- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

Dear TurboTax Community,

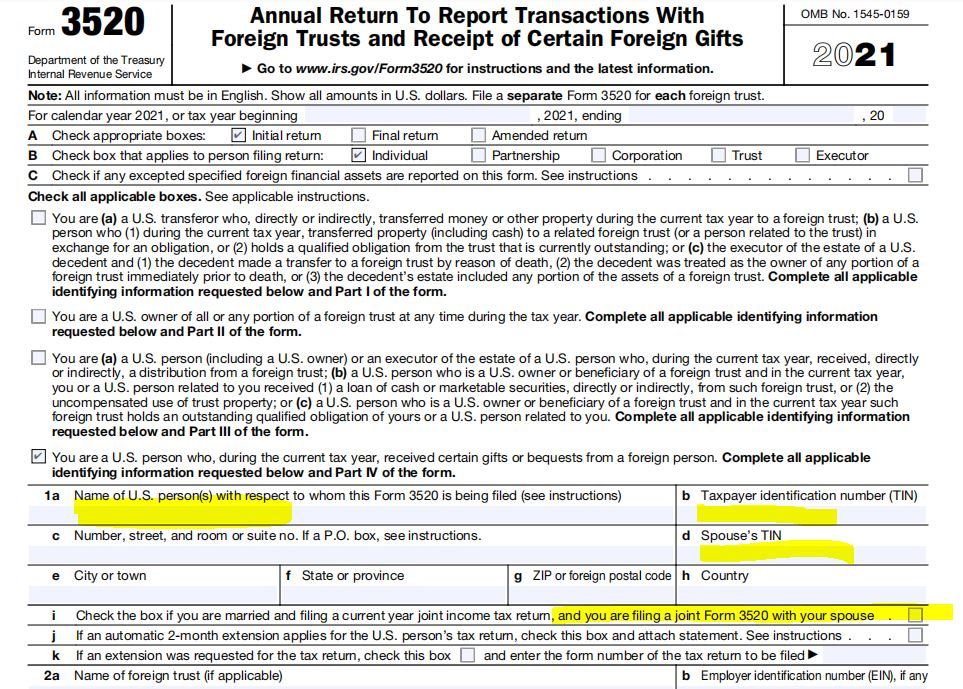

Thanks for the help with my previous questions, we learned that she would need to file Form 3520 to the IRS. As we were going through the form, we found something that was confusing and we would like some clarification from the community.

My wife received $250,000 incoming wires from her foreign relatives as gifts in 2021. We are filing married jointly on Form 1040. Since my wife was the only person that received the gifts, should I even include my name and SSN in 1a and 1d? Also, for 1i, does it need to be checked?

Not sure if my thoughts were correct. Since I did not receive any gifts in 2021, I do NOT need to include my name or SSN, or check the box for 1i.

Greatly appreciate your help,

Sincerely,

Leo

March 30, 2022

6:11 PM