- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: report bug (reply to Abraham)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

report bug

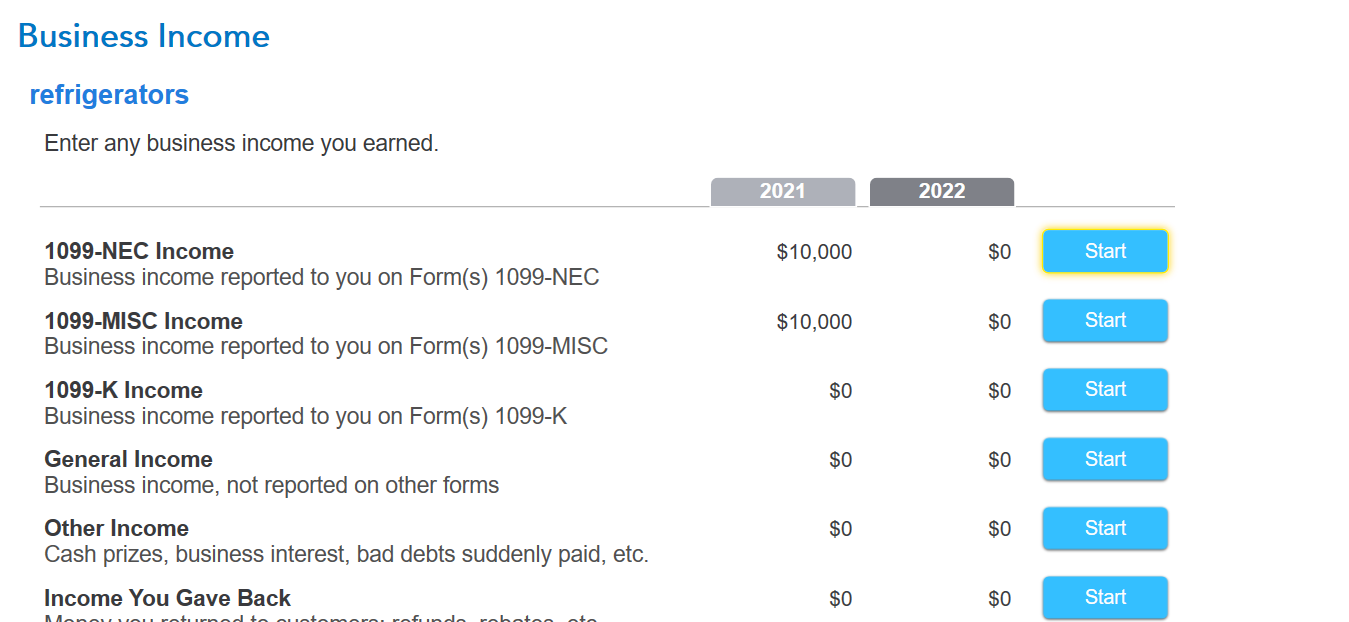

The import doesn't seem to be working correctly. We did have 1099 NEC and 1099 Misc income last year (different numbers), but the import for last year data is showing the 1099 MISC number in both spots. The last year 1099 NEC amount was barely three thousand. 2021 Turbotax worked fine, it has the right numbers in the right places, but the 2022 import seem to have a problem displaying incorrect last year numbers as shown below.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

report bug

I tested it out on my end and it worked fine for me. See here

Try clearing cache and cookies. You can also check for updatees on the program and by clicking Online at the top of the toolbar and then going into Check for Updates.

Finally, double check your 2021 tax return to see if you correctly picked up the 1099MISC and the 1099NEC in the correct places and it shows up on the actual return itself.

Test it out and if you still have issues, feel free to come back.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

report bug

Every time my laptop restarts I have it configured to cleanse cookies and clear cache. Every time I restart TurboTax I let the system download and catch up on software updates. I’m restarting my laptop and launching TurboTax several times a day over the last week (when I have time to work on it). This data import problem persists after numerous reboots and restarts. I don’t get paid to debug and report Turbotax software defects, just trying to let you all know there is a legitimate glitch somewhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

report bug

Your 2021 information on your 2022 return is merely a reference for you as you proceed. The income is not reported anywhere on your 2022 return so you can proceed with filing your 2022 returns when you have completed entering all your information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

report bug

AliciaP1, I understand your statement is correct, but it fails to address the reported concern. The "reference" the software shows me is wrong. At first glance displaying wrong number makes me think I may be missing some 1099 NEC income, when in reality the last year 1099 NEC income is simply wrong, obviously a bug in the software. Visible bugs destroy user confidence in the software, make us think maybe we should use another brand of tax software. I mean if this is wrong, how many other places are wrong and I can't trust the software? I'm just trying to help you all, but it seems no one cares about the coding defect?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

report bug

The prior year's information is to be used as a reference only.

If for example your carryover passive loss, net operating loss, and accumulated depreciation are not flowing correctly, then those will need to be addressed.

We will report your concern but prior year Schedule C information will not affect your 2022 return. Once you finish your 2022 return, you can print your return, and review it to make sure all information is entered correctly.

Here is how to print before filing:

u can, but if you haven't already paid your TurboTax fees (if any), you'll be asked to pay before you can print your return.

- Sign in to your TurboTax account and open your return by selecting Continue or Pick up where you left off

- Select Tax Tools from the left menu, then Print Center (on mobile devices, tap in the upper left corner to expand the menu)

- Select Print, save, or preview this year's return, and follow any additional instructions

- Once your PDF opens in Adobe Acrobat Reader, select the printer icon near the top

- Make any adjustments in the Print window and then select Print at the bottom

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

report bug

Agree and I have the same bug with the prior year 1099-NEC amount being the same as the prior years 1099-MISC. It's a bug, but does not effect the 2022 return info. It did get me to fire up TT2021 and check to see what was there though. Looks like the programmer just grabbed the 1099-MISC value and plugged it into both the 1099 NEC and MISC prior year fields.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

report bug

Hello there I found one Comon mistake from Developer and QA which is a bug

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

advancedindustries

New Member

BME

Level 3

aodum

New Member

gl2024confused

Level 2

Roy Vanderlinden

Returning Member