- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Need help on filing Form 3520

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

Dear TurboTax Community,

Thanks for the help with my previous questions, we learned that she would need to file Form 3520 to the IRS. As we were going through the form, we found something that was confusing and we would like some clarification from the community.

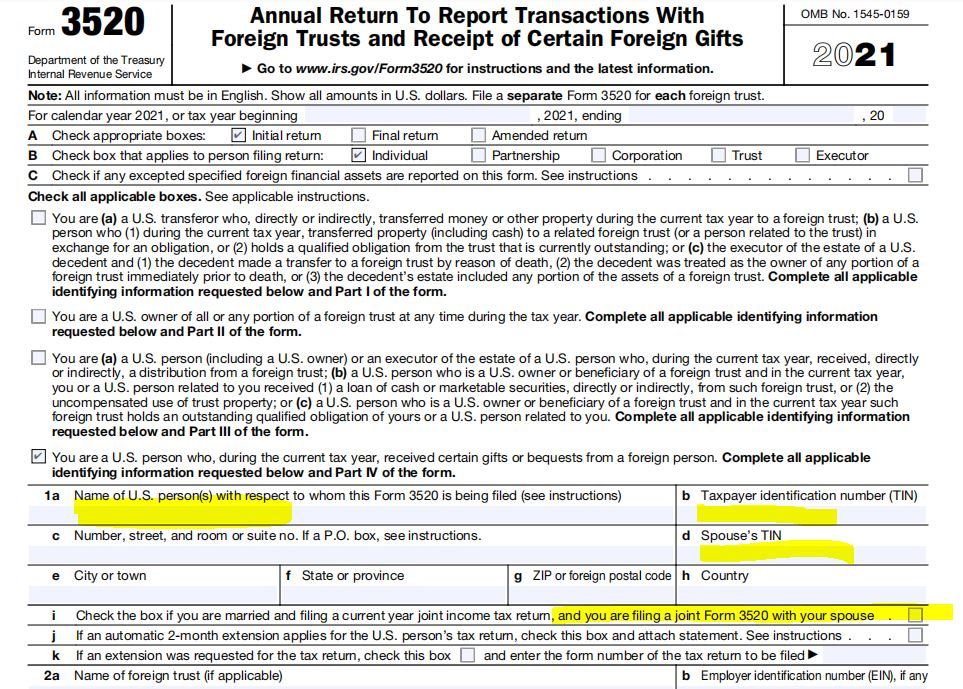

My wife received $250,000 incoming wires from her foreign relatives as gifts in 2021. We are filing married jointly on Form 1040. Since my wife was the only person that received the gifts, should I even include my name and SSN in 1a and 1d? Also, for 1i, does it need to be checked?

Not sure if my thoughts were correct. Since I did not receive any gifts in 2021, I do NOT need to include my name or SSN, or check the box for 1i.

Greatly appreciate your help,

Sincerely,

Leo

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

If you are not the beneficiary, you don't need to file a joint 3520 even if you are filing a joint tax return.

For more details, refer to 2021 Instructions for Form 3520.

@linyi1985

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

I believe the joint filing refers to foreign trusts so I would not check the box. See below the relevant section from Form 3520 instructions.

If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or beneficiaries of the same foreign trust, then you may file a joint Form 3520. If you and your spouse are filing a joint Form 3520, check the box on line 1i on page 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

Look at this info for line 1a

https://www.irs.gov/instructions/i3520#en_US_2021_publink1000190366

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

Put your Wife's Name and SSN on Form 3520. If you are filing as Married, Filing Jointly, check the box to indicate that.

Here's more info about Form 3520 from @GeoffreyG:

"If you have to file Form 3520 this year (Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts), you can do that manually, by downloading the tax form itself and the instructions at the following internet link:

https://www.irs.gov/pub/irs-pdf/f3520.pdf

You can then use TurboTax to complete your tax return normally if you wish. While Form 3520 must be printed and paper filed, by mail (it cannot be e-filed), there is no reason that this should interfere with your regular income tax return preparation and filing. Form 3520 is a disclosure document, really, and there is never any actual tax due with it.

However, if you meet the conditions of having to file Form 3250 (receipt of more than $100,000 in value from a foreign source), then failure to file it can lead to a fine of up to 5% per month (maximum of 25%) of the amount received."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

Thanks, Marilyn, in this case, do you suggest that I need to put in my name on 1a as well and my SSN on 1d, and check that 1i box, even I did not receive any gifts in 2021?

Thank you,

Leo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

If you are not the beneficiary, you don't need to file a joint 3520 even if you are filing a joint tax return.

For more details, refer to 2021 Instructions for Form 3520.

@linyi1985

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

Thanks FangxiaL, it makes sense NOT to check the 1i box since I am NOT the beneficiary. I am just wondering if I need to put in my name and SSN on 1a and 1d?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

No, you don't, since you're not checking Box 1i.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mc257

New Member

evictor213

Level 1

geoffsIntuitUserID456

New Member

jerryandevescrab

Level 1

pachecosj1

New Member