- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Not sure how to use a k-1 for stock I bought, Form 1065

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

I received a k-1for UCO, a stock that I bought and sold twice in 2021, as well as bought and sold options twice within 2021. I've been able to enter the k-1 into turbo tax, but I'm a little confused by my 11C box, which has 1541, suggesting I made this amount, which I did not. My brokerage is etrade. If I look at gains\losses for the UCO I made 188.44 with the stock and 138.97 with the options, a total of 327.41.

On my 1099 from etrade, the cost basis for only the stock is not being reported. In prior years if this happened I'd look at what my brokerage had and input the dates bought and cost basis. But If I enter in the K-1 for UCO and enter the cost basis and dates from etrade, it seems like id be taxed twice?

K-1 1065

Box 5 - 0

Box 8 - 210

Box 11C - 1,541

Box 13W - 10

Box 20 B - 10

The amounts for box 8 are close to what etrade would show in gains, off by about $22, but if I report this income in the K1, I should not report it in etrade as well? Box 11C I do not understand where they got this info from.

I am also confused by the 2021 Sales Schedule, there are 7 columns.

Shares sold

Sales Date

Sales Proceeeds

Purchase amounts

Cumulative Adjustments to basis

Cost basis

percentage long term

What's interesting is for 1 of the trades, there's 1741 in column 5 which is the Cumulative Adjustments to basis, and the Cost basis in the k-1 is 13,365, but in etrade it shows 11,623.50.

Am I supposed to use this K-1 info to adjust the cost basis of my 1099 from etrade? Again, for this stock the cost basis is not being reported to the IRS. Not clear on how

I very very much appreciate any help here, looked at it for a few hours and am stumped on what I'm supposed to do. Please let me know if there are any questions or I can help clarify anything!

Thank you!!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

the K-1 reports the partnership activity which is not reported by the broker

K-1 1065

Box 5 - 0 leave balnk

Box 8 - 210 enter

Box 11C - 1,541 enter

Box 13W - 10 enter

Box 20 B - 10 ignore

that partnership is reporting your share of its earnings is +210+1541-10

you may not have actually gotten any cash for this profit so it adds to your tax basis as shown on the sales schedule

this may help

MLP reporting k-1 and 8949

see the sales schedule that was included with the k-1

Enter the k-1 info

Check the PTP box

If total disposition proceed as follows:

On the k-1 disposition section for sales price use the ordinary income (sometimes you’ll see a column with the “751” or the words ”gain subject to recapture as ordinary income” 751 income reported could be zero

Cost is zero

Ordinary income is the sales price.

This info flows to form 4797 line 10 and is taxed as ordinary income.

Now for the 8949.

The broker’s form is probably coded as B or E – sales proceeds but not cost basis reported to the IRS. This is because the broker does not track the tax basis. It used what you paid originally which is not correct.

The correct tax basis is:

What you paid originally, should be the same as what is on 8949,

Then there is a column on the sales schedule that says cumulative adjustment to basis. If it’s positive add it to the original cost. If it’s negative subtract the amount

Finally add the amount of ordinary income reported above.

The result is your corrected cost basis for form 8949.

Some other things. Look at lines 20Z1. That number should be added to the ordinary income above for reporting the 199A (qualified business income from the PTP). You don’t have to enter this but then you lose out on a tax deduction = 20% of this amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

I got a related question.

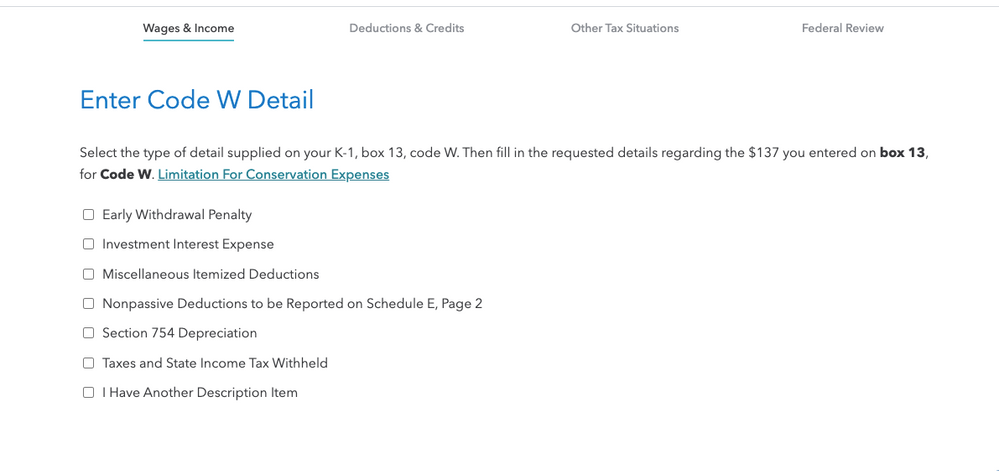

For Box 13W - I got a follow-up question asking more details about this W.

Like to know if anyone has the same issue with UCO K-1 filing.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

I too saw that on mine, also for UCO 🙂

We'll see if anyone else replies here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

The platform asks this question - just to be specific.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

If none of the box descriptions applies to your K-1 Box 13W, you could choose 'I have another description item.'

It is really not necessary to enter these expenses. They are investment management/advisory fees. Because of tax reform changes, these are no longer deductible on your personal return. You can omit them for your personal return purposes.

