- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: On both of my 2018 and 2019 tax returns, I checked the box where it says that Someone CAN cla...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On both of my 2018 and 2019 tax returns, I checked the box where it says that Someone CAN claim me as a dependent. However, neither my mom or dad claimed me for both years. Am I still eligible for the

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On both of my 2018 and 2019 tax returns, I checked the box where it says that Someone CAN claim me as a dependent. However, neither my mom or dad claimed me for both years. Am I still eligible for the

tyou answer correctly if they could claim you. the fact that they didn't is irrelevant.

1) did you live with either or both of them for more than 1/2 the year?

2) as of 12/31/2019 are you under 19 or under 24 if a full time student?

3)did either or both parents provide over 1/2 your support?

4) are you married and if you are did you file a tax rturn becuase you had a tax liability

if the answer to the first 3 are yes and the 4th is no, they can claim you.

if the answer to any of the first 3 is no or the 4th is yes. you can claim yourself but would have to amend if you already filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On both of my 2018 and 2019 tax returns, I checked the box where it says that Someone CAN claim me as a dependent. However, neither my mom or dad claimed me for both years. Am I still eligible for the

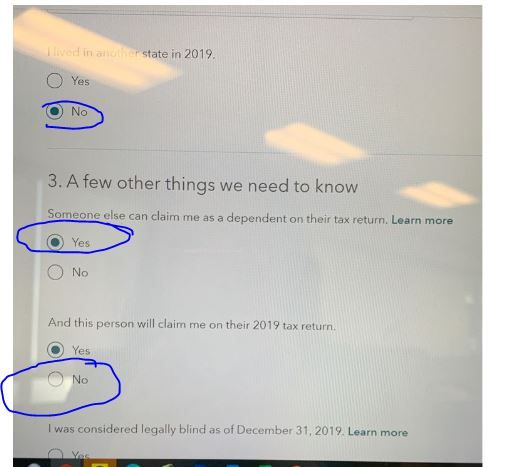

this is how i answered those questions - plus i made over $20k in 2019.

my parents couldnt add me to their returns either because Turbo said i made too much money to be a dependent.

i also answered your questions as follows

1) yes

2) no

3) no

4) no

will i be getting a stimulus check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On both of my 2018 and 2019 tax returns, I checked the box where it says that Someone CAN claim me as a dependent. However, neither my mom or dad claimed me for both years. Am I still eligible for the

No, not a check this year.

If your parent's TurboTax program told them they could not claim you, you should have selected "No." to "Someone else can claim me".

Who did you think could claim you if not your parents?

You could now file an amended return, you might get additional refund.

As far as the stimulus payment, the IRS has you as a dependent in their file, so you should not receive a stimulus payment any time soon.

We are told that the payment is an advance of a 2020 tax year credit, so when you file your 2020 tax return, IF you claim yourself, you should get the payment as a refund at that time.

I wish I could give you better news or advice on how to get the payment sooner, but the IRS is not taking phone calls and I don't think there is anything more you can do beside file an amended return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bees_knees254

New Member

justice-binion

New Member

pmrbgr5099

New Member

dave

New Member

mikedwards406

New Member