- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: One sold vehicle for multiple rental properties.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

I used the same car for 2 rental properties. I always use the standard mileage deduction in the previous years tax returns on Sch E. In 2023, I sold that car.

In Turbotax, for EACH rental property:

1. I selected 'I stopped using this vehicle in 2023'

2. Entered the appropriate sales price (business portion)

3. Entered vehicle total fair market value when it was placed in service

4. Entered prior depreciation equivalent

Then turbotax filled the information on the Form 4797 (Sales of Business Property), however, I found the sales of this vehicle was reported twice (one for the first rental--sales gain, the other for the second rental--sales loss) as if turbotax treated the same vehicle as a different one for each property.

Is this fine? Can the sales of this vehicle be reported twice on the same form?

I am confused. Please help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

When you enter the sale, first know that you are to use the actual cost of the vehicle, not the fair market value when you began using it in business.

- Total miles driven for the life of the vehicle (rental and personal combined from the date you acquired it)

- Total rental miles for all rental use all years (both rental 1 and 2)

- Divide number 2 total by number 1 above total to arrive at the business use percentage.

- Take the actual cost of the vehicle and multiply by number 3 above - this equals your cost basis

- Take the sales price ($8,000 x the percentage you calculated in number 3 above = this equals your selling price

- Use the chart to arrive at the depreciation portion of the standard mileage rate then take that rate times the business miles for each year of use for both rentals

- Add all years of depreciation together and this will be the amount to enter in the Depreciation slot.

Please update here if you have more questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

Yes, my advice is to say the vehicle was removed from service and then do not indicate it was sold or say 'Yes' it was converted to personal use. This takes care of the vehicle in the rental section(s). This will eliminate any sales information in the vehicle itself. Next you will enter the sale one time using the steps below.

- Calculate the standard mileage rate depreciation portion for the business miles each year (see chart below)

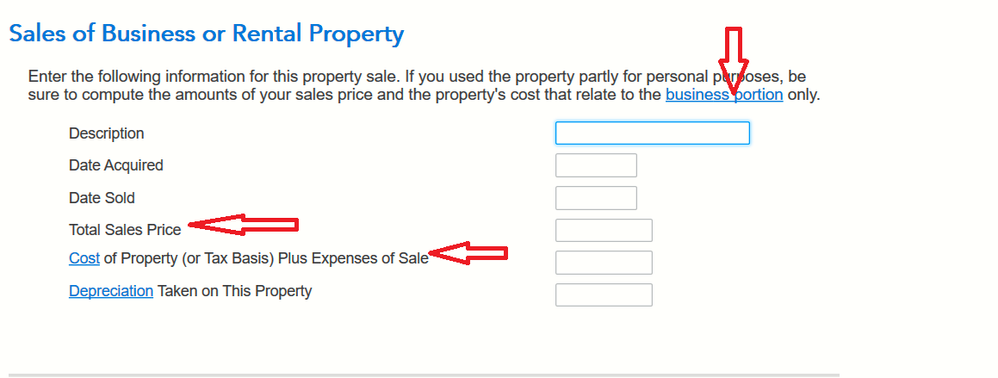

- Go to Less Common Business Situations

- Scroll to Sale of Business Property

- On the next screen select Any Other Property Sale

- Use the information from step one and the depreciation from step 1 to complete your sale

- If the personal portion of your vehicle is a loss there is nothing to report for that portion of the sale/trade.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

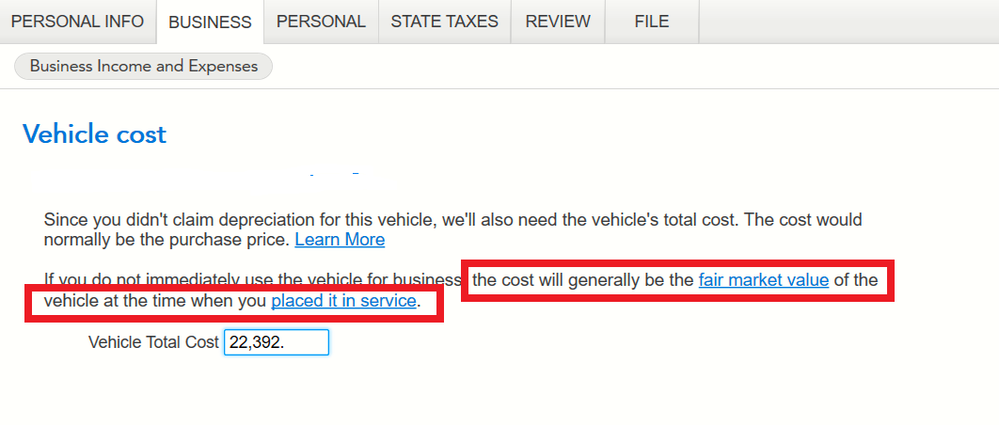

Turbotax still asked me about the vehicle total cost (fair market value) when I placed it in business service.