Click this link for more info on Box 13W.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

Hi,

Just want to be clear on the cost basis I report on the 8949

What you paid originally, should be the same as what is on 8949,

11,623.50

Then there is a column on the sales schedule that says cumulative adjustment to basis. If it’s positive add it to the original cost. If it’s negative subtract the amount

Cumulative Adjustment to basis = 1741

Finally add the amount of ordinary income reported above.

This one, is 210? box 8?

So cost basis should be 11,623.50 plus 1741plus 210 = 13574.5?

//sorry i had to use plus there i think turbo tax thought it was a social or something and 'removed it'

This makes sense to me, just want to confirm I have it right.

Since the sale proceeds I see in etrade already capture $217.49 of the gains, if I don't add the 210, it seems like I'm being taxed twice on it.

Thanks for your replies!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

I'm also not understanding this part

Some other things. Look at lines 20Z1. That number should be added to the ordinary income above for reporting the 199A (qualified business income from the PTP). You don’t have to enter this but then you lose out on a tax deduction = 20% of this amount.

I'll gladly take a deduction, can you point to what I should be looking for? I don't see a box 20 with a code of Z? If that's what you're referincing?

Appreciate the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

Correct. Box 20 and code Z.

If a Qualified Business Income Deduction is available, the preparer of the K-1 would prepare a statement supplying information you would need to generate the deduction.

IRS Form K-1 (1065) Partnership Instructions page 17 states:

Code Z

Section 199A information. Generally, you may be allowed a deduction of up to 20% of your net qualified business income (QBI) plus 20% of your qualified REIT dividends, also known as section 199A dividends, and qualified PTP income from your partnership. The partnership will provide the information you need to figure your deduction. Use one of these forms to figure your QBI deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

Hi,

Just want to be clear on the cost basis I report on the 8949

What you paid originally, should be the same as what is on 8949,

11,623.50

Then there is a column on the sales schedule that says cumulative adjustment to basis. If it’s positive add it to the original cost. If it’s negative subtract the amount

Cumulative Adjustment to basis = 1741

Finally add the amount of ordinary income reported above.

This one, is 210? box 8?

So cost basis should be 11,623.50 plus 1741plus 210 = 13574.5?

//sorry i had to use plus there i think turbo tax thought it was a social or something and 'removed it'

This makes sense to me, just want to confirm I have it right.

Since the sale proceeds I see in etrade already capture $217.49 of the gains, if I don't add the 210, it seems like I'm being taxed twice on it.

Thanks for your replies!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

Yes, you are adding the adjustments correctly to arrive at your adjusted cost basis as indicated by our awesome Tax Champ @Mike9241. You do not want to pay tax on the ordinary income twice which is why it can be added to your cost basis. The tax basis steps are shown below again for your convenience.

- The correct tax basis is:

- What you paid originally, should be the same as what is on 8949,

- Then there is a column on the sales schedule that says cumulative adjustment to basis.

- If it’s positive add it to the original cost. If it’s negative subtract the amount

- Finally add the amount of ordinary income reported.

- The result is your corrected cost basis for form 8949.

@hybridtaxguy

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

@DianeW777 Thank you!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

Column 5 from the sales schedule says ‘your cumulative adjustment to the basis includes your cumulative allocable partnership income’. So apart from adjusting cost basis on 8949 by amount reported on schedule column 5 ‘cumulative adjustment to the basis’, no additional action is required. Can anyone please confirm my understanding is correct here? Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

What if the broker put the sale as a long term sale that is reported to the IRS? I can't get Turbo Tax not to hit me twice because Robinhood did this. How would I correct it?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not sure how to use a k-1 for stock I bought, Form 1065

Assuming you are saying your Form 1099B from Robinhood is incorrect, you would have to contact Robinhood to correct Form 1099B. The Form 1099B is furnished to the IRS so your return should matched what was reported.

If for example, the cost basis on the Form is incorrect, you can adjust the basis in TurboTax using the steps below:

For the sales listed on your 1099-B, you may need to enter their adjusted cost basis. To add this information in TurboTax do the following steps:

- Sign in to TurboTax and open or continue your return

- Select Search and search for 1099-B

- On the Did you have investment income in 2022? screen, select Yes

- If you’ve already added some investment info, select Add investments

- On the Let's import your tax info screen, search for your bank and import your forms

- If you don’t want to import your info, select Enter a different way, then Stocks, Bonds, Mutual Funds

- Continue until you get to the Now, choose how to enter your sales screen, and select One by one then Continue

- On the Review your sales screen, select the pencil icon next to one of your sales

- You may not see this screen if you chose to enter your 1099-B another way

- On the Now, enter one sale on your 1099-B screen, check the box next to The cost basis is incorrect or missing on my 1099-B and select Continue

- On the Let us know if any of these situations apply to this sale screen, check the box next to None of these apply and select Continue

- On the We noticed there's an issue with your cost basis… screen, select I know my cost basis and need to make an adjustment and enter the amount

- You can find your adjusted cost basis on a supplemental form provided by your financial institution. It’s usually available by mid-February along with Form 1099-B

- Select Continue

- Your adjusted cost basis has been added for your sale. Repeat steps 5-9 for any other sales you need to modify

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

howverytaxing

Returning Member

Leokakim21

New Member

lucyx513

Returning Member

carlcam

Returning Member

Tchelo

Returning Member