- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

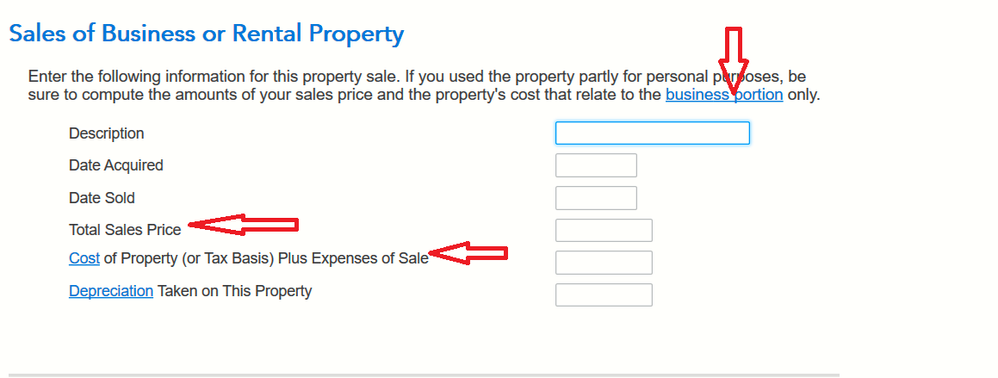

Hi @DianeW777 I followed your instruction to use the Less Common Business Situations -- Sales of Business Property.

But I am still very confused about how to enter the total sales price and cost of property

Suppose:

The FMV of this vehicle started to use for rental 1 was $40,000

The FMV of this vehicle started to use for rental 2 was $30,000

Total miles driven in 2023 on this vehicle was 10,000 miles

Total business miles driven for rental 1 was $1,300 miles (business portion = 1,300/10,000 = 13%)

Total business miles driven for rental 2 was $1,500 miles (business portion =15%)

I sold this vehicle for $8,000 in 2023

Should the total sales price be $8,000 * 13% + $8,000 * 15% = $1,200 ?

Should the cost of property be $40,000 *13% + $30,000 * 15% = $9,700?

If so, do you think the sales of this vehicle is actually calculated twice?