Suppose the FMV of the vehicle in service for rental 1 was $40,000, and the FMV of the same vehicle in service for rental 2 was $30,000

Should I enter:

vehicle FMV for rental 1 = $40,000 *50% = $20,000

or

$40,000 * 50% * 13.5% (2023 business portion) = $2,700 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

You should enter the business use percentage of the vehicle fair market value (FMV) in each rental activity based on the business miles and total miles of the vehicle for each rental.

- Example: Total miles 10,000 | Business miles rental 1 = 2000 | 2,000/10,000 =20%

- | Business miles rental 2 = 3,000 | 3,000/10,000 = 30%

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

Hi @DianeW777 I followed your instruction to use the Less Common Business Situations -- Sales of Business Property.

But I am still very confused about how to enter the total sales price and cost of property

Suppose:

The FMV of this vehicle started to use for rental 1 was $40,000

The FMV of this vehicle started to use for rental 2 was $30,000

Total miles driven in 2023 on this vehicle was 10,000 miles

Total business miles driven for rental 1 was $1,300 miles (business portion = 1,300/10,000 = 13%)

Total business miles driven for rental 2 was $1,500 miles (business portion =15%)

I sold this vehicle for $8,000 in 2023

Should the total sales price be $8,000 * 13% + $8,000 * 15% = $1,200 ?

Should the cost of property be $40,000 *13% + $30,000 * 15% = $9,700?

If so, do you think the sales of this vehicle is actually calculated twice?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

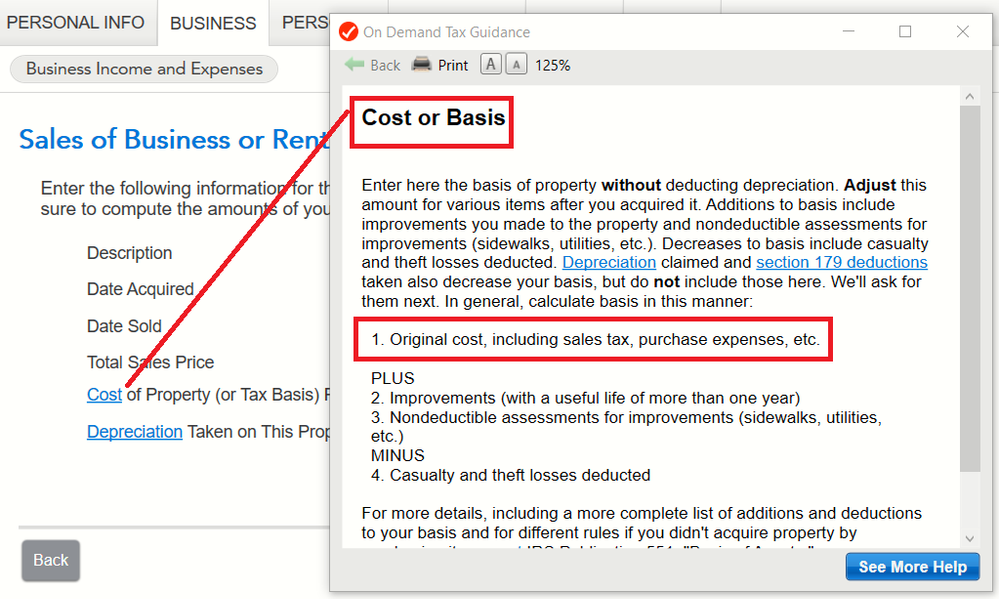

When you enter the sale, first know that you are to use the actual cost of the vehicle, not the fair market value when you began using it in business.

- Total miles driven for the life of the vehicle (rental and personal combined from the date you acquired it)

- Total rental miles for all rental use all years (both rental 1 and 2)

- Divide number 2 total by number 1 above total to arrive at the business use percentage.

- Take the actual cost of the vehicle and multiply by number 3 above - this equals your cost basis

- Take the sales price ($8,000 x the percentage you calculated in number 3 above = this equals your selling price

- Use the chart to arrive at the depreciation portion of the standard mileage rate then take that rate times the business miles for each year of use for both rentals

- Add all years of depreciation together and this will be the amount to enter in the Depreciation slot.

Please update here if you have more questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

@DianeW777 I really appreciate your detailed instructions and help!

Just one thing I would like to confirm with you. When you said 'the actual cost of the vehicle', you mean the original cost plus taxes that I purchased the vehicle, right?

