at a time.

- Enter the information in the boxes that appear. You will have to type in Land Sale in box 1a.

- Enter the total sales proceeds as well as the other information requested. [See Screenshot #1 below.]

- Continue to the screen, Select any less common adjustments that apply.

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #2]

- Enter the sales expenses not deducted from the sales price entered earlier.

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

I can see that

However in 2019 Turbo Tax handled it completely different

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

I live in Iowa. I sold a vacant lot in Minnesota. Where do I record this sale for income..., since I have a long term ownership (1974 to 2020) and have a large capital gain?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

To enter the sale on the federal return, it (long-term capital gain) gets reported as an investment sale. Where do I enter the sale of a second home or vacant land on my 2020 taxes?

The capital gain resulting from the sale is Minnesota's income. Enter the sale on your federal return and then TurboTax will generate a nonresident income return for Minnesota (and a resident return for Iowa). On your federal tax return, in the personal information (My Info) section, make sure to indicate that you have income from MN in the ''Other State Income'' field. These instructions are included in the link below.

How do I file a nonresident state return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

Using Premier desktop. Did you get a 1099-B or brokerage statement? I answer NO and the next screen is: Tell us about this sale. I can't get to the Enter Land Sale Information screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

THANK YOU

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

Thanks for explaining this. I am doing taxes for 2021 and could not find 'land" either as we sold a piece of land (investment only) at a loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant lot

To enter your land sale, follow these steps:

- Open or continue with your return

- In the search box, type investment sales and hit Enter key, select the Jump to investment sales link

- Click on Add investments at the bottom of the next screen

- Continue > Enter a different way > Ok, let's start with one investment type, select Other

- Proceed to enter information for your land sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

cparke3

Level 4

johnjames9

Level 2

acmeacme

New Member

glabold

New Member

mstruzak

Level 2