- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Overpaid and Refunded amounts on 1040 are different

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid and Refunded amounts on 1040 are different

Why would the Overpaid amount ($21) and Refunded amount ($16) on the 1040 be different, if I did not ask to apply part of the refund to the following year. The difference is $5.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid and Refunded amounts on 1040 are different

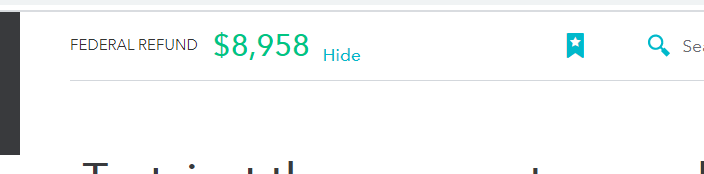

If you are looking at Federal Refund from the top of your screen, this is an estimate only. After you completely entering all of your data, this number will be the same as your tax summary. You can hide the estimate by selecting hide on the right of the $ amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid and Refunded amounts on 1040 are different

I have the same question. On my 1040, Amount Overpaid is 2,065.00; Amount of overpayment you want refunded to you is 2,060.00. Why the $5.00 difference??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid and Refunded amounts on 1040 are different

I have the same question!! Why the $5.00 difference?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid and Refunded amounts on 1040 are different

There is a $5.00 difference after entering all my information! Why. I don't want to file until this is clarified.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid and Refunded amounts on 1040 are different

I suggest checking the "Other Tax Situations" tab at the top of page.

1. Scroll down to "Additional Tax Payments"

2. Click "Show More"

3. Click "Start/Revisit" next to "Apply refund to next year"

4. Make sure there are not amounts taken in there

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid and Refunded amounts on 1040 are different

Was ready to efile when I looked at the Electronic Filing Instructions page (first page when you do a Preview) and noticed it shows a refund but also a $5 penalty/interest. How can TT calculate a penalty when I am getting a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid and Refunded amounts on 1040 are different

I found a workaround.

We are retirees and so we do not have W-2s. We do Quarterly Tax Payments ONLY.

I shifted the 4th Qtr amount to the 3rd Qtr box

3rd Qtr amount to the 2nd Qtr box

and lumped the 2nd and 1st Qtr payments into the 1st Qtr box.

That cleared the $5 penalty. Looks like a BUG to me!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid and Refunded amounts on 1040 are different

In this case it's not a bug. The US tax system is a pay-as-you-go system. People with W2 income have taxes withheld from each paycheck to cover this. Non-W2 taxpayers have to cover this aspect by paying quarterly taxes. If a quarterly payment doesn't cover a quarter of the yearly taxes then late payment penalties accrue until the next payment is made and so on for each quarter. So in your case your work around was to shift payments to earlier in the year which then satisfied the amount due for the quarter.

Note: You have adjusted in TurboTax, but remember the IRS has the dates and amounts of your actual payments so you may see that penalty subtracted from your refund still.

To help in the future, use your total tax liability for 2019 to figure your estimated tax for 2020. Divide that amount by 4 for your quarterly payments. If you at least pay what your tax liability was for 2019 and pay by the quarterly due dates, the penalties are waived.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jloveee8

New Member

Malmo

New Member

Kuehnertbridget

New Member

jjon12346

New Member

moranjcfollowers

New Member