- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Need help with K1 from Energy Transfer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

Do I need 4 K1s as follows?

1 to enter part III of the main info (1st page

and 3 for each entities in the supplemental K1 (ET, USAC, SUN)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

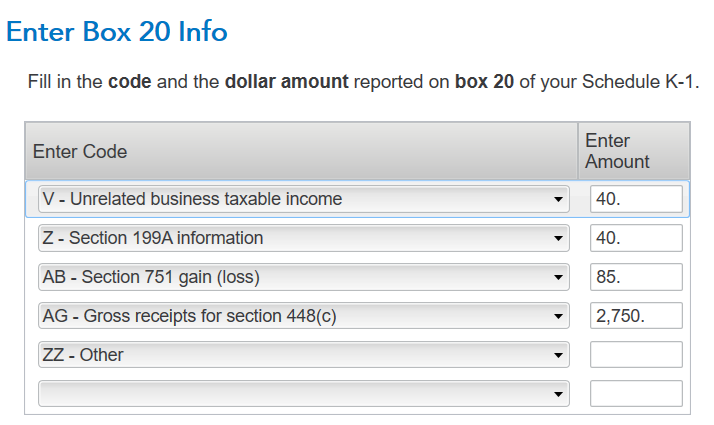

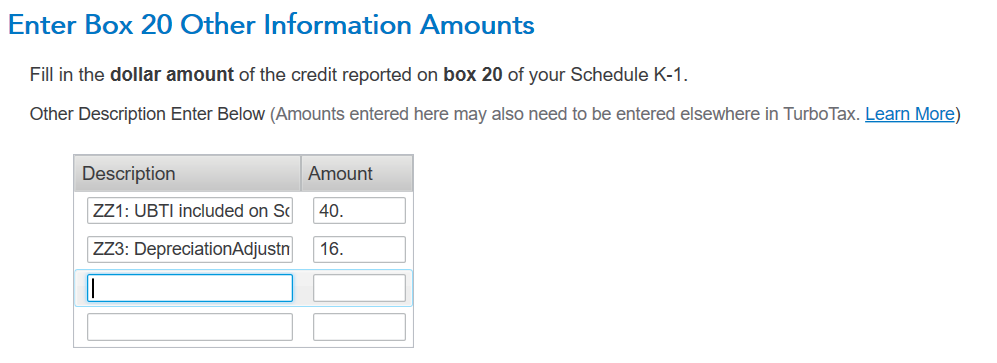

Also Did I enter box 20 correctly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

By the way I sold all my shares last year because of the headache at tax time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

On "describe how you disposed this partnership/LLC", What does "No Entry" option mean? Do I pick that or "Complete disposition"

I sold all shares last year through my brokerage account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

Another question: Should it be treated as part of a combined business? I have small side gig and report self employment income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

No. These are two separate business interests. Besides, you do not report an entry in Box 14 of a K-1 in a Schedule C because your share of the profit and loss is reported in Box 14. If it is a profit, you will be assessed a self-employment tax.

You would report this as a liquidation of partnership interest if that choice appears before you, if working in the desktop version of Turbo Tax. If online, pick Disposed of a portion of my interest in partnership during 2023.

Your Box 20 entries look good especially the ZZ details.

Anyhow, enjoy the remainder of your year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

attitudinator

New Member

garmanbeau

New Member

JRPATEL-AHMEDABAD

Level 1

billOst

New Member

dbausmith

New Member