- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

The IRS will continue to make stimulus payments until February 5. Continue to check the IRS Get My Payment website to see if a bank deposit is made or if a check or debit card is issued. After February 12, if these is still no payment made then follow these steps to add the payment to your 2020 tax refund.

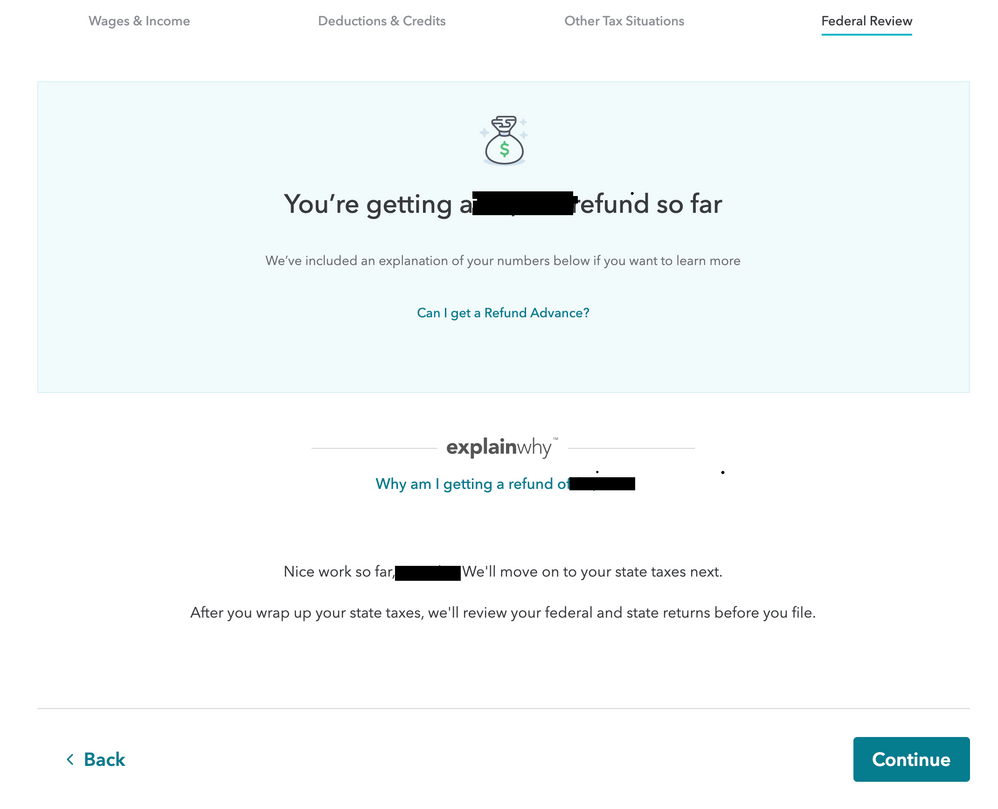

At the top of your tax return select Federal Review

That will take you to this screen where it asks if you have already received your stimulus payments. If you received the first or second payment already, then select Yes and fill in the information. If you did not receive any payment select No. If you received the first payment only, fill in that amount and put zero (0) for the second payment.

When the screen is correct, you refund will be adjusted for the amount of stimulus payment that will be added to your 2020 refund.

I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

I suspect you can't claim it for this year taxes and it is next, but would like someone smarter than me to confirm

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

The IRS will continue to make stimulus payments until February 5. Continue to check the IRS Get My Payment website to see if a bank deposit is made or if a check or debit card is issued. After February 12, if these is still no payment made then follow these steps to add the payment to your 2020 tax refund.

At the top of your tax return select Federal Review

That will take you to this screen where it asks if you have already received your stimulus payments. If you received the first or second payment already, then select Yes and fill in the information. If you did not receive any payment select No. If you received the first payment only, fill in that amount and put zero (0) for the second payment.

When the screen is correct, you refund will be adjusted for the amount of stimulus payment that will be added to your 2020 refund.

I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

Thank you for answering the question. However I don't have that screen. What I see is this.

We got a single payment

We each got a separate payment

We didn't get a payment.

So not sure why the turbotax is not updated to reflect what yours is showing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

An update resolved this. Thank you for the response. This should be at the top of this forum.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

Remember that the IRS will continue to make stimulus payments until February 5. Continue to check the IRS Get My Payment website to see if a bank deposit is made or if a check or debit card is issued. After February 12, if these is still no payment made then follow these steps to add the payment to your 2020 tax refund.

At the top of your tax return select Federal Review

That will take you to this screen where it asks if you have already received your stimulus payments. If you received the first or second payment already, then select Yes and fill in the information. If you did not receive any payment select No. If you received the first payment only, fill in that amount and put zero (0) for the second payment.

When the screen is correct, you refund will be adjusted for the amount of stimulus payment that will be added to your 2020 refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

If the check arrives and it is not cashed or used I assume that will be fine if I rather just do my taxes and take care of it now rather than hope and wait for a check that may never arrive or get lost.

My understanding is if it is not cashed or returned to the IRS in the case where my old bank account was closed and the payment was returned than no need to worry if you claim it in taxes but not take the payments if they show up in the mail later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

IRS will not even start to look at your return until Feb 12. Why SUBMIT before then ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

Why wait, if you can get it out the way and have all your documents why wait longer. If you are due a refund you will get it faster, not that it is the driver, but I flip the script and ask you why wait if you have everything you need to file early?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

I am not sure why you are seeing the screen that you describe. I would recommend you use the Chrome browser and clear browsing data for all time before you sign in to TurboTax.

If that does not work, please let me know which version of TurboTax you are using and also which browser.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

I'm using Desktop version, it required a TurboTax update to show the same option you posted.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

Hello,

I am using the IRS Free File Program. I was claimed as a dependent on my mother's 2019 tax returns and did not receive any stimulus checks because of it, however for 2020 I was no longer a dependent and should qualify. I do not see the option to state whether I received any stimulus checks or not. I am using TurboTax in Google Chrome. Please let me know if I missed something.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

If you don't receive your stimulus payment by the time you file your tax return, you can make an adjustment on your 2020 tax return for stimulus payments you qualify for, but have not received.

To do this in the IRS FreeFile program by TurboTax, please follow these steps:

- Enter the information in your return.

- Click Federal Review at the top of your screen. [See screenshot below.]

- On the screen, Let's make sure you got the right stimulus amount, click Continue.

- You will be asked about the amounts of first round and second round stimulus payments you received.

- TurboTax will then calculate the amount of stimulus payment remaining that you are still entitled to. This will show as a credit on line 30 of the 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

Thank you for your response. Once I click Federal Review it says my return is in great shape then takes me to my total refund summary. I do not get the option to enter in any info/or answer any questions about the stimulus checks. Am I missing a step? Should I completely start over?

I appreciate the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit - I did not receive the 2nd Covid-19 stimulus. Where in Turbotax can I apply for this. I only see the first payment option not second.

Yes, you should go back and re-enter the information about your stimulus checks. To get to the section, type stimulus in the search box and Jump to stimulus.

Then you will tell the software the amounts that you received in the form of a check or direct deposit (if any).

If you don't know the amounts, you can get them from the IRS website by logging into your IRS tax account. Here is a link.

@Anonymous

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

roybnikkih

New Member

lucasmyamurray

New Member

Garyb3262

New Member

sebastiengrrr

New Member

HW11

Returning Member