- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Re:If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

round sale and cost of sale to whole $. the IRS says 50 cents or more is rounded up. 49 cents or less is rounded down. then if the cost of sale is more than the sales amount make sure you enter the difference (which should be no more than $1) is entered

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

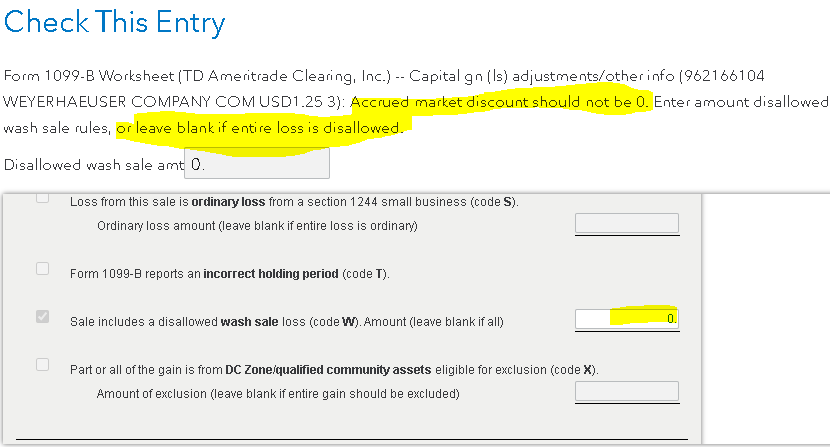

In the case of rounding a wash sale loss disallowed amount (like I have) of .15, .11, .20, it is rounded to 0, and the review of the info comes back as an issue with the amount of 0. It says it cannot be 0. I tried setting it to blank, and it takes and then comes back around again on review and never gets past this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

It depends. If the value was at least .5, Turbo Tax automatically rounded up the amount to one dollar. But if it was below 5 then no amount on the screen or just blank.

The wash sale doesn't allow deduction on a replacement stocks before or after you sold identical securities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

Yeah, that's the issue I'm running into - it won't take 0. and it won't take empty, and the amount is trying to round down to 0.

So do I have to just do this manually? Is there no way to fix it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

It depends. If you enter 50 cents, Turbo Tax will automatically rounded up the amount to one dollar. You may only enter the amount over 50 cents and skip or enter zero on amount less than 50.

The wash sale doesn't allow deduction on a replacement stocks before or after you sold identical securities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

Hi @JoannaB2 - thanks for the speedy response. The issue is the 0. Zero is not allowed in this entry. It must be non-zero, or blank. But the entire loss is .33, and the wash sale loss disallowed is .15. So TurboTax is rounding to 0, which is not allowed. When I try and erase it and leave it blank it will just come back around again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

This is where it gets stuck. I cannot put in 0., and I cannot leave it blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

You can put there $1, it won't create a tax liability for you and you will be able to move forward with your taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

@npierson7 Unfortunately even putting $1 in there brings it back around with the value populated with a 0, and the same error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

I'm sure that the IRS will have seen this before with other low cash flow newbie investors. I just decided to print it out and go for it. But I would definitely call this a software bug. You need to allow either a blank or a 1.00 entry on that line. Zero is not allowed (but that's how I sent it).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

Hey, I'm having this exact same problem. It won't take 0 and it won't take $1.00. It just swings back around to the review and asks me to edit again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

Exactly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

Negative. It does not work. See Rob's response -- It just comes back around to the same error (in my case, the amount was 21 cents). The solution I finally used, after speaking with one of the TT tax experts, was to delete all the transaction info I imported from my broker, and then manually enter a generic Capital Gains/Loss entry using just the summary numbers from my broker's info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my disallowed wash sale loss is less than one dollar, how do I enter it? TurboTax won't accept it.

I agree that this seems to be a TurboTax bug. I just don't see how to submit a report on this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

blaineleesutton

New Member

Jeff-W

Level 1

karunt

New Member

The Cocoa Kid

Returning Member

DIY79

New Member