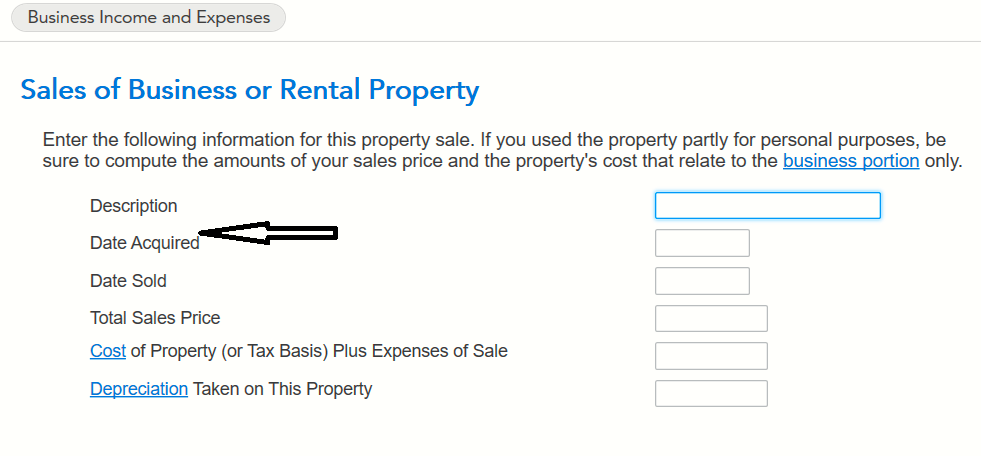

And the date acquired should be the data when I purchased this vehicle, not the date what it was used in service for the rental properties?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

Yes, that's right. Use the actual original cost plus taxes that you paid for the vehicle you sold and less any trade-in for another vehicle if applicable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

And the date acquired should be the date when I purchased this vehicle, not the date when it was used in service for the rental properties?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

@DianeW777 One more question regarding the cost basis:

I didn't immediately use this vehicle for business and actually three years later I started to use it for rental properties.

When I initially used the rental property interview, it said that "If you do not immediately use the vehicle for business, the cost will generally be the fair market value oft he vehicle at the time when you placed in in service." but you said I should use the original actual cost.

I am confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

Yes, I understand. It can be confusing, however the depreciation (you didn't use actual expenses but it could have happened) would be limited when you convert a property to business use when it was originally used only for personal purposes. When that happens you are required to use the lower of cost or fair market value (FMV) for any business use or expense.

You did use the standard mileage rate for your vehicle so it did not affect your tax return as far as depreciation expense.

At the time of sale - You use real numbers, actual cost not FMV to determine the actual amount of the gain or loss (business portion allows loss or gain/personal portion would require you to report gain, but a loss is not allowed.

In the case of a vehicle personal portion rarely results in a gain due to the rapid cost depreciation from the time it moved off the car lot.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

Thank you so much for reply and patience.

Now I understand I should use the real numbers --- actual cost, not FMV

Regarding 'Date Acquired' of this vehicle, I think I should enter the date when I originally purchased this vehicle? not the date when I placed this vehicle in service for my rentals?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

Yes, you should enter the actual date of purchase as well, when entering the sale of your vehicle. The sale should be completely accurate, it can make a difference if there is a gain. Any gain up to the amount of depreciation claimed will be ordinary income. In a case where a gain could potentially be higher than the depreciation that was expensed over time, any gain in excess of that depreciation would have special tax treatment if the holding period was greater than one year.

- Long term: held more than one year (one year plus one day) - This could qualify for capital gains tax rates if applicable (consider the information above for depreciable assets).

- Short term: held one year or less

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

I actually got capital loss for the sales of this vehicle. I assume I don't need any special tax treatment?

Here are the actual numbers ( I assume I followed your instruction correctly).

Bought this car in 2011 and sold it in 2013. The original actual price plus taxes: $33,565, and sold this car for $7,600. Business portion: 302 miles/ 1746 miles = 17.3%

1. Cost basis: $5,806 ($33,565 * 17.3%)

2. Sales price: $1,314 ($7,600 * 17.3%)

3. Depreciation: $1894 (2015-2023)

Loss: $1,314 - $5,806 + $1,894 = -$2,596

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold vehicle used for multiple rental properties.

Yes, you have the actual numbers and it would make sense to have a loss when it comes to vehicles unless it had been fully expensed like when actual depreciation is used. The loss is fully deductible against your other income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

justine626

Level 1

business mileage for rental real

New Member

kare2k13

Level 4

randomGen

New Member

lemliw

New